Analysis of Commercial Banks' Dividend Capacity and Financial Health: Financial Results for 2080/081

Author

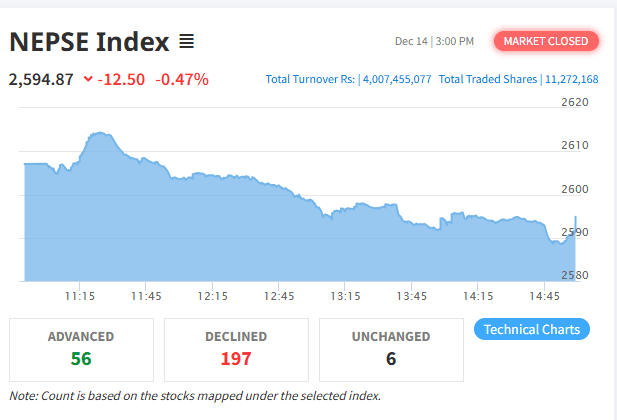

NEPSE trading

By the end of the fourth quarter of the fiscal year 2080/081, 20 commercial banks in operation have published their unaudited financial statements. These figures reflect the financial health, profitability, and dividend distribution capacity of the banks. Overall, the profit of these banks has increased by 13.40% compared to the previous year. However, not all banks have shown the same financial performance. Below, we analyze the financial performance, dividend capacity, and key financial indicators of various banks.

1. Nabil Bank: High Profit and Strong Performance

Profit and Dividend Capacity

Nabil Bank has achieved a net profit of NPR 7.06 billion in FY 2080/081, which is 10.23% higher than the previous year. Although there has been an 8.69% decline in net interest income, the reduction in impairment charges has led to an increase in profit. Nabil's distributable profit stands at NPR 3.85 billion, indicating an improved dividend distribution capacity.

Financial Indicators

During the review period, Nabil's total operating income decreased by 6.02%, but operating profit increased by 6.51%. The bank's non-performing loan (NPL) ratio decreased from 1.18% to 1.07%. Nabil's earnings per share (EPS) increased by NPR 2.42 to reach NPR 26.09.

2. Global IME Bank: Profit Decline, Challenging Situation

Profit and Interest Income

Global IME Bank's net profit decreased by 10.13% to NPR 6.01 billion compared to the previous year. The bank's net interest income fell by 2.74%, and impairment charges rose to NPR 3.74 billion, contributing to the decline in profit.

Financial Indicators

Although Global IME Bank's total operating income increased by 2.96%, operating profit declined by 8.25%. The bank's NPL ratio increased from 3.15% to 4.37%, putting pressure on its financial stability.

3. Nepal Investment Mega Bank: High Profit Growth and Improvement

Profit and Interest Income

Nepal Investment Mega Bank has reported a net profit of NPR 5.19 billion, marking a 39.71% increase compared to the previous year. The bank's net interest income increased by 22.02%, significantly boosting its profit.

Financial Indicators

The bank's total operating income increased by 19.65%, and operating profit rose by 21.62%. The bank's EPS increased by NPR 4.33 to reach NPR 15.23. However, the bank's distributable profit stands at a negative NPR 3.43 billion, affecting its dividend distribution capacity.

4. Prabhu Bank: Remarkable Profit Growth

Profit and Dividend Capacity

Prabhu Bank achieved a net profit of NPR 4.48 billion, a 1499.04% increase compared to the previous year. The bank's net interest income grew by 19.43%, and impairment charges stood at NPR 5.21 billion, contributing to the profit increase.

Financial Indicators

Prabhu Bank's total operating income increased by 20.67%. The bank's EPS increased by NPR 17.84 to reach NPR 19.45. The bank's distributable profit stands at NPR 1.22 billion, enhancing its dividend distribution capacity.

5. Agricultural Development Bank: Excellent Financial Progress

Profit and Dividend Capacity

Agricultural Development Bank achieved a distributable profit of NPR 2.66 billion, reflecting a 114.19% increase compared to the previous year. The bank's net profit reached NPR 3.65 billion, a 176% leap from the previous year.

