Which Bank Stock to Invest in Based on Q3 Report? Price and Valuation Analysis

Author

Nepsetrading

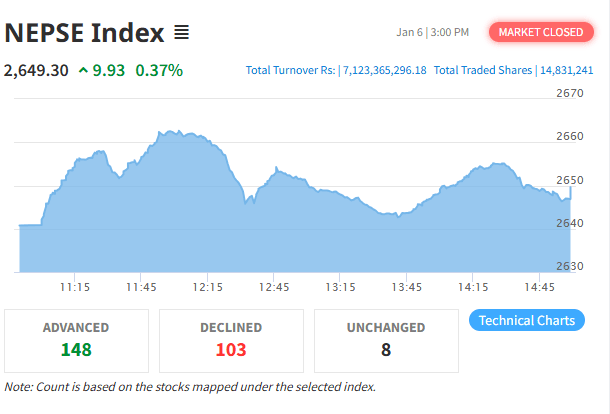

As the Nepal Stock Exchange (NEPSE) enters a phase of cautious optimism in 2025, many investors are shifting their focus from speculation to fundamentals. The banking sector, which forms the backbone of NEPSE, offers a wealth of opportunities when analyzed through key financial metrics like Earnings Per Share (EPS), Book Value (BV), Dividends (DPPS), Return on Equity (ROE), Non-Performing Loans (NPL), and valuation ratios like PE and PB. A detailed comparison of 18 listed commercial banks reveals some standout performers for those looking to invest with confidence.

Best Overall Value: Nepal Bank Limited (NBL)

Among all banks analyzed, Nepal Bank Limited (NBL) emerges as the best value stock. With an impressive EPS of NPR 25.26, its current price of NPR 259.20 translates to a very attractive Price-to-Earnings (PE) ratio of just 10.26. Even more appealing is its Price-to-Book (PB) ratio of 0.99, meaning the stock is trading below its book value of NPR 260.74. This combination of strong earnings, low market price, and undervaluation by book metrics makes NBL a compelling pick for both value and income investors.

Highest Book Value at a Low Price: Global IME Bank (GBIME)

When it comes to intrinsic value, Global IME Bank (GBIME) offers one of the most solid profiles. Its share price of NPR 222.80 is quite reasonable compared to its strong Book Value of NPR 173.47 and EPS of 15.86. While the Price-to-Book ratio stands at 1.28, the bank also boasts decent returns with a ROE of 9.76%. GBIME strikes a balanced pose between stability and growth, making it a suitable option for investors who prioritize fundamentals over hype.

Best Dividend Performer: Everest Bank Limited (EBL)

For dividend seekers, Everest Bank Limited (EBL) is the clear leader. It offers a Dividend Per Share (DPPS) of 34.09%, the highest among all the listed commercial banks. Alongside this, EBL boasts a Return on Equity (ROE) of 15.82% and a Non-Performing Loan (NPL) ratio of just 0.64%, signaling both profitability and strong risk management. Though its share price is higher at NPR 625.04, its consistent dividend history and sound financials make it a worthwhile choice for conservative, income-focused investors.

Highest EPS at Lowest Price: NMB Bank (NIMB)

If you’re looking for earnings strength at a budget-friendly price, NMB Bank (NIMB) is hard to beat. Trading at only NPR 216.29, it delivers an EPS of 17.74, making it one of the best earnings generators in its price range. Its PE ratio is just 12.19, and its PB ratio of 1.14 is also appealing. These metrics show that NMB is undervalued relative to its profitability, giving it excellent potential for both short- and long-term gains.

In today’s market, successful investors are those who analyze beyond just the share price. Fundamentals matter — and metrics like PE, PB, ROE, and DPPS can help reveal the real winners. Based on this comprehensive data analysis, Nepal Bank Limited (NBL) and NMB Bank (NIMB) stand out as smart long-term picks for value and earnings, while Everest Bank (EBL) remains a top choice for dividend income. For those looking to anchor their portfolios in quality banking stocks, these three banks provide a reliable mix of safety, return, and growth potential.