By Writer Content

Analyzing Everest Bank Limited's Financial Performance: Key Metrics and Insights Over the Last Five Fiscal Years

Analysis and Interpretation

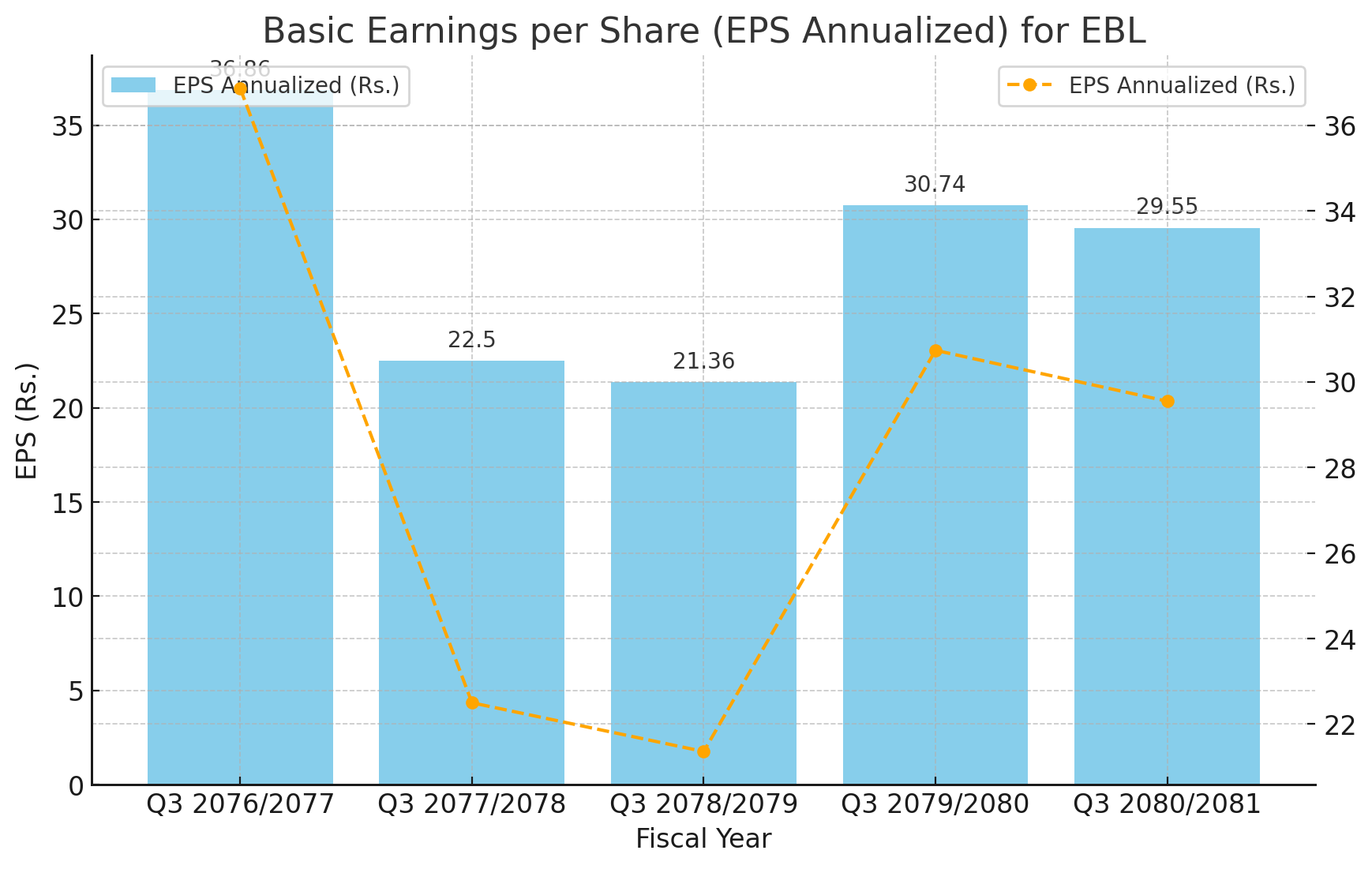

The chart above illustrates the annualized Basic Earnings per Share (EPS) for Everest Bank Limited (EBL) over the last five fiscal years.

Key Observations:

Fiscal Year 2076/2077: EBL experienced its highest EPS at 36.86 Rs. This represents a peak in profitability.

Fiscal Year 2077/2078: There was a significant drop to 22.5 Rs, indicating a decline in earnings.

Fiscal Year 2078/2079: The EPS decreased further to 21.36 Rs, continuing the downward trend.

Fiscal Year 2079/2080: The EPS rebounded to 30.74 Rs, suggesting a recovery in earnings.

Fiscal Year 2080/2081: The EPS slightly declined again to 29.55 Rs, indicating a small reduction in profitability compared to the previous year.

Interpretation:

The data shows that EBL's EPS has experienced considerable fluctuations over the last five years. The highest EPS was recorded in the fiscal year 2076/2077, followed by a sharp decline in the next two years. This decline could be attributed to various factors, such as economic conditions, changes in banking regulations, or internal challenges faced by the bank. However, the EPS showed a strong recovery in 2079/2080, possibly due to strategic adjustments or improvements in market conditions. The slight decline in 2080/2081 suggests that while the bank has stabilized, it still faces some challenges in maintaining its peak profitability.

Overall, the trend indicates that EBL has experienced volatility in its earnings, but recent years show signs of recovery and stabilization. Investors might interpret this as a sign of the bank's resilience and ability to adapt to changing conditions, though the slight recent decline warrants cautious optimism.

Analysis and Interpretation

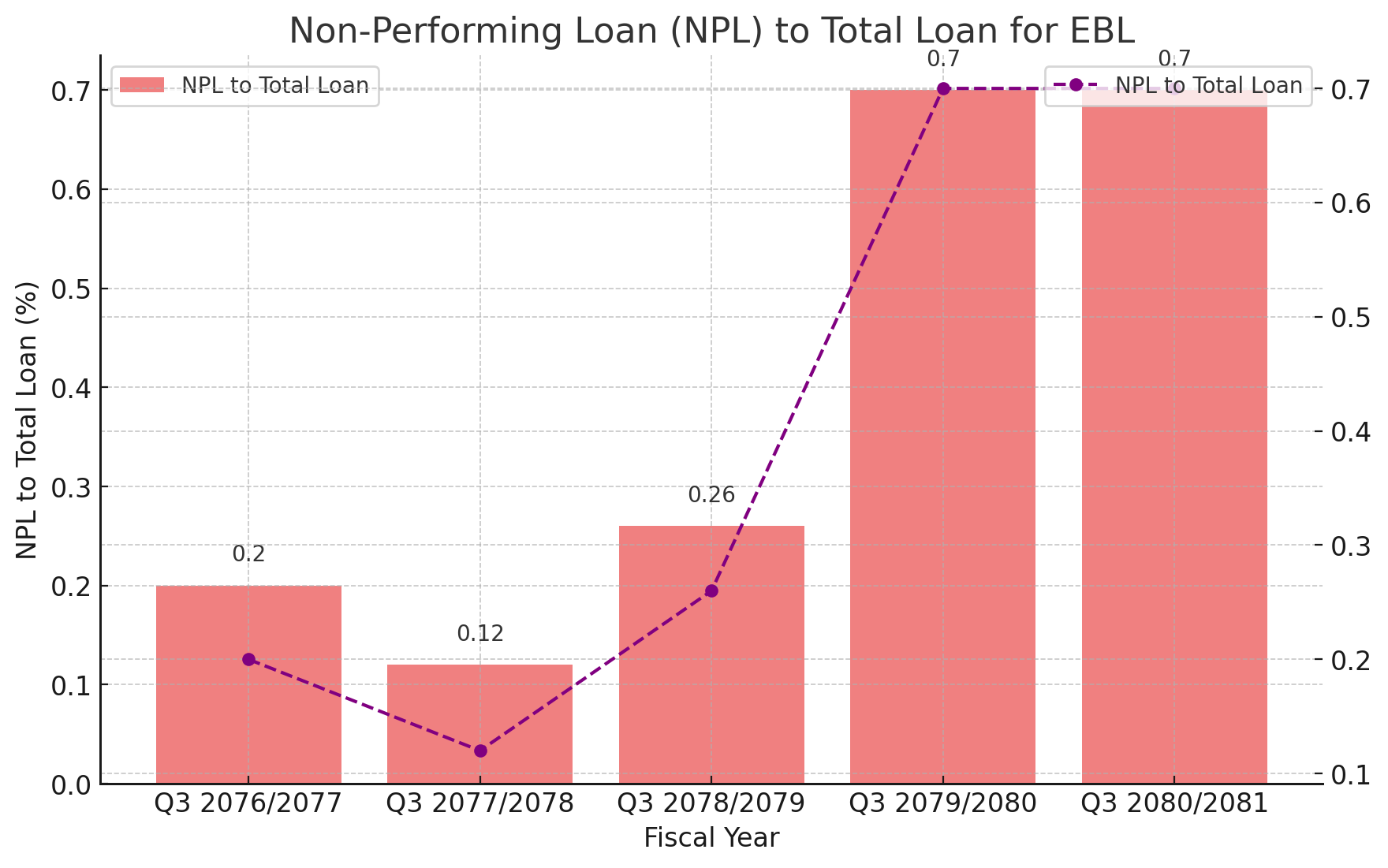

The chart above illustrates the Non-Performing Loan (NPL) to Total Loan ratio for Everest Bank Limited (EBL) over the last five fiscal years.

Key Observations:

Fiscal Year 2076/2077: The NPL ratio was at 0.2%, indicating a relatively low level of non-performing loans.

Fiscal Year 2077/2078: There was a significant improvement, with the NPL ratio decreasing to 0.12%.

Fiscal Year 2078/2079: The NPL ratio increased to 0.26%, showing a rise in non-performing loans.

Fiscal Year 2079/2080: The NPL ratio spiked to 0.7%, representing a substantial increase in the proportion of non-performing loans.

Fiscal Year 2080/2081: The NPL ratio remained high at 0.7%, indicating ongoing issues with loan performance.

Interpretation:

The data shows that EBL experienced fluctuations in its NPL ratio over the last five years. The lowest NPL ratio was recorded in the fiscal year 2077/2078, suggesting an effective period in managing non-performing loans. However, this was followed by a steady increase, culminating in a significant spike in the fiscal year 2079/2080, which persisted into 2080/2081.

The high NPL ratio in the last two years could be attributed to various factors such as economic downturns, poor credit risk management, or external shocks affecting borrowers' ability to repay loans. This trend raises concerns about the bank's asset quality and the effectiveness of its credit risk management practices.

Overall, the increasing NPL ratio is a worrying sign for EBL. Investors and stakeholders might interpret this as a signal of underlying financial stress within the bank. It underscores the need for EBL to implement more stringent measures to manage credit risk and improve the quality of its loan portfolio to ensure long-term financial stability.

Analysis and Interpretation