Financial Indicators

The bank's operating profit increased by 70%. Net interest income reached NPR 10.12 billion, marking a significant increase compared to the previous year. The bank's deposit collection increased by 22%, while credit disbursement increased by 13%.

6. NIC Asia Bank: Challenging Financial Situation

Profit and Impairment Charges

NIC Asia Bank's profit declined to NPR 1.38 billion, a 68.91% decrease compared to the previous year. The bank's impairment charges rose to NPR 2.84 billion, putting pressure on its financial stability.

Financial Indicators

NIC Asia Bank's EPS fell by NPR 29.17 to reach NPR 9.26. The bank's total operating income decreased by 12.36%. The bank's distributable profit stands at a negative NPR 2.30 billion, significantly affecting its dividend distribution capacity.

7. Sanima Bank: Declining Profit and Challenges

Profit and Interest Income

Sanima Bank's profit decreased by 8.59% to reach NPR 2.38 billion. The bank's net interest income declined by 4.64%, and the increase in provisioning expenses led to a decrease in profit.

Financial Indicators

Sanima Bank's EPS fell by NPR 3.37 to reach NPR 17.54. The bank's net worth is NPR 154.35. The bank has significantly improved its NPL ratio, bringing it down to 1.73%.

8. Himalayan Bank: Profit Growth and Improvement

Profit and Interest Income

Himalayan Bank's profit increased by 81.59% to reach NPR 2.83 billion compared to the previous year. The bank's net interest income increased by 17.12%, leading to an improvement in profit.

Financial Indicators

Himalayan Bank's net operating profit reached NPR 10.35 billion. The bank's EPS reached NPR 13.10, indicating an improvement in its financial performance. However, the bank's distributable profit stands at a negative NPR 5.78 billion.

9. Standard Chartered Bank: Profit Decline and Need for Improvement

Profit and Interest Income

Standard Chartered Bank reported a net profit of NPR 3.30 billion, a 4.62% decline compared to the previous year. The bank's net interest income fell to NPR 5.15 billion, leading to a decline in profit.

Financial Indicators

Standard Chartered Bank's distributable profit stands at NPR 2.49 billion. The bank's price-earnings ratio is 11.6 times, positively affecting its financial stability and dividend distribution capacity.

10. Nepal Bank: Decline in Net Profit

Profit and Interest Income

State-owned Nepal Bank Limited reported a net profit of NPR 1.65 billion for the last fiscal year, a 51.85% decline compared to the previous year. The bank's net interest income decreased by 6.43% to NPR 8.80 billion.

Financial Indicators

Nepal Bank's total operating income saw a slight decline, and there was an increase in impairment charges. The bank's EPS fell from NPR 23.39 to NPR 11.28. However, the distributable profit stands at NPR 769.3 million, having some positive impact on its dividend distribution capacity.

11. Rastriya Banijya Bank: Moderate Profit Decline

Profit and Interest Income

Rastriya Banijya Bank reported a net profit of NPR 3.39 billion for the last fiscal year, a 5.48% decline compared to the previous year. The bank's net interest income decreased by 13.39%, while impairment charges decreased.

Financial Indicators

The bank's total operating income increased by 11.18%, and operating profit also increased by 4.94%. The bank's EPS decreased from NPR 24.22 to NPR 21.73. The bank's distributable profit stands at NPR 582.1 million.

12. NMB Bank: Profit Decline

Profit and Interest Income

NMB Bank has reported a decrease in net profit compared to the previous fiscal year. The bank earned a net profit of NPR 2.33 billion for the last fiscal year, a decrease compared to the previous year.

Financial Indicators

The bank's distributable profit stands at NPR 233.8 million, affecting its dividend distribution capacity. During this period, the bank's base rate decreased from 10.37% to 8.42%.

13. Kumari Bank: Profit Growth but Challenging Financial Condition

Profit and Interest Income

Kumari Bank reported a net profit of NPR 2.30 billion for the last fiscal year, a 345.68% increase compared to the previous year. Although the bank's operating profit increased, the increase in provisioning expenses led to a negative distributable profit.

Financial Indicators

Kumari Bank's net interest income decreased by 0.72% to NPR 10.98 billion. The bank's distributable profit stands at a negative NPR 3.78 billion, putting pressure on its dividend distribution capacity.

