By Sandeep Chaudhary

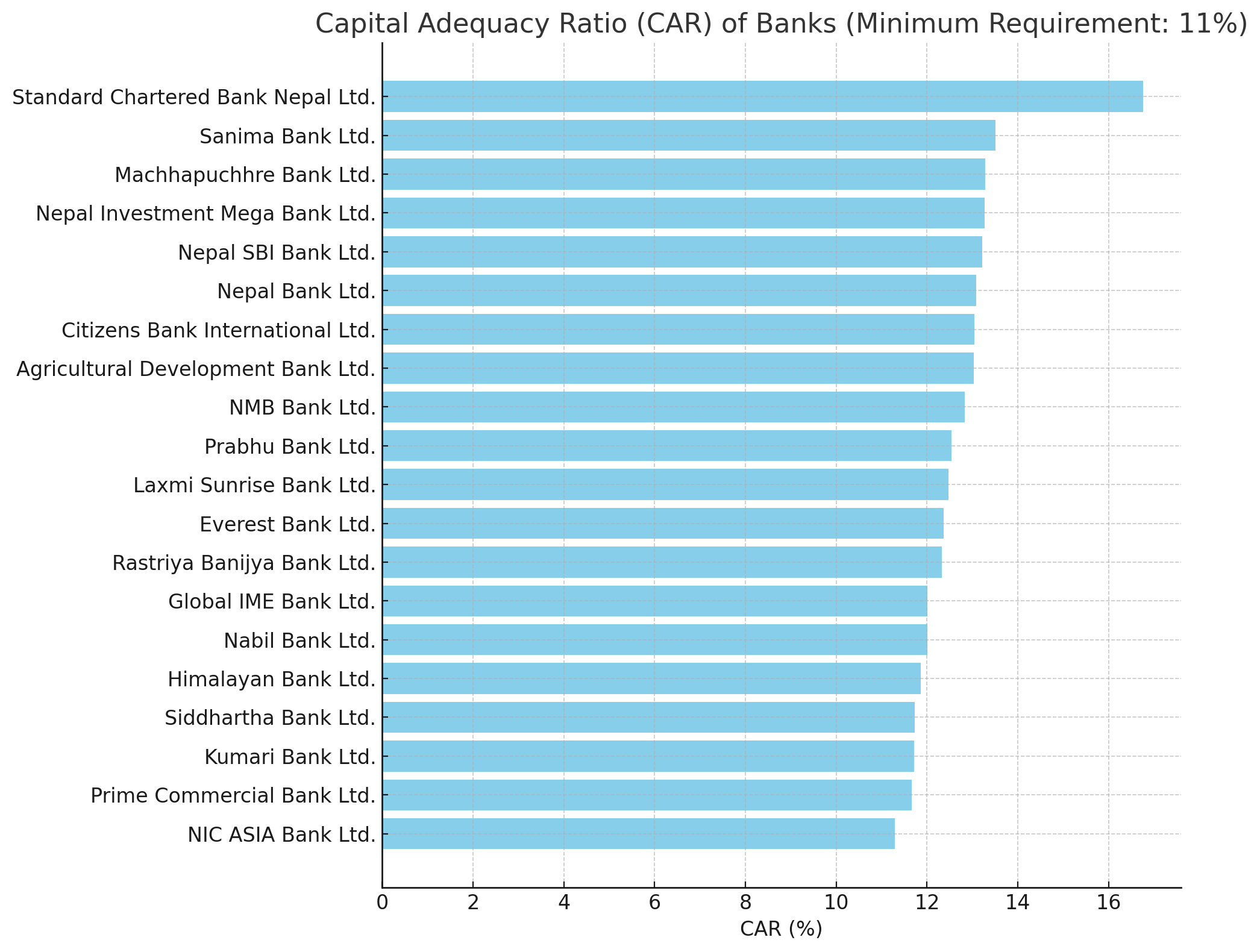

CAR Interpretation with NRB Regulations and Dividend Restrictions (Chait End, 2080)

The Capital Adequacy Ratio (CAR) is a crucial metric for banks as it ensures that they have enough capital to absorb potential losses and protect depositors. In the context of Nepal Rastra Bank (NRB) regulations, maintaining a minimum CAR of 11% is mandatory. Falling below this threshold can lead to restrictions on dividend distributions and other regulatory actions.

Key Points:

Minimum CAR Requirement (11%):

NRB mandates that banks must maintain a CAR of at least 11%. Banks that fall below this threshold are subject to restrictions, particularly in their ability to distribute dividends to shareholders. This restriction ensures that banks prioritize capital retention over profit distribution, thereby strengthening their financial stability.

Banks Close to Minimum Requirement:

Banks such as NIC ASIA Bank Ltd. (11.29%) and Prime Commercial Bank Ltd. (11.67%) are just above the minimum requirement. While they comply with NRB's regulation, their close proximity to the threshold suggests a need for caution. These banks should consider strategies to boost their CAR to avoid regulatory restrictions and ensure they can freely distribute dividends.

Impact of Dividend Restrictions:

For banks operating close to the 11% CAR threshold, the inability to distribute dividends can have several implications:

Shareholder Sentiment: Shareholders may perceive dividend restrictions negatively, potentially affecting the bank's stock price and investor confidence.

Capital Retention: Retaining earnings instead of distributing them as dividends can help improve the CAR, enhancing the bank's financial buffer against potential losses.

Highest CAR and Financial Strength:

Standard Chartered Bank Nepal Ltd. has the highest CAR at 16.76%, well above the minimum requirement. This strong capital position signifies:

Financial Stability: The bank has a robust buffer to absorb unexpected losses, ensuring greater financial stability.

Regulatory Compliance: With a high CAR, the bank is far from the risk of falling below regulatory requirements, allowing it to operate without the threat of dividend restrictions.

Investor Confidence: Investors may view the high CAR positively, as it indicates a lower risk of insolvency and a safer investment.

Conclusion:

Banks with CAR Just Above 11%:

Banks like NIC ASIA Bank Ltd. and Prime Commercial Bank Ltd. must carefully manage their capital to avoid falling below the 11% threshold. They might need to retain earnings and limit risk-weighted asset growth to improve their CAR.

Banks with High CAR:

Banks with high CARs, such as Standard Chartered Bank Nepal Ltd., are in a strong financial position, offering greater stability and confidence to investors and regulators. These banks can distribute dividends without restrictions and have more flexibility in their operations.

Strategic Recommendations:

For Banks Close to 11%:

Capital Enhancement: Focus on strategies to raise additional capital, such as issuing new equity or retaining more earnings.

Risk Management: Implement robust risk management practices to control and reduce risk-weighted assets.

For Banks with High CAR:

Leverage Strength: Utilize the strong capital position to explore growth opportunities, invest in new technologies, and enhance customer services.

Maintain Balance: Ensure a balanced approach to capital utilization, avoiding excessive risk-taking that could undermine the strong CAR.

By adhering to these strategies, banks can maintain regulatory compliance, enhance financial stability, and ensure sustainable growth while meeting shareholder expectations.