S&P 500 and Nasdaq Hit Record Highs as Tech Gains Outweigh Fed Concerns

Author

NEPSE TRADING

S&P 500 and Nasdaq Hit Record Highs as Tech Gains Outweigh Fed Concerns

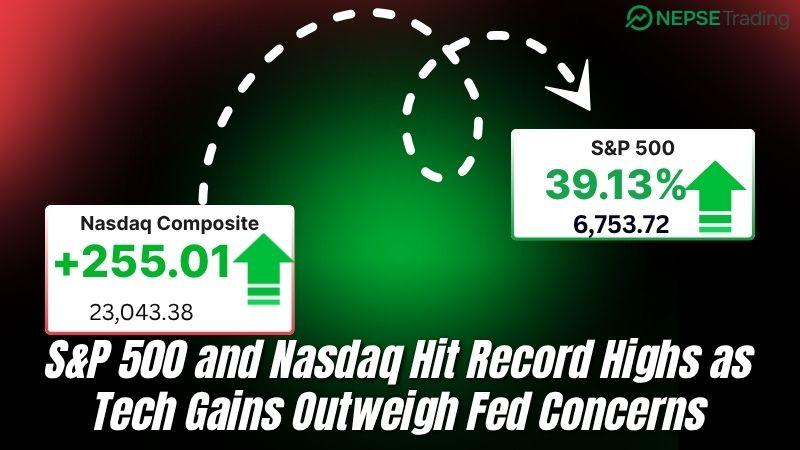

U.S. stock markets closed higher on Wednesday, led by strong gains in technology shares. Both the S&P 500 and Nasdaq Composite ended at all-time highs, while the Dow Jones Industrial Average finished nearly flat.

With the ongoing government shutdown leaving investors without new economic data, attention turned to the Federal Reserve’s September meeting minutes for signals about future interest rate policy.

AI-related megacap stocks continued to drive market momentum, helping the Nasdaq rise 1.12% to 23,043.38. The S&P 500 gained 0.58% to 6,753.72, while the Dow slipped marginally by 1.20 points to 46,601.78.

Semiconductor stocks (.SOX) were the day’s strongest performers, while energy, consumer staples, and homebuilders lagged behind. A Mortgage Bankers Association report showed that home loan demand fell 4.7% last week despite easing mortgage rates.

“The theme continues to be aggressive growth, with one AI-related deal after another,” said Bill Merz, Head of Capital Market Research at U.S. Bank Wealth Management.

The ongoing enthusiasm for artificial intelligence has captured investors’ attention, with major tech names driving much of this year’s rally.

At the same time, rising geopolitical tensions and uncertainty have driven gold prices above $4,000 per ounce, as investors turn to the precious metal for safety. “We’ve seen in recent years that stocks and safe havens can rise together,” Merz added, pointing to strong fundamentals and increased government debt financing.

The Fed’s latest minutes revealed a split among policymakers — some concerned about labor market risks, others still focused on inflation.

While most members agreed that it may be appropriate to ease policy further later this year, the timing and pace of rate cuts remain uncertain.

Markets now price in a 92.5% probability that the Fed will cut interest rates by 25 basis points at its October 29 meeting.

AMD (AMD.O) surged 11.4%, extending its three-day rally to a 43% gain for the week.

Dell Technologies (DELL.N) jumped 9.1% after multiple brokerages raised their price targets.

Freeport-McMoRan (FCX.N) climbed 5.3% after a Citigroup upgrade to “Buy.”

Datadog (DDOG.O) rose 6.2% following a Bernstein price target hike.

Intercontinental Exchange (ICE.N) fell 2.2% after Barclays cut its outlook.

Fair Isaac Corp (FICO.N) dropped 9.8% after Equifax (EFX.N) announced plans to offer lower-cost mortgage credit scores.

Gold miners Newmont (NEM.N) and Gold Fields gained 1.7% and 3.7%, respectively, on the back of surging gold prices.

Joby Aviation (JOBY.N) fell 8.1% after pricing a $514 million share sale at a 10.9% discount.

Advancers outnumbered decliners by a 1.74-to-1 ratio on the NYSE and 1.81-to-1 on the Nasdaq.

The S&P 500 posted 35 new 52-week highs, while the Nasdaq recorded 129 new highs.

Total volume across U.S. exchanges hit 20.7 billion shares, above the recent 20-day average.

Analysts say the market’s current optimism is driven by AI-fueled tech growth, expectations of Fed rate cuts, and a flight to safety in gold amid ongoing political and economic uncertainty.