Over Rs 40 Billion Parked in 10 Government Funds Raises Future Risk

Author

NepseTrading

A new government study has found that more than Rs 40 billion is sitting idle across various funds created by ten public institutions for purposes such as gratuity, retirement benefits, medical support, and welfare payments. Although regulations allow institutions to establish and manage these funds independently, the report warns that weak oversight has resulted in money being used beyond its intended purpose, creating potential risks for future pension and liability payments.

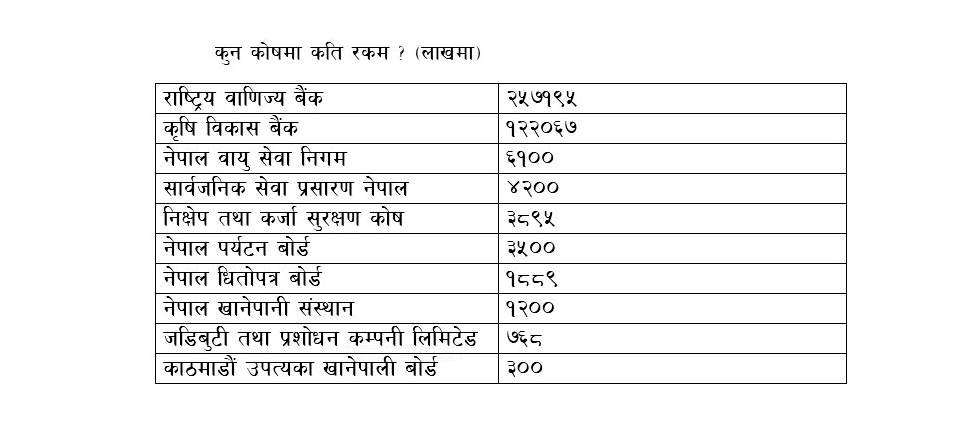

The report highlights that Rastriya Banijya Bank holds the largest balance with Rs 25.71 billion in its funds. It is followed by the Agricultural Development Bank with Rs 12.20 billion, Nepal Airlines Corporation with Rs 610 million, Public Service Broadcasting Nepal with Rs 420 million, the Deposit and Credit Guarantee Fund with Rs 380 million, the Nepal Tourism Board with Rs 350 million, and the Securities Board of Nepal with over Rs 180 million. Additionally, Rs 120 million is held by the Nepal Water Supply Corporation, Rs 70 million by the Herbs Production and Processing Company, and more than Rs 30 million by the Kathmandu Valley Water Supply Board.

While these funds are meant to cover retirement payments, employee facilities, and medical expenses, the study warns that long-term accumulation without proper oversight can reduce transparency, delay essential payouts, and increase institutional financial risks. With both employees and the government contributing to these funds, the report emphasizes the need for stronger regulatory control to ensure sustainable and responsible fund management.