Over $1 Billion in China Property-Backed Loans at Risk of Default, Putting Asian Banks on Alert

Author

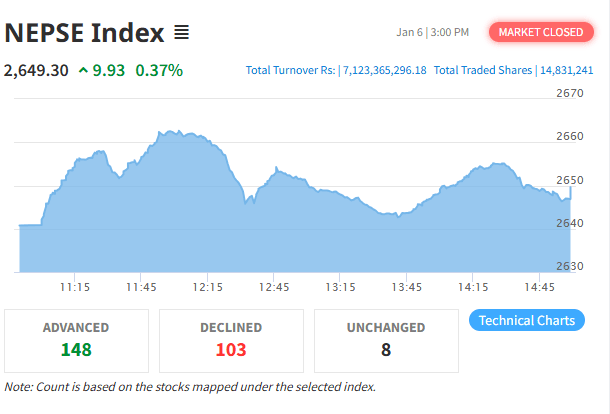

NEPSE TRADING

Asian banks are facing fresh pressure as China’s deepening real estate crisis threatens more than $1 billion in property-backed loans with imminent default unless extension or refinancing deals are finalized.

Parkview Group Struggles to Extend $940 Million Loan

Hong Kong developer Parkview Group Ltd. is attempting to extend a $940 million loan that matures on Friday. Negotiations remain tense as Taiwan’s Bank of Panhsin has not yet approved the extension of its share of the loan, according to sources familiar with the matter. This delay has heightened concerns about a potential default.

Gaw Capital Partners–Led Fund Misses Payment on $260 Million Facility

Separately, a fund led by private equity firm Gaw Capital Partners has missed the repayment deadline for a $260 million loan facility that matured earlier this week. Creditors now have the option to declare a default within days if no agreement is reached.

Major Banks Caught in the Middle

Banks involved in these loans—including HSBC Holdings Plc, Hang Seng Bank Ltd., United Overseas Bank Ltd. (UOB), and several Taiwanese banks—are facing a difficult choice:

Extending deadlines repeatedly will not solve the underlying problems in China’s real estate sector.

Forcing borrowers into default may result in heavy financial losses for the banks.

This has led to tense negotiations and disagreements among lenders as they attempt to find refinancing solutions for a growing pile of maturing property-backed loans.

A New Wave of Risk in China’s Real Estate Crisis

The situation reflects the ongoing fragility of China’s property sector, where stalled projects, weak cash flow, and sluggish sales continue to undermine developers’ ability to service debt. As more loans approach maturity without viable repayment plans, analysts warn that the region’s financial system may face another wave of defaults if structural solutions are not implemented soon.

Asian banks, already exposed to China’s protracted property downturn, now find themselves bracing for further shocks as the crisis deepens.