Nepal Rastra Bank Signs Agreement with Bangladeshi Firm to Review Loan Quality of 10 Commercial Banks

Author

NEPSE TRADING

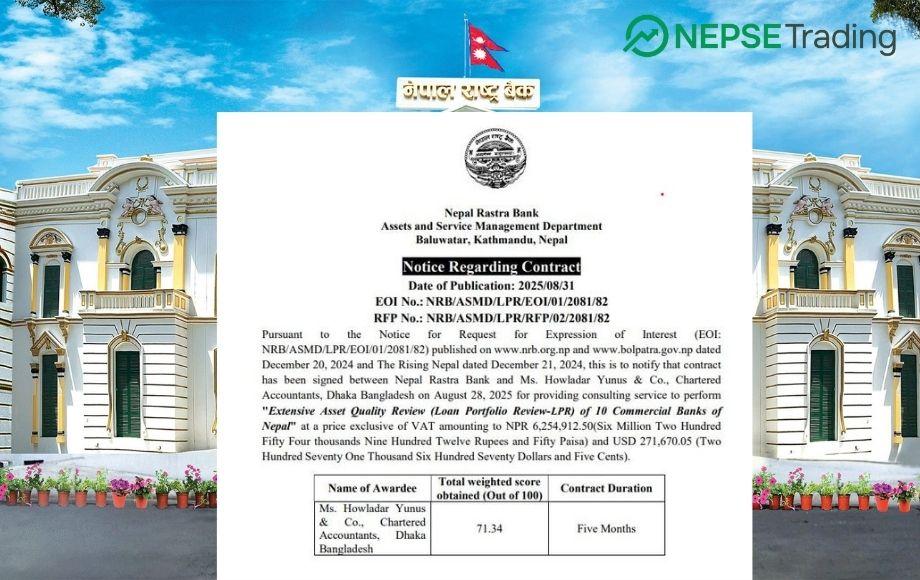

Kathmandu – Nepal Rastra Bank (NRB) has moved ahead with a plan to review the loan quality (Loan Portfolio Review) of the country’s major commercial banks. For this purpose, NRB has signed an agreement worth around USD 271,679 (approx. NPR 62.54 million) with Howladar Yunus & Co., Chartered Accountants, a Bangladeshi audit firm. According to the agreement, the firm must complete the review within five months.

Which Banks Will Be Reviewed?

The loan portfolio review will cover 10 large and systemically important commercial banks: Rastriya Banijya Bank, Global IME Bank, Nepal Investment Mega Bank, Nabil Bank, Kumari Bank, Laxmi Sunrise Bank, Himalayan Bank, NMB Bank, Prabhu Bank, and NIC Asia Bank.

Why Was This Necessary?

The review comes under the conditions of the Extended Credit Facility (ECF) provided to Nepal by the International Monetary Fund (IMF). The IMF has pressed Nepal to conduct an independent assessment of large banks’ loan portfolios to ensure greater transparency, proper risk management, and early identification of potential non-performing loans (NPLs).

In recent years, credit expansion in Nepal has grown rapidly, but concerns remain about the actual quality of loans across various sectors. By involving an external firm, the central bank aims to obtain a clearer and more credible picture of risks in the banking system.

Possible Implications

The review could reveal hidden weaknesses in loan books, including underreported NPLs or high-risk exposures. This might directly impact banks’ capital adequacy, lending capacity, and dividend distribution policies.

The findings may also influence investor confidence. If loan portfolios prove to be strong, it would send a positive message to foreign investors and donors like the IMF. However, if weaknesses are uncovered, NRB may have to enforce stricter regulations, possibly creating short-term uncertainty in the financial market.

Experts believe this review will strengthen Nepal’s banking system in the long run, even if it introduces short-term challenges. Investors, banks, and regulators are all expected to closely follow the outcomes.

For NRB, the move is being framed as a key reform step in safeguarding financial stability. The final report—expected within five months—will reveal the true health of Nepal’s largest commercial banks.