Trade Tower Limited’s IPO Plan: Raising Public Funds to Pay Bank Debt and Repair Infrastructure

Author

NEPSE trading

Trade Tower Limited is set to issue an Initial Public Offering (IPO) worth nearly NPR 330 million to the general public starting Jestha 14 (May 27, 2025). Previously, the company had already issued about NPR 39.7 million worth of shares to Nepali citizens working abroad. Now, it plans to issue the remaining 3,296,505 units of shares at a face value of NPR 100 per share.

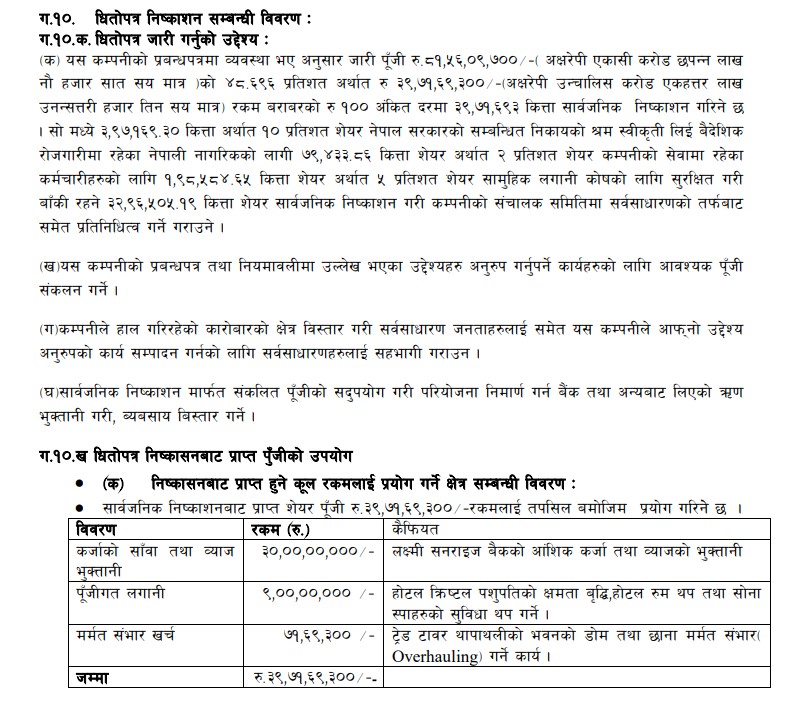

According to the company’s prospectus, a major portion of the raised capital — NPR 300 million, or 75% of the total proceeds — will be used to repay bank loans and interest to Laxmi Sunrise Bank. Additionally, NPR 90 million will go toward expanding Hotel Crystal Pashupati, adding new rooms and wellness facilities such as a sauna and spa. The remaining NPR 7.1 million will be used to repair the roof and dome of the Trade Tower building located in Thapathali, Kathmandu.

Trade Tower Limited operates commercial buildings in Thapathali and Gaushala, leasing the spaces to businesses. The company stated that it had taken large loans during the construction of these complexes, and the IPO is being issued primarily to clear those debts.

Financial Performance

According to the published financials, the company’s net profit has been rising:

In FY 2078/79, the net profit was NPR 13.8 million

By mid-FY 2081/82 (Poush), it had increased to NPR 56 million

However, the net worth per share has shown a declining trend:

From NPR 103.63 in FY 2078/79

Projected to fall to NPR 88.56 by FY 2083/84

Despite growing profit and EPS, this decline in net worth per share suggests a dilution of shareholder value due to increased capital without a proportional growth in assets.

Credit Rating & Risk

ICRA Nepal has rated the IPO with “ICRA NP BB-”, which indicates:

Moderate risk

The company has average capacity to meet its financial obligations, but external or internal shocks could affect repayment ability

This is not an investment-grade rating, and it implies a cautious investment profile for potential investors.

IPO Details

Total public shares offered: 3,296,505 units

Price per share: NPR 100

Minimum application: 10 shares

Maximum application: 1,000 shares

Application period: From Jestha 14 to Jestha 19 (extended till Jestha 28 if under-subscribed)

Issue manager: Laxmi Sunrise Capital Limited

Application via: C-ASBA, MeroShare platform

This IPO is not aimed at business expansion, but rather financial cleanup — clearing old debts and maintaining existing infrastructure. The company's operational growth hinges on rental income and a modest expansion into the hospitality sector.

While the company has improved its profit margins and EPS over recent years, shrinking net worth per share and a non-investment grade credit rating indicate that retail investors should weigh risk carefully. This offering appears better suited for investors with moderate-to-high risk tolerance and a long-term horizon.

"Recently, there has been a growing trend of newly formed and poorly managed companies bringing IPOs and offering shares to the general public. While investing in such IPOs may seem profitable initially, once these shares start trading in the secondary market, they often create negative impacts on the overall market sentiment."