RSDC Laghubitta Records Sharp Profit Decline Despite Robust Deposit Growth

Author

NEPSE TRADING

RSDC Laghubitta Bittiya Sanstha Limited has published its unaudited financial report for the fourth quarter of fiscal year 2082, revealing a mixed performance marked by a significant decline in profit and core income, even as deposits surged by over 27%. The microfinance institution, which caters to rural and small-scale borrowers, faces margin pressure and declining earnings per share despite maintaining capital adequacy and net worth stability.

Profitability Under Pressure: Net Income Falls Over 27%

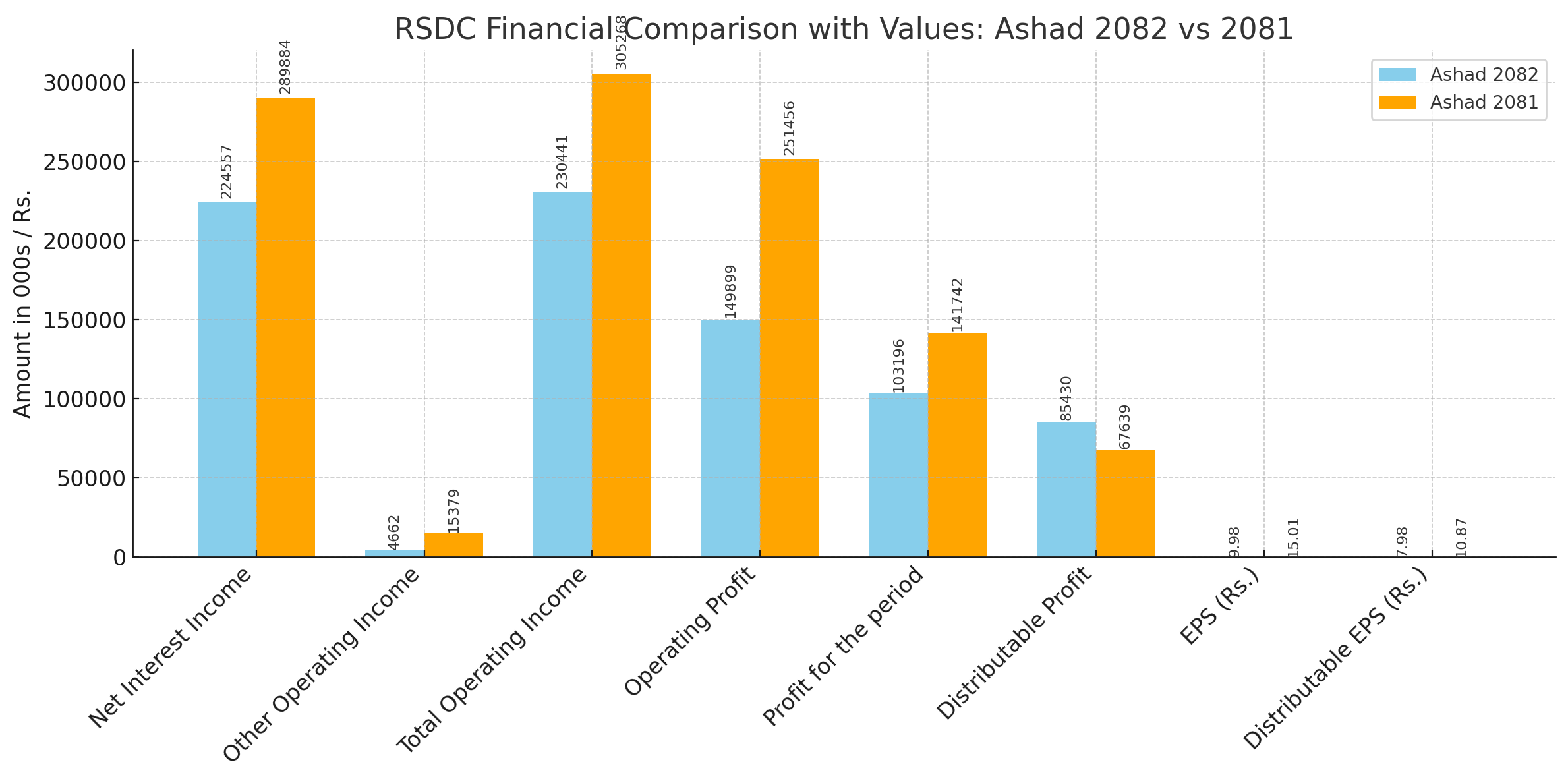

RSDC reported a net profit of NPR 103.19 million in Ashad 2082, a 27.19% drop compared to NPR 141.74 million in the same period last year. This decline was primarily driven by a sharp reduction in Net Interest Income (NII), which dropped by 22.54% to NPR 224.56 million, from NPR 289.88 million a year ago.