14. Sanima Bank: Decline in Profit and Challenging Situation

Profit and Interest Income

Sanima Bank's profit decreased by 8.59% to reach NPR 2.38 billion. The bank's net interest income fell by 4.10%, leading to a decline in profit.

Financial Indicators

Sanima Bank's EPS stands at NPR 17.54, while its net worth is NPR 154.35. The increase in provisioning expenses has contributed to the decrease in profit. The bank's distributable profit stands at NPR 1.41 billion, reducing its dividend distribution capacity.

15. Siddhartha Bank: Decline in Profit

Profit and Interest Income

Siddhartha Bank's net profit stands at NPR 3.01 billion, a 4.78% decline compared to the previous year. The bank's net interest income saw a slight decrease, and the increase in impairment charges led to a decline in profit.

Financial Indicators

Siddhartha Bank's EPS stands at NPR 21.40, while its distributable profit stands at NPR 366.6 million. The bank's net worth is NPR 196.36, indicating financial stability.

16. Laxmi Sunrise Bank: Profit Growth

Profit and Interest Income

Laxmi Sunrise Bank reported a net profit of NPR 3.03 billion for FY 2080/081, a 32.79% increase compared to the previous fiscal year. The bank's net interest income increased by 103.97%, significantly boosting its profit.

Financial Indicators

Laxmi Sunrise Bank's total operating income increased by 90.50%, and operating profit increased by 35.99%. The bank's EPS increased by NPR 2.54 to reach NPR 13.09. As of Ashad end, the bank's net worth per share stands at NPR 175.80. The bank's distributable profit stands at NPR 1.28 billion, enhancing its dividend distribution capacity.

17. Everest Bank: High Dividend Capacity

Profit and Interest Income

Everest Bank achieved a net profit of NPR 3.70 billion, reflecting an increase compared to the previous year. The bank's total operating profit reached NPR 5.60 billion, strengthening its financial performance. The bank's net interest income also increased to NPR 7.66 billion.

Financial Indicators

The bank's NPL ratio decreased from 0.79% to 0.71%, strengthening its financial stability. The bank's EPS reached NPR 31.45, while the net worth per share stood at NPR 236.06. The bank's distributable profit stands at NPR 3.51 billion, indicating high dividend capacity.

18. Himalayan Bank: Profit Growth

Profit and Interest Income

Himalayan Bank's profit increased by 81.59% to reach NPR 2.83 billion compared to the previous year. The bank's net interest income increased by 17.12%, leading to an improvement in profit.

Financial Indicators

Himalayan Bank's net operating profit reached NPR 10.35 billion. The bank's EPS reached NPR 13.10, indicating an improvement in its financial performance. However, the bank's distributable profit stands at a negative NPR 5.78 billion.

19. Standard Chartered Bank: Profit Decline and Need for Improvement

Profit and Interest Income

Standard Chartered Bank reported a net profit of NPR 3.30 billion, a 4.62% decline compared to the previous year. The bank's net interest income fell to NPR 5.15 billion, leading to a decline in profit.

Financial Indicators

Standard Chartered Bank's distributable profit stands at NPR 2.49 billion. The bank's price-earnings ratio is 11.6 times, positively affecting its financial stability and dividend distribution capacity.

20. Citizens Bank: Decline in Profit

Profit and Interest Income

Citizens Bank earned a net profit of NPR 1.34 billion for the last fiscal year, a 28% decline compared to the previous year. The bank's net interest income stands at NPR 5.68 billion, slightly down from the previous year.

Financial Indicators

The bank provisioned NPR 1.76 billion for impairment charges, reducing its profit. The bank's distributable profit stands at NPR 616.1 million.

Conclusion: Mixed Picture of Commercial Banks' Financial Health

The financial performance of commercial banks in 2080/081 presents a mixed picture. Some banks have achieved remarkable profit growth, while others have faced financial challenges. Overall, the banking sector has shown improvement compared to the previous year, but there is inconsistency in dividend distribution capacity. In the coming years, banks will need to strengthen their financial positions to gain the trust of investors.