Finance Minister’s Efforts to Contain the Stock Market “Landslide”

Author

NEPSE TRADING

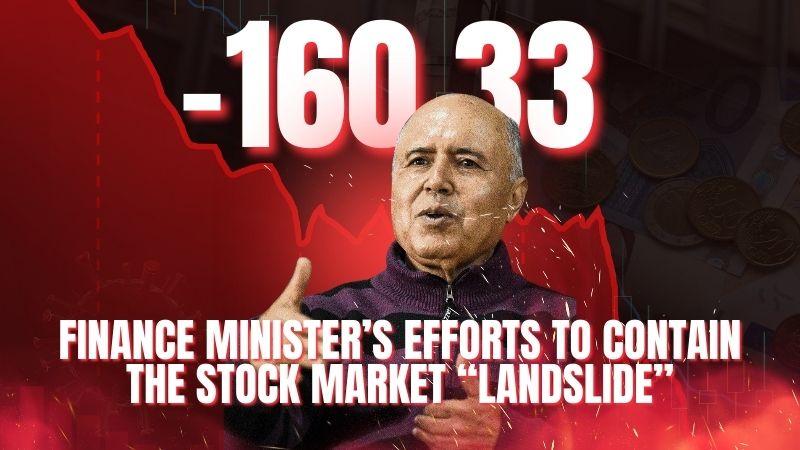

Kathmandu. After remaining closed for ten days due to the Gen Z movement, the stock market reopened on Thursday (Ashwin 2) with a sharp fall of 160 points. On the very first day of trading, the market faced three consecutive negative circuits, leading to a complete halt in transactions. For the first time in history, NEPSE lost 160 points in a single day, plunging to 2,511.91 points.

Formation of a Task Force

Following this historic drop, Finance Minister Rameshwar Khanal formed a special task force under the leadership of Rupesh KC, the Acting Executive Director of the Securities Board of Nepal. The task force also includes:

Sharan Adhikari, Director of Nepal Rastra Bank

Niranjan Phuyal, Acting Executive Director of NEPSE

Sharad Niraula, Undersecretary at the Ministry of Finance (Member Secretary)

The task force has been mandated to present concrete recommendations and a reform plan for market stabilization within five days.

Previous Commission Report

Earlier, a High-Level Economic Reform Suggestion Commission, also chaired by Minister Khanal, had already prepared a report with 13 detailed recommendations for capital market reforms. The commission suggested:

Restructuring and recapitalizing NEPSE

Increasing private sector participation

Launching a secondary market for government bonds

Allowing Non-Resident Nepalis (NRNs) to participate in trading

Expanding margin lending facilities

Bringing productive industries into the stock market

Initiating a commodity exchange market, among others.

Demands of Investors

Investors have also forwarded their own demands for market reforms. The major ones include:

Increasing the personal loan ceiling

Adjusting capital gains tax to 3% for long-term and 5% for short-term investments

Modernizing and strengthening the online trading system

Establishing a new stock exchange for competitive market operation

Listing small and medium-sized enterprises (SMEs) in the capital market

Eliminating double taxation on dividends and bonus shares

Revising broker commission to a one-way system.

To contain the unprecedented “landslide” in the stock market, both short-term immediate actions and long-term structural reforms are essential. If the recommendations of the newly formed task force, along with those of the earlier high-level commission, are implemented effectively, investor confidence is expected to recover and the market could regain stability.