Service Account Deficit Widens as Travel Spending—Especially on Education—Surges

Author

NEPSE TRADING

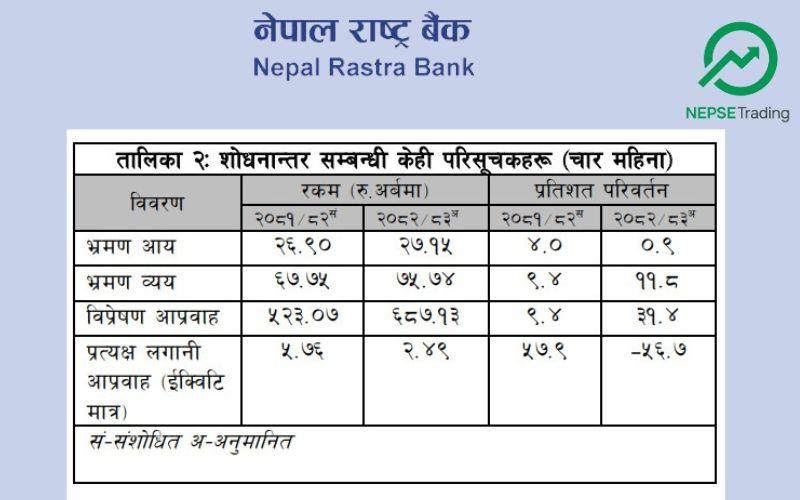

Nepal’s service account remained under growing pressure in the first four months of fiscal year 2082/83 (up to mid-November 2025), as a sharp rise in outbound travel spending outweighed modest gains in service income. According to balance of payments indicators released by Nepal Rastra Bank, the net service income recorded a deficit of Rs 32.91 billion during the review period, significantly wider than the Rs 22.37 billion deficit seen in the same period last year.

The data show that while some service-sector inflows improved slightly, overall expenses increased at a much faster pace, deepening the structural imbalance in the service account. Economists note that this trend reflects long-standing weaknesses in Nepal’s ability to export services compared to its growing dependence on foreign services.

Tourism Income Grows Slowly

Under the service account, travel income increased marginally by 0.9 percent to Rs 27.15 billion, up from Rs 26.90 billion a year earlier. Although tourist arrivals and related activities have gradually improved, the slow growth rate suggests that tourism earnings have yet to regain strong momentum. Analysts point out that shorter stays, lower per-tourist spending and a focus on budget travel may be limiting income growth despite rising visitor numbers.

Outbound Travel Spending Rises Sharply

In contrast, travel expenditure surged by 11.8 percent to Rs 75.74 billion during the same period, compared to Rs 67.75 billion last year. A large share of this increase came from education-related expenses, which alone amounted to Rs 48.26 billion, up sharply from Rs 37.77 billion in the previous year.

The rising cost of overseas education and the growing number of Nepali students studying abroad have significantly increased foreign currency outflows. Experts warn that unless domestic higher education capacity improves, education-related travel spending will continue to exert heavy pressure on the service account.

Remittance Inflows Provide Strong Support

Despite the widening service deficit, Nepal’s external position received substantial support from remittance inflows. During the review period, remittances increased by 31.4 percent to Rs 687.13 billion, compared to Rs 523.07 billion a year earlier. The strong growth in remittances helped cushion the impact of higher service and trade deficits on the overall balance of payments.

Foreign Direct Investment Declines

In contrast to the positive remittance trend, foreign direct investment (equity only) fell sharply by 56.7 percent to Rs 2.49 billion, down from Rs 5.76 billion in the same period last year. The decline in FDI has raised concerns about investor confidence, policy predictability and the broader investment climate. Analysts argue that sustained weakness in foreign investment could limit long-term growth and technology transfer.

The latest figures underline a key challenge facing Nepal’s external sector. While remittances continue to provide vital support, the persistent rise in service-sector outflows—particularly education-related travel spending—has widened the service account deficit. At the same time, slow growth in tourism income and declining foreign investment point to missed opportunities in service exports and capital inflows.

Economists emphasize that addressing these imbalances will require strengthening domestic education and health services, diversifying tourism products to increase per-visitor spending, and improving the investment climate. Without such reforms, Nepal’s service account deficit is likely to remain a structural drag on the balance of payments, leaving the economy increasingly reliant on remittances to maintain external stability.