Audit of 10 Commercial Banks to Proceed After Supreme Court Lifts Stay Order

Author

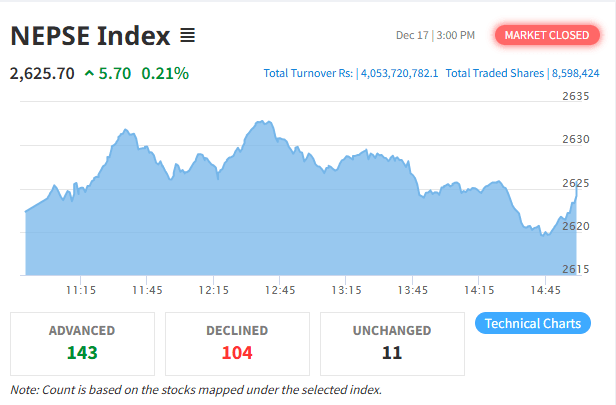

Nepse trading

The full audit process of 10 commercial banks in Nepal will now move forward after the Supreme Court lifted its interim stay order. The audit is a key condition under the IMF's Extended Credit Facility (ECF), prompting Nepal Rastra Bank (NRB) to initiate a global competitive selection of audit firms. After Indian firm KPMG withdrew due to high cost, a Bangladeshi firm—Howladar Yunus & Co.—was selected in the second round. However, a rival firm filed a writ petition, halting progress. On 9th Asar, the joint bench of the Supreme Court ruled against continuing the interim order, allowing the process to resume.

NRB will now request a financial proposal from Howladar, and auditing will soon begin. Each bank will be assigned 2 auditors and 2 NRB staff, with 22 personnel deployed in total. The audit will cover the banks’ entire financials—not just loans—focusing on asset quality, loan defaults, and governance. The IMF had raised concerns over loan "evergreening" practices in Nepal and had urged the NRB to implement working capital loan guidelines to ensure transparency.

Following the court's decision, the IMF is expected to approve Nepal's sixth ECF installment worth $42.7 million (approx. NPR 5.85 billion). With this, Nepal will have received $331.8 million (approx. NPR 45.45 billion) under the facility so far. The ECF was approved in January 2022 with a total commitment of $395.9 million (around NPR 54 billion), contingent on Nepal's implementation of financial reforms and anti-money laundering measures.