By Sandeep Chaudhary

Understanding Core Capital || Curent Data of Bank as of 2080-81 (Mid-April 2024)

Core capital is a fundamental measure of a bank's financial strength and stability. It plays a crucial role in maintaining the confidence of depositors, investors, and regulators in the banking system. This educational blog will delve into the concept of core capital, particularly as defined and regulated by Nepal Rastra Bank (NRB), Nepal's central bank.

In the latest report on the core capital of banks in Nepal as of 2080-81 (Mid-April 2024), significant insights can be drawn from the financial positions of these institutions. Core capital, which includes equity capital and disclosed reserves, serves as a buffer against potential financial distress and is a key indicator of a bank’s financial health. Here's a detailed analysis of the core capital standings of various Nepalese banks and their potential impact on the stock market.

Key Highlights

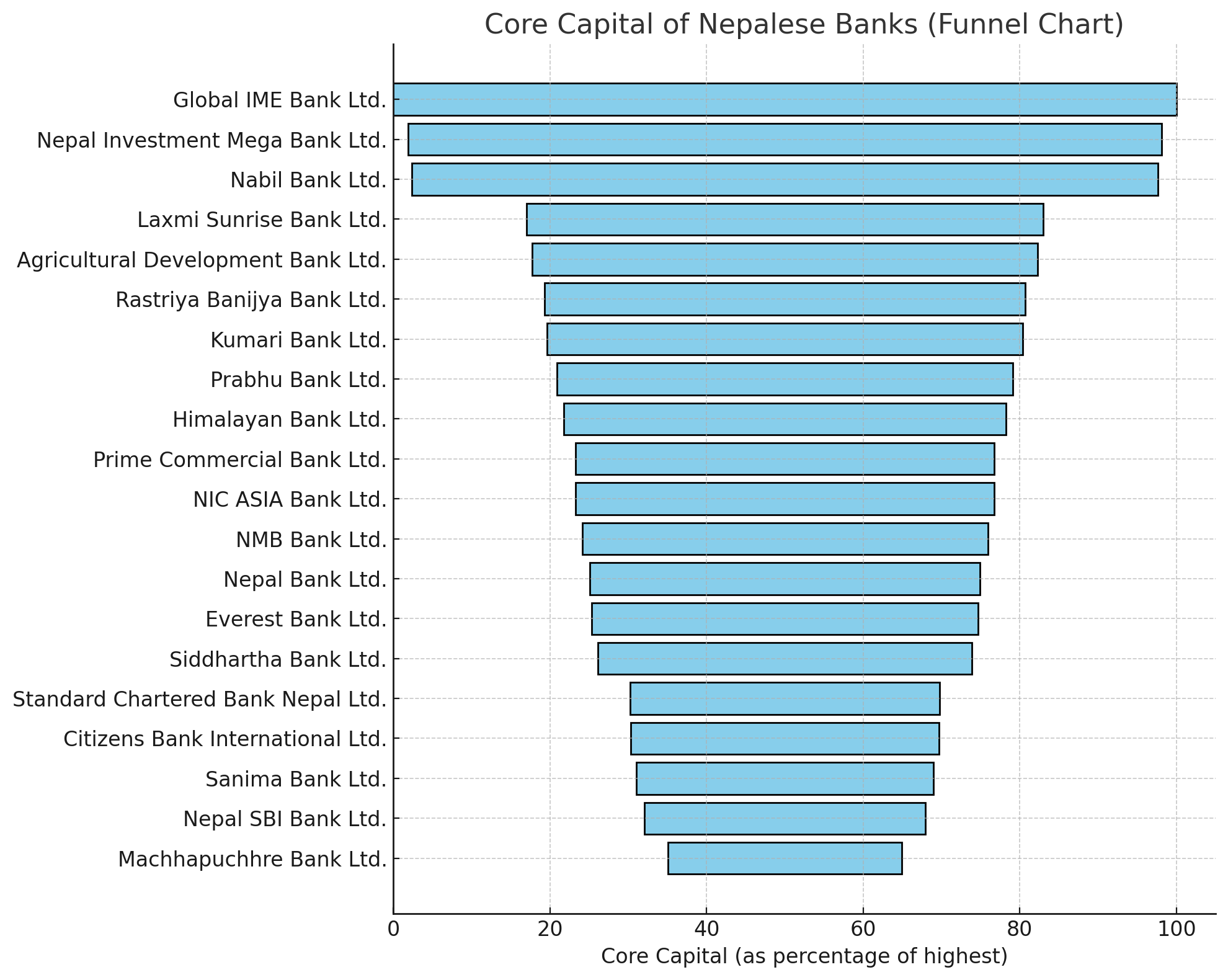

Global IME Bank Ltd. Leading the Pack

With a core capital of NPR 46,744 million, Global IME Bank Ltd. stands out as the bank with the highest core capital. This strong capital base not only signifies financial stability but also enhances investor confidence, potentially leading to a positive impact on its stock price.

Close Competition Between Mega Banks

Nepal Investment Mega Bank Ltd. and Nabil Bank Ltd. follow closely with core capitals of NPR 45,006 million and NPR 44,562 million, respectively. These figures reflect robust financial health, positioning these banks as attractive options for investors looking for stable and secure investments.

Mid-Tier Banks Showing Steady Growth

Banks such as Agricultural Development Bank Ltd. (NPR 30,195 million) and Laxmi Sunrise Bank Ltd. (NPR 30,852 million) exhibit solid core capital bases, indicating steady growth and resilience. This could translate to moderate but stable stock performance, attracting risk-averse investors.

Smaller Banks Lagging Behind

On the lower end, banks like Machhapuchhre Bank Ltd. (NPR 13,967 million) and Nepal SBI Bank Ltd. (NPR 16,737 million) have relatively smaller core capitals. While they may present higher risk, they also offer potential for higher returns if they manage to improve their financial positions.

Standard Chartered and Citizens Bank – Anomalies in Core Capital

Standard Chartered Bank Nepal Ltd. and Citizens Bank International Ltd. show core capitals of NPR 18,480 million and NPR 18,405 million, respectively. These figures are relatively low compared to their counterparts, which might impact investor perception and their stock performance adversely.

Impact on the Stock Market

Increased Investor Confidence

Banks with higher core capital, such as Global IME Bank Ltd., Nepal Investment Mega Bank Ltd., and Nabil Bank Ltd., are likely to see increased investor confidence. This could lead to a rise in their stock prices as investors seek to invest in financially stable institutions.

Potential for Mergers and Acquisitions

The disparity in core capital among banks might drive mergers and acquisitions. Smaller banks with lower core capital might become targets for acquisition by larger, more financially robust banks. Such activities can lead to significant movement in stock prices.

Enhanced Market Stability

A strong capital base across major banks contributes to overall market stability. Investors are likely to feel more secure, which can lead to increased trading volumes and a more vibrant stock market.

Impact on Lending and Economic Growth

Banks with higher core capital are better positioned to increase their lending capacity. This can stimulate economic growth by providing more loans to businesses and individuals, further boosting the stock market as economic conditions improve.

Regulatory Implications

Regulators might use this data to ensure that banks maintain adequate capital levels. Stricter regulatory measures could be introduced for banks with lower core capital, potentially affecting their operations and stock market performance.

What is Core Capital?

Core capital, often referred to as Tier 1 capital, comprises the primary funding sources of a bank. These sources include:

Equity Capital: This is the capital raised from shareholders through the issuance of common shares. Equity capital represents the ownership stake of the shareholders in the bank.

Disclosed Reserves: These are reserves that are explicitly stated in the bank’s financial statements. They include retained earnings, which are profits that the bank has reinvested rather than distributed as dividends.

Paid-Up Capital: This is the portion of capital that shareholders have fully paid for, including the amount received from issuing shares.

Non-Cumulative Preferred Stock: This includes preferred shares that do not accumulate unpaid dividends.

Importance of Core Capital

Core capital is vital for several reasons:

Absorbing Losses: It acts as a buffer to absorb unexpected losses, ensuring that the bank can continue operating even during financial downturns.

Maintaining Solvency: A strong core capital base helps in maintaining the solvency of the bank, thereby protecting depositors and maintaining confidence in the financial system.

Regulatory Compliance: Banks are required to maintain a minimum level of core capital as mandated by regulatory bodies like NRB. This ensures that banks operate within safe and sound financial practices.

Core Capital Requirements by NRB

Nepal Rastra Bank (NRB) has established specific guidelines and requirements for core capital to ensure the stability and health of the banking sector. These requirements are part of the broader capital adequacy framework that banks must adhere to.

Minimum Core Capital Ratio: NRB mandates that banks must maintain a minimum core capital ratio, which is the ratio of core capital to the bank’s risk-weighted assets. This ratio ensures that banks have enough capital to cover potential losses from their risk exposures.

Periodic Reporting: Banks are required to report their capital positions periodically to NRB. This transparency allows NRB to monitor the financial health of banks and take corrective actions if necessary.

Supervisory Reviews: NRB conducts regular supervisory reviews to assess the adequacy of a bank’s capital. This includes evaluating the quality and sustainability of the core capital.

Impact of Core Capital on the Banking Sector

Investor Confidence: A robust core capital base enhances investor confidence. Investors are more likely to invest in banks that have strong financial foundations, leading to better stock performance and easier access to capital markets.

Economic Stability: Core capital contributes to the overall stability of the banking sector, which is crucial for the broader economy. Stable banks can continue lending even in adverse economic conditions, supporting businesses and economic growth.

Risk Management: Strong core capital allows banks to take on reasonable risks while still protecting themselves against potential losses. This balanced approach to risk management supports sustainable growth in the banking sector.

Formula

Core Capital=Equity Capital+Disclosed Reserves+NonCumulative Preferred Stock+Paid-Up Capital−Deductions