Sayapatri Hydropower Faces Sharp Profit Drop, EPS Down to Rs.1.93

Author

NEPSE TRADING

Sayapatri Hydropower Limited has published its unaudited financial results for the fourth quarter ending on 32nd Ashadh, 2082 (FY 2081/82). The company reported a significant decline in profit compared to the same quarter of the previous fiscal year.

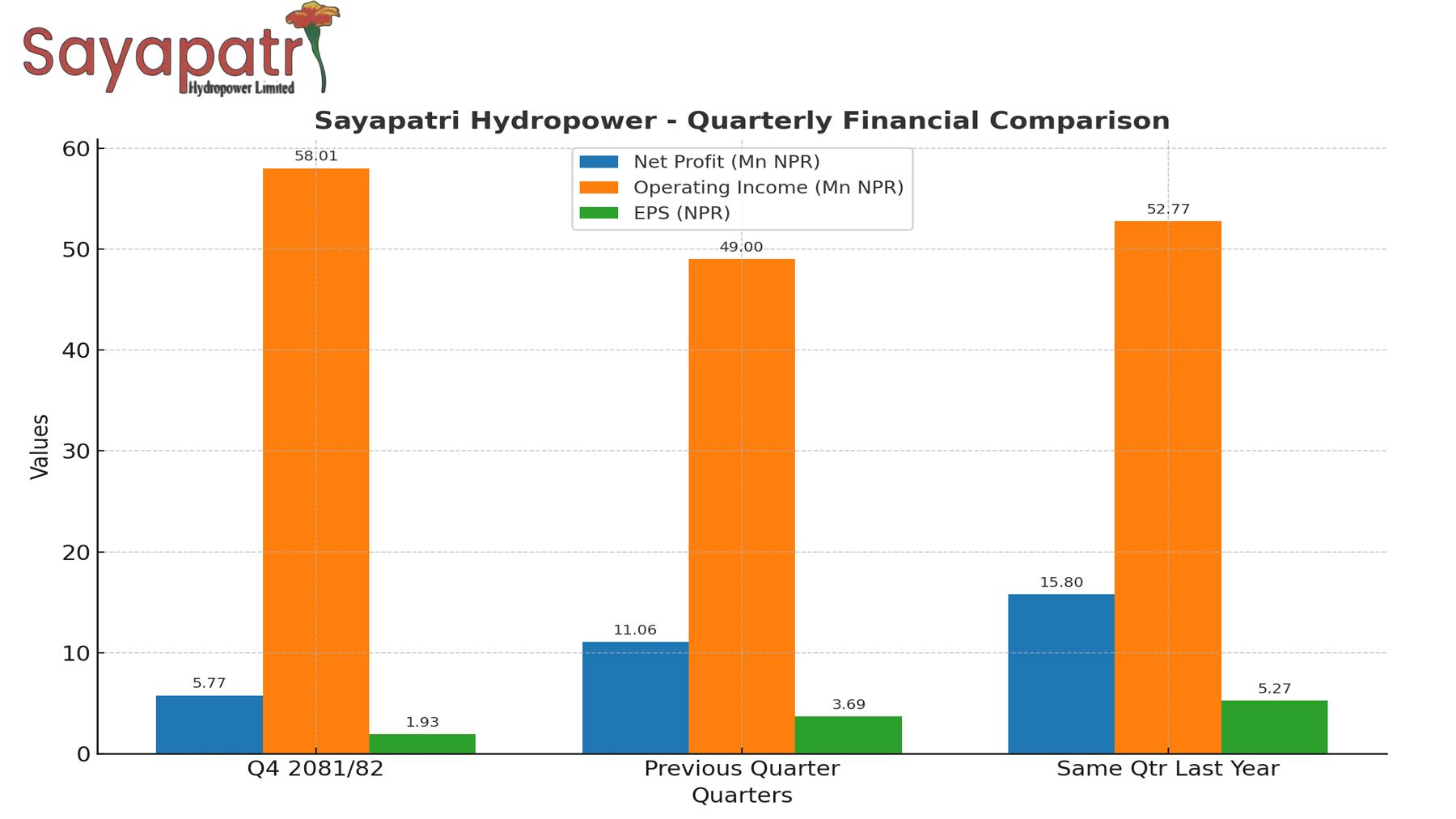

During this quarter, the company posted a net profit of Rs. 5.77 million, a sharp decline of nearly 48% compared to Rs. 11.06 million in the previous quarter, and a steep fall from Rs. 15.80 million in the corresponding period last year.

The decline in profit is mainly attributed to rising finance costs, which increased to Rs. 38.32 million this quarter, up from Rs. 29.64 million in the previous quarter. Similarly, administrative and repair expenses also added pressure to the earnings.

The company generated a total operating income of Rs. 58 million, slightly higher than the previous year’s Rs. 52.77 million. However, heavy interest expenses and depreciation reduced the overall profitability.

In terms of shareholder returns, the company’s Earnings Per Share (EPS) dropped to Rs. 1.93, down from Rs. 3.69 in the previous quarter and Rs. 5.27 in the same period last year. The Net Worth per Share stands at Rs. 92.78, while the market price per share is Rs. 154, pushing the P/E ratio to 79.8 – indicating the stock is trading at a very high valuation relative to its earnings.

On the balance sheet side, Sayapatri Hydropower holds total assets of Rs. 503.41 million, while total equity is recorded at Rs. 278.33 million. The company’s retained earnings remain negative at Rs. -21.66 million, reflecting accumulated past losses despite recent profits.

Cash flow from operating activities turned negative at Rs. -9.08 million, indicating liquidity stress, while financing cash outflows due to interest payments further squeezed cash positions. Consequently, cash & cash equivalents dropped to Rs. 2.95 million, down from Rs. 8.58 million in the previous quarter.

Overall, Sayapatri Hydropower is struggling with high debt servicing costs, which continue to weigh on its profitability despite steady revenue generation. Investors are likely to remain cautious as the company’s P/E ratio suggests the share is expensive compared to its earnings capacity.