Global Markets Slip as Fed Rate-Cut Expectations Cool and Oil Prices Surge

Author

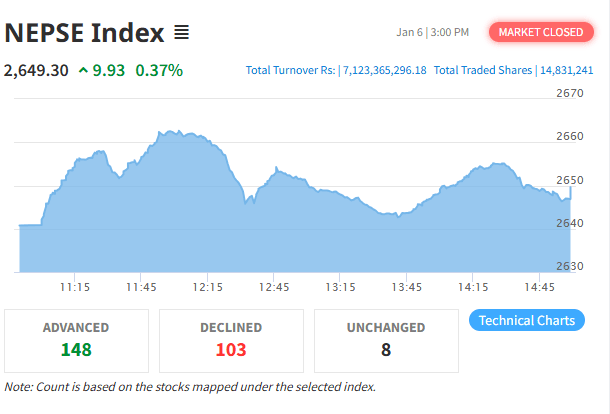

NEPSE TRADING

Asian stocks declined after four consecutive days of gains as growing uncertainty over potential Federal Reserve interest-rate cuts and stretched valuations in the technology sector weighed on investor sentiment.

The MSCI Asia Pacific Index fell 1.2%, led by a drop in chipmakers such as SK Hynix Inc.. Recent comments from Federal Reserve officials have reduced the likelihood of a rate cut in December, prompting caution among global investors.

Earlier in the week, markets had rallied on hopes that the end of the US government shutdown would allow key economic data releases to resume, improving visibility for traders. As a result, global equities were on track for their fourth weekly gain in five weeks. However, the renewed uncertainty surrounding Fed policy has injected fresh volatility into market sentiment.

Meanwhile, Chinese stocks extended their losses after the release of weak economic data, reflecting ongoing concerns about the country’s slowing growth and insufficient policy support. Investors remain cautious as China continues to navigate a challenging economic environment.

Adding to market pressure, global oil prices surged, raising fears of renewed inflationary pressures. Higher energy costs could further complicate central bank policy decisions and make near-term rate cuts less likely, analysts noted.

Overall, a mix of Fed policy uncertainty, weak Chinese data, and rising oil prices has combined to weigh down Asian and global markets heading into the weekend.