Questions Over Nepali Banks’ Loan Quality: Suspicions of ‘Loan Evergreening’

Author

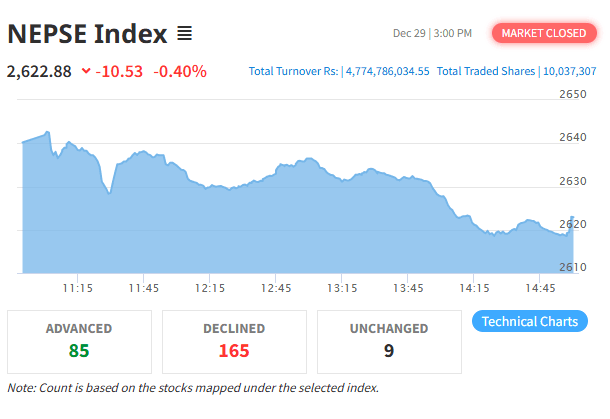

Nepse trading

Nepal Rastra Bank has shortlisted six consulting firms to assess the asset quality of Nepal’s top ten banks. Sri Lanka’s Deloitte Partners, Bangladesh’s Howlader Younus & Company, and four Indian firms are on the list. The International Monetary Fund (IMF) and World Bank have raised concerns over the lending practices of Nepali banks, particularly suspecting ‘loan evergreening’—where new loans are issued to borrowers unable to repay old debts. This evaluation aims to address these doubts.

The IMF’s 2020 Article IV consultation and the World Bank’s 2014 Nepal Development Update flagged uncertainties about the true health of Nepal’s banking sector. Concerns include overdrafts and working capital loans making up to 40% of total lending. With high interest rates eroding loan quality and suspicions of banks hiding bad loans to distribute dividends, this asset quality review is expected to uncover risks in the banking system.