By Sandeep Chaudhary

Analysis of presents data: Securities listed in the Nepal Stock Exchange (NEPSE)

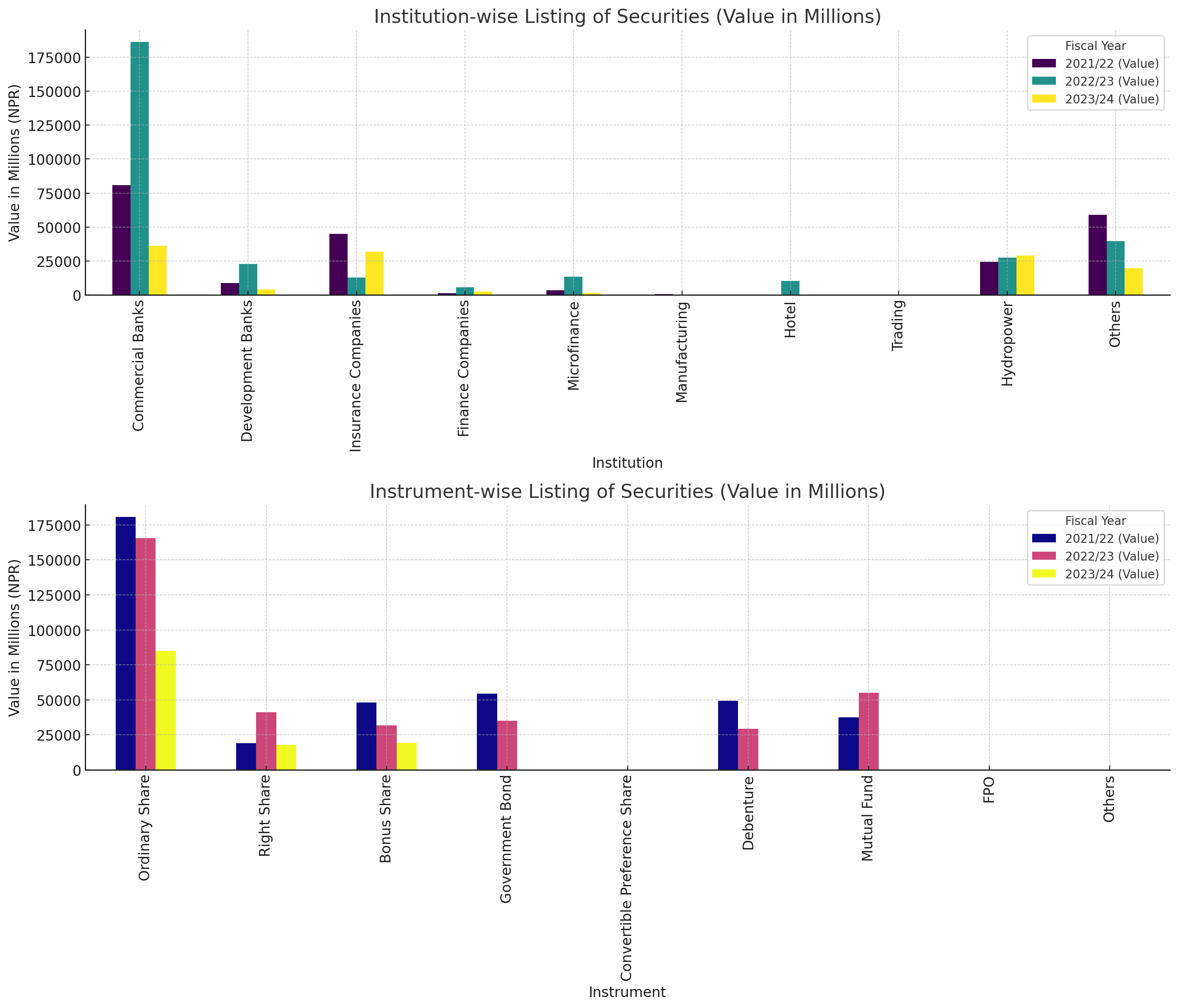

This analysis presents data on securities listed in the Nepal Stock Exchange (NEPSE) from mid-July to mid-April across three consecutive fiscal years: 2021/22, 2022/23, and 2023/24. The data is organized into institution-wise and instrument-wise listings, showing the share units (in thousands), the value in millions of Nepali Rupees (Rs.), and the percentage share of value.

Institution-wise Listing

The institution-wise listing chart displays the value (in millions) of securities listed by various types of institutions over three fiscal years: 2021/22, 2022/23, and 2023/24.

Commercial Banks showed a dramatic increase in 2022/23, reaching Rs. 186,144.5 million, before falling to Rs. 36,167.0 million in 2023/24.

Development Banks also saw a significant rise in 2022/23, with Rs. 22,662.0 million, and then decreased to Rs. 3,968.3 million in 2023/24.

Insurance Companies experienced a steady increase, peaking at Rs. 31,765.3 million in 2023/24.

Hydropower maintained a relatively stable growth, reaching Rs. 28,939.1 million in 2023/24.

Others had fluctuations but showed a notable decrease from Rs. 58,928.2 million in 2021/22 to Rs. 19,672.9 million in 2023/24.

Other categories like Finance Companies, Microfinance, and Manufacturing had minor contributions and showed less fluctuation across the years.

Instrument-wise Listing

The instrument-wise listing chart illustrates the value (in millions) of securities listed by different types of instruments over the same three fiscal years.

Ordinary Shares dominated the listings in all years, although their value decreased significantly from Rs. 180,571.7 million in 2021/22 to Rs. 84,992.8 million in 2023/24.

Right Shares saw a substantial increase in 2022/23 but remained lower compared to the peak value in 2021/22.

Bonus Shares experienced fluctuations but remained a considerable portion of the listings.

Government Bonds were significant in 2021/22 and 2022/23 but had no value listed in 2023/24.

Debentures and Mutual Funds had notable values in previous years but dropped significantly in 2023/24.

The charts and the accompanying data highlight the trends and changes in the Nepal Stock Exchange, showcasing which institutions and instruments dominated the market over the given periods