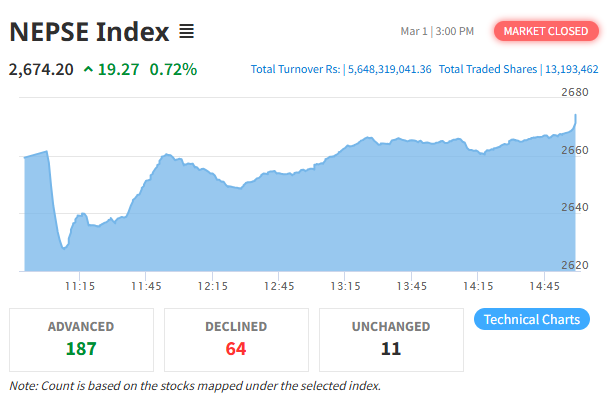

Nepse Falls by 13.52 Points on the Week’s Final Trading Day, Turnover Surges to Rs 5.23 Billion

Author

NEPSE TRADING

Nepse

The Nepse index has declined even on the last trading day of the week. The market, which has been weak since the first day of the week, continued the same trend on Wednesday. Although the continuous decline has put pressure on investor morale, the overall trading volume has increased. On Wednesday, the Nepse index fell by 13.52 points to 2,631.17 points. The Sensitive Index weakened by 3.03 points, while the Float Index decreased by 1.01 points and the Sensitive Float Index decreased by 1.04 points. Looking at the overall condition of the indicators, it is seen that the market is still in a weak psychology. However, the trading volume has increased on the contrary. In the market, which had a turnover of Rs 4.48 billion on Tuesday, shares worth Rs 5.23 billion were bought and sold on Wednesday. On this day, 18.73 million shares of 332 companies were traded 67,485 times, which indicates that trading activity is high. The shares of five companies have reached positive circuit levels on this day. Shares of Sagar Distillery, Mithila Microfinance, Jhapa Energy, Swastik Microfinance and Srinagar Agritech Industries have reached the circuit. Similarly, the price of Om Megashree Pharmaceuticals has increased by 7 percent, while the share price of Bungal Hydro has increased by about 6.5 percent. Bandipur Cable Car and Tourism remained at the forefront in terms of trading volume. Shares worth Rs 184.976 crore of this company have been bought and sold. Next, Himalayan Re Insurance has traded worth Rs 180 million. Despite the decline in prices, trading was widespread in most stocks. Out of 13 subgroups, 4 subgroups remained green, while the remaining 9 subgroups turned red. The finance subgroup was the highest-growing subgroup, increasing by 1.59 percent. Similarly, the hotels and tourism, manufacturing and processing, and mutual fund subgroups also increased moderately. The life insurance subgroup was the weakest, decreasing by 1.18 percent. Tomorrow, government offices, banks and insurance companies, including the stock market, will remain closed as Yomhri Purnima and Udhauli festivals will be celebrated across the country. Now, the stock market will reopen only from 11 am on Sunday. It is believed that the Newar community has been celebrating Yomhri Purnima for 400 years. This Purnima is considered special because of this important dish 'Yomhri' made from rice flour during the winter. Similarly, the Kirat community has a tradition of celebrating Udhauli festival as a token of gratitude for successful farming.

Technical Analysis

Analysts have claimed that there will be some small corrections as the market continues to decline. It is claimed that the market will go up after a small correction. Now the main support of the market seems to be from 2590 to 2600. It is claimed that the market has made the current correction higher low. Currently, the RSI is 54.02, which was seen in the day chart. According to the Ichimo cloud, the market is not currently in the danger zone.

Broker Analysis

Looking at the status of big brokers today, it is seen that 6 out of 10 brokers have bought more than they sold. Similarly, 4 brokers have sold more than they bought. This situation is considered positive from the point of view of buying and selling. Today, 58,42,44,49,62 and 57 have bought more. Similarly, 48,34,45 and 32 have sold more in today's market. Similarly, looking at the activity of brokers by stock, investors have raised UMHL 49 thousand units from broker number 39. Which is 31 percent of the total buy. The average price of which is 584. Similarly, ICFC has bought 48 thousand units from broker number 58. Similarly, NIMB has been bought from 58. On the other hand, on the sell side, SIKLES 65. It is seen that 1 lakh 2 thousand units have been sold from broker number 69. Which is 69 percent of the total sell. The average price of which is 662. Similarly, investors have sold 62 thousand shares of MEN from broker number 35. Similarly, 59 thousand shares of NIMB have been sold from broker number 48.