Stock Market Gains Momentum with Rising Three Methods Pattern Ahead of Nepal Rastra Bank's Monetary Policy Review

Author

Dipesh Ghimire

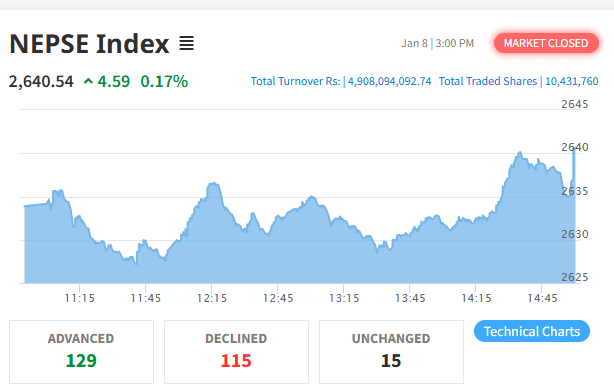

Kathmandu, February 6, 2025 – The Nepal Stock Exchange (NEPSE) is witnessing strong bullish momentum as investors anticipate a market-friendly Monetary Policy Review by Nepal Rastra Bank (NRB). The formation of the Rising Three Methods pattern last week signals continued upward momentum, and if this week also follows a similar pattern, NEPSE could experience further gains.

Market analysts predict that the upcoming monetary policy changes will boost liquidity, lower interest rates, and ease restrictions on stock market investments, driving continued bullish sentiment.

Monetary Policy Review: Key Expectations

Nepal Rastra Bank’s mid-term monetary policy review is expected to introduce several key changes that will impact the banking sector, stock market, and overall economy. Investors are eagerly awaiting the following policy updates:

1. Revised Lending Growth Policy

✅ NRB is expected to revise its lending growth policy, allowing banks and financial institutions to expand their loan portfolios.

✅ This could result in higher credit availability, boosting business growth and stock market liquidity.

2. Banks May Be Allowed to Invest in the Stock Market

✅ Current banking regulations limit direct investments in the stock market. However, NRB may allow banks to invest in securities, leading to fresh liquidity inflows into NEPSE.

✅ If implemented, this policy could significantly strengthen institutional participation, increasing market depth and stability.

3. Reduction in Bank Interest Rates, CRR, and SLR

✅ Bank interest rates may be reduced, making credit more accessible to businesses and investors.

✅ Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) may be lowered, increasing the funds available for lending and investment.

✅ These measures could drive higher stock market participation by reducing borrowing costs.

4. Removal of Share Loan Cap for Individuals

✅ The current cap on share loans for individual investors may be removed, allowing high-net-worth investors to deploy larger amounts into the stock market.

✅ This policy shift could boost market volumes and improve liquidity.

5. Eased Margin Loan Policy

✅ NRB is expected to ease margin lending regulations, allowing banks to increase the margin loan limit for investors.

✅ A more relaxed margin loan policy would increase retail investor participation and fuel further market growth.

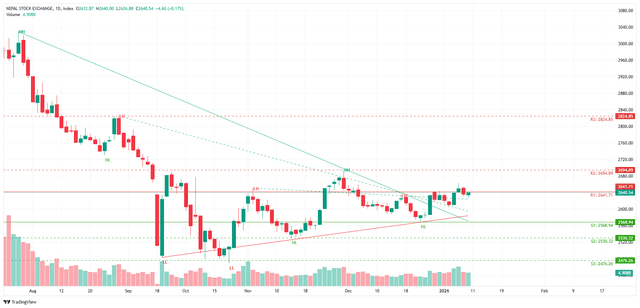

Technical Analysis: Market Outlook and Key Levels

The stock market has formed a strong uptrend, making higher highs (HH) and higher lows (HL) over the past few weeks. Key levels to watch:

✅ Immediate Resistance (Target 1): 2,785

✅ Second Resistance (Target 2): 3,023

✅ Support Zone: 2,650 - 2,700

Last week’s Rising Three Methods pattern confirmed strong buyer dominance, and if another similar pattern forms this week, NEPSE could break above the 3,000 level.

Investor Strategy: How to Trade This Market?

📌 Buy/Hold Strategy: Given the bullish trend, investors should consider holding or adding new positions in fundamentally strong stocks.

📌 Watch for Gap-Up Openings: A gap-up opening could confirm strong bullish momentum.

📌 Manage Risk with Stop-Loss: Stop-loss orders should be placed below the last higher low (HL) to minimize downside risks.

📌 Focus on Key Sectors: Banking, hydropower, insurance, and microfinance sectors are expected to benefit the most from an expansionary policy.

Conclusion: Will the Bullish Momentum Continue?

If the monetary policy review meets market expectations, NEPSE could continue its upward trend, possibly surpassing the 3,000 level in the coming weeks.

Investors should closely monitor official announcements from Nepal Rastra Bank and market reactions to position themselves accordingly.

✅ Stay prepared for the monetary policy announcement and market response! 🚀