The microfinance company also saw a substantial fall in Other Operating Income, plummeting by nearly 70%, from NPR 15.37 million to just NPR 4.66 million. This contraction pushed Total Operating Income down to NPR 230.44 million, a 24.51% year-over-year decline.

Meanwhile, Impairment Charges rose to NPR 26.82 million from a reversed credit of NPR -6.56 million in the previous year. This reversal of impairment last year had temporarily inflated profits but its reappearance now reflects deteriorating asset quality.

EPS Slips Below NPR 10: Weak Returns for Shareholders

The drop in net income translated into a significant erosion in shareholder earnings. Earnings Per Share (EPS) dropped from NPR 15.01 to NPR 9.98, while Distributable EPS also fell from NPR 10.87 to NPR 7.98. This could impact the dividend-paying capacity of the company and lower investor confidence.

However, Distributable Profit increased to NPR 85.43 million, up from NPR 67.63 million—likely due to lower tax liabilities or adjustments outside core operations.

Strong Deposit Mobilization and Capital Resilience

Amid profitability challenges, RSDC showed strength in deposit mobilization. Deposits and Borrowings increased from NPR 5.36 billion to NPR 6.81 billion, a 27.05% surge. This indicates growing customer confidence and an expanding funding base.

While the loan book slightly contracted by 1.30% to NPR 6.22 billion, the microfinance company maintained a Capital Fund to Risk Weighted Assets (RWA) ratio of 18.45%, almost unchanged from the previous year’s 18.49%, which is well above regulatory requirements.

The Net Worth per Share also increased modestly from NPR 124.50 to NPR 125.95, signifying stable internal capital accumulation.

Cost of Fund and Spread Down: Margin Pressure Intensifies

RSDC’s Cost of Fund dropped sharply to 6.17%, down from 10.87%, indicating cheaper borrowing. However, the Base Rate also declined to 6.96% from 9.81%, meaning the lending rates fell too.

Most notably, the Interest Rate Spread narrowed from 2.54% to just 1.43%, reflecting squeezed margins—this is a critical concern as lower spreads limit earnings from core lending activities.

Adding to the concern, Non-Performing Loans (NPL) slightly increased to 3.34%, from 3.31%, hinting at rising stress in the loan portfolio.

Interpretation: Solid Fundamentals but Weak Profitability

RSDC’s FY 2082 report paints a cautionary picture. The company has done well in expanding its funding base and retaining capital strength, which is commendable in the microfinance space. However, its profitability has weakened considerably, and shrinking interest margins could become a long-term risk if not addressed.

The fall in EPS and operating profit will weigh on investor sentiment, especially for shareholders expecting stable dividends. Nonetheless, the rise in distributable profit suggests the company may still sustain moderate payouts, at least in the short term.

Analysts suggest that RSDC needs to:

Recalibrate its lending strategy,

Tighten its credit underwriting to reduce impairment,

And find new sources of non-interest income.

If margin compression continues and loan quality worsens, the company's earnings outlook may remain subdued.

Key Financial Figures at a Glance (Ashad 2082 vs 2081):

Indicator | Ashad 2082 | Ashad 2081 | % Change |

|---|---|---|---|

Net Interest Income | NPR 224.56 Mn | NPR 289.88 Mn | -22.54% |

Operating Profit | NPR 149.89 Mn | NPR 251.46 Mn | -40.39% |

Net Profit | NPR 103.19 Mn | NPR 141.74 Mn | -27.19% |

EPS | NPR 9.98 | NPR 15.01 | -33.5% |

Distributable Profit | NPR 85.43 Mn | NPR 67.63 Mn | +26.3% |

Deposits & Borrowings | NPR 6.81 Bn | NPR 5.36 Bn | +27.05% |

Loan and Advances | NPR 6.22 Bn | NPR 6.31 Bn | -1.30% |

NPL Ratio | 3.34% | 3.31% | ↑ 0.03% |

Interest Rate Spread | 1.43% | 2.54% | ↓ 1.11% |

RSDC’s FY 2082 performance underscores a company at a crossroads—financially resilient but facing profitability headwinds. Unless it revives core interest income and stabilizes loan quality, the growth in deposits and capital may not fully translate into investor gains.