NRB to Absorb Additional Rs. 50 Billion Liquidity Through Deposit Collection Instrument

Author

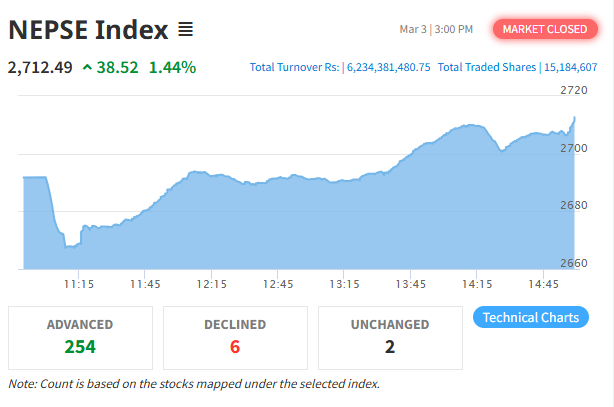

NEPSE TRADING

With excess liquidity continuing in Nepal’s financial system, Nepal Rastra Bank (NRB) has announced another round of liquidity absorption worth Rs. 50 billion through its Deposit Collection Instrument. The central bank will conduct the auction today at 2 PM via the online bidding system for a tenure of 175 days.

According to the latest NRB data, total deposits in the banking system have reached Rs. 7.514 trillion. Despite continuously falling interest rates, credit disbursement remains sluggish, leaving the banking system with excess liquidity. To manage this situation, NRB has repeatedly been using deposit collection tools to mop up surplus funds.

Only Class “A”, “B”, and “C” banks and financial institutions licensed by NRB are eligible to participate in the auction. Interested institutions can bid for a minimum of Rs. 100 million and up to Rs. 5 billion, ensuring the total amount is divisible without remainder. The maturity date of this deposit collection round is 23rd Baisakh 2083 (May 5, 2026), and the interest rate will be determined through competitive bidding.

So far in the current fiscal year, NRB has absorbed Rs. 949.6 billion from the financial system through deposit collection instruments. Out of this, Rs. 234.95 billion remains parked at the central bank, while another Rs. 587.15 billion is held under the Standing Deposit Facility. In total, banks have deposited around Rs. 822.10 billion with NRB due to a lack of lending opportunities.

Since mid-last fiscal year, excess liquidity has become a structural problem in Nepal’s banking sector. Weak loan demand and sluggish business activity have prevented banks from expanding credit portfolios, forcing the central bank to repeatedly withdraw liquidity through long-term open market operations and deposit collection tools.