NEPSE Declines Again — Investors Cautiously Hope After Ministry’s Reform Directive

Author

NEPSE TRADING

The Nepal Stock Exchange (NEPSE) witnessed another decline on Wednesday, marking the second consecutive day of losses in the trading week. Despite earlier hopes of stabilization, the capital market remains volatile, with investors’ confidence weakening further.

The NEPSE index dropped by 45.36 points, closing at 2,559.59 points. The market broke below the crucial 2,580 support level, signaling growing bearish pressure and technical weakness.

Ministry’s Intervention and Reform Efforts

Amid falling investor confidence, the Ministry of Finance has directed concerned regulatory agencies to immediately implement the recommendations of the Capital Market Reform Taskforce Report, submitted on Aswin 9 (September 25, 2025) to Finance Minister Rameshwor Khanal.

According to ministry sources, circulars have been sent to the Nepal Rastra Bank (NRB), Securities Board of Nepal (SEBON), Nepal Stock Exchange (NEPSE), and CDSC for prompt implementation. However, the directive has not been officially made public, creating confusion among investors.

Several investors have expressed dissatisfaction, saying they lack clarity on the government’s specific reform agenda. Nonetheless, regulatory bodies have confirmed receiving the official instruction.

The circular reportedly includes measures on margin trading facilitation, review of collateral lending limits, enhanced transparency, and investor protection frameworks. Analysts view this as a decisive move toward market stability. If the directives are fully implemented within the next three months, long-term transparency and sustainability in Nepal’s capital market are expected.

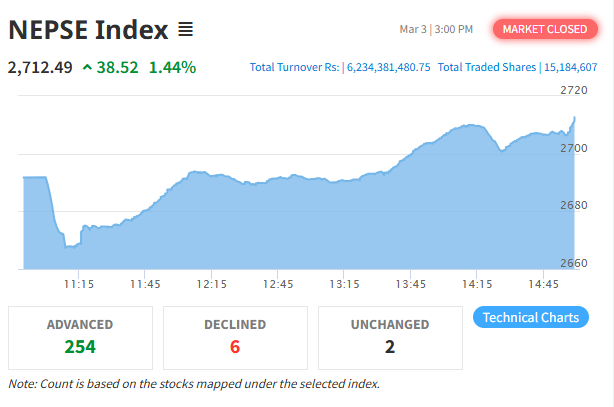

Trading Overview

Despite the index decline, trading volume increased compared to the previous day.

Total Turnover: NPR 5.76 billion (up from NPR 4.62 billion on Tuesday)

Total Companies Traded: 335

Total Transactions: 63,509

Total Shares Traded: 13.75 million

Nepal Reinsurance Company led the turnover list with NPR 261.6 million in transactions. It was followed by Union Hydropower Limited (NPR 240 million) and Synergy Power Development (NPR 220 million+).

Top Gainers and Losers

Top Gainers:

Sangrila Development Bank Debenture 2087 (+7.09%)

NIMB Debenture 2090 (+6%)

Aatmanirbhar Laghubitta (+5.9%)

Top Loser:

Prabhu Insurance (–6.12%)

Sectoral Performance

All 13 sectoral sub-indices declined on Wednesday.

The Finance sector led the fall with a 3.09% drop,

Followed by Hotels and Tourism (–3%),

Development Banks, Hydropower, Investment, and Non-Life Insurance sectors each fell by over 2%.

Market analysts said that despite ample liquidity, investor sentiment remained subdued due to uncertainty over government actions and market direction.

Technical Analysis

According to technical analyst Ajit Khanal, the market’s break below the 2,580-point support zone is a sign of continued selling pressure. The NEPSE closed with a strong bearish candle, suggesting heightened downward momentum.

The Relative Strength Index (RSI) is now approaching the oversold zone, indicating excessive selling activity. Similarly, the index touched the lower Bollinger Band, implying the possibility of a short-term rebound if buying sentiment improves.

However, analysts warn that if the market fails to recover soon, the NEPSE could retest its previous low of 2,482 points in the coming sessions.

Market Sentiment and Broker Activity

The market opened weak and remained negative for most of the session. Panic selling in the hydropower sector was a major drag on the index.

Interestingly, around 1:40 PM, some positive signals emerged as buying volumes picked up briefly.

Out of the top 10 brokers, six were net sellers, while four were net buyers, showing a mixed sentiment among institutional traders.

Though the NEPSE remains technically fragile in the short term, the Finance Ministry’s reform directives have rekindled cautious optimism among investors.

If implemented effectively, these policy measures could restore market transparency, boost investor confidence, and set the foundation for long-term capital market stability in Nepal.

#NEPSE #NepalStockMarket #NepseUpdate #CapitalMarketNepal #AjitKhanal #TechnicalAnalysisNepal #NepalReinsurance #UnionHydro #SynergyPower #SangrilaDebenture #NIMBDebenture #PrabhuInsurance #NepalEconomy #NepalFinance #StockNewsNepal