Interest Rates on Deposits Decline: What It Means for Investors and the Economy

Author

NEPSE trading

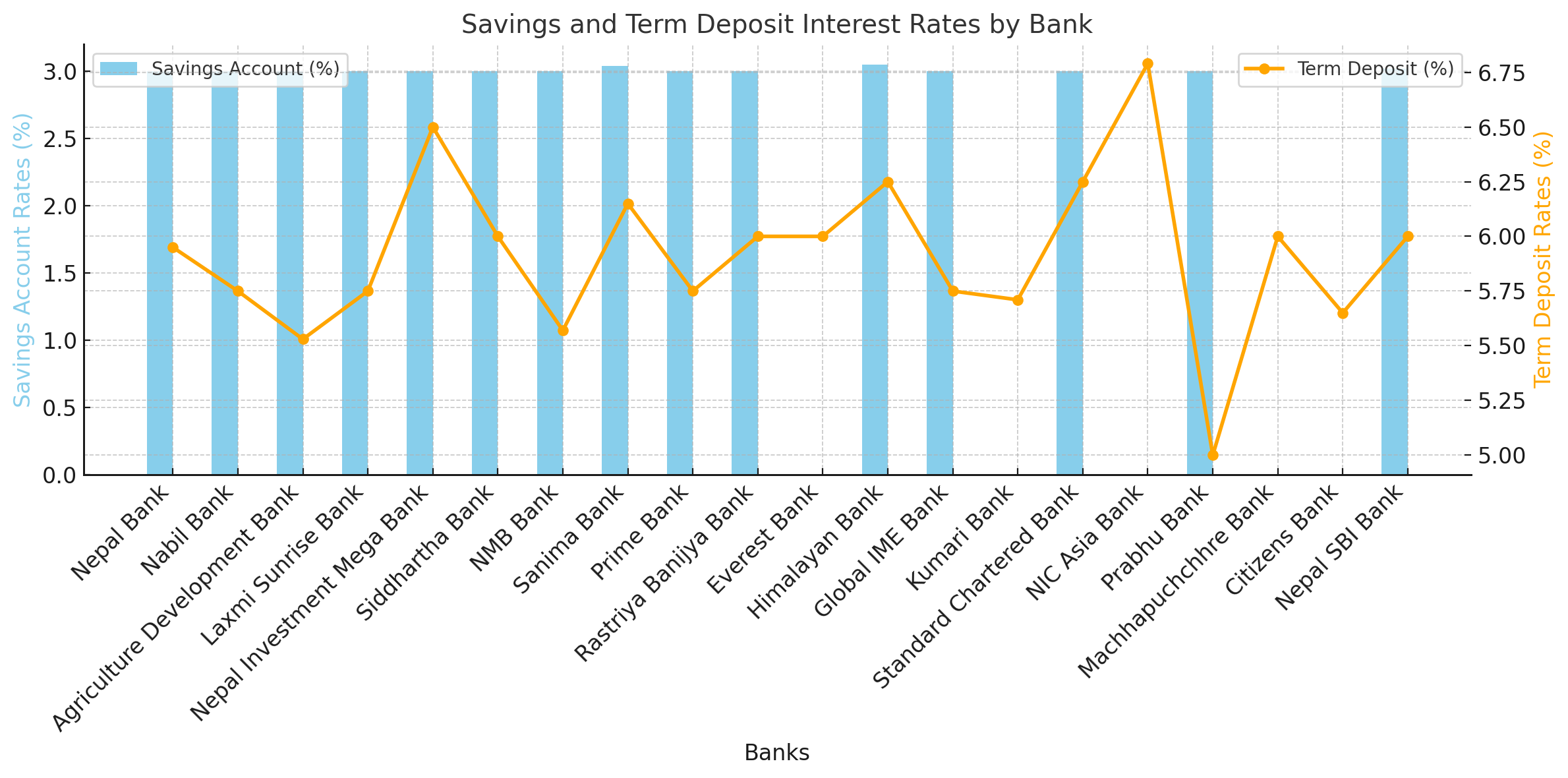

Commercial banks in Nepal have reduced their interest rates on both savings and term deposits for the month of Mangsir, signaling a continuation of the downward trend in deposit rates. Savings account rates are now capped at 3%, while term deposit rates hover around 6%. The decline reflects a shift in the banking sector's strategies amid changing economic conditions.

Savings Account Rates: Most banks, including major players like Nepal Bank, Nabil Bank, and Rastriya Banijya Bank, have set their savings rates at the lowest permissible level of 3%. Few banks, such as Sanima Bank (3.04%) and Himalayan Bank (3.05%), have slightly higher rates, but the differences are negligible.

Term Deposit Rates: While term deposit rates remain relatively competitive, the majority are clustered around 5.5% to 6%. NIC Asia Bank leads with the highest rate of 6.79% for deposits exceeding five years, followed by Himalayan Bank and Standard Chartered Bank offering 6.25% for longer-term deposits. Banks like Everest Bank and Nepal SBI Bank provide up to 6%, while many others are slightly below this threshold.

Base Rate Decline: The reduction in deposit rates is accompanied by a decline in banks' base rates, which impacts loan interest rates. This could benefit borrowers but poses challenges for savers who now earn lower returns on their deposits.

Interpretation and Impact

The current rate cuts are reflective of excess liquidity in the banking system, with deposit inflows exceeding credit outflows. This situation suggests that investment activities remain sluggish, leaving banks with surplus funds. Consequently, banks are reducing deposit rates to balance their cost of funds.

For investors and savers, the declining rates make fixed-income instruments less attractive, potentially encouraging shifts toward alternative investments like equities or mutual funds. This could explain the rising interest in the stock market, particularly among retail investors.

From an economic perspective, the rate reduction may support growth by lowering borrowing costs. However, it also signals cautious lending practices by banks, likely due to uncertainty in the broader economic environment.

What Should Depositors Do?

Depositors seeking higher returns may need to lock in their funds for longer durations to benefit from higher term deposit rates. For example, NIC Asia Bank offers 6.79% for deposits exceeding five years, which is significantly higher than rates for shorter terms. Savers might also consider diversifying their investments to achieve better overall returns.

The reduction in deposit interest rates marks a challenging environment for savers but creates opportunities for borrowers. As banks navigate this period of surplus liquidity and low credit demand, both individual and institutional investors will need to adapt their strategies to maximize returns while managing risks.

This trend underscores the importance of understanding market conditions and aligning financial decisions with broader economic shifts. Savers and investors alike must stay informed to make the most of the evolving financial landscape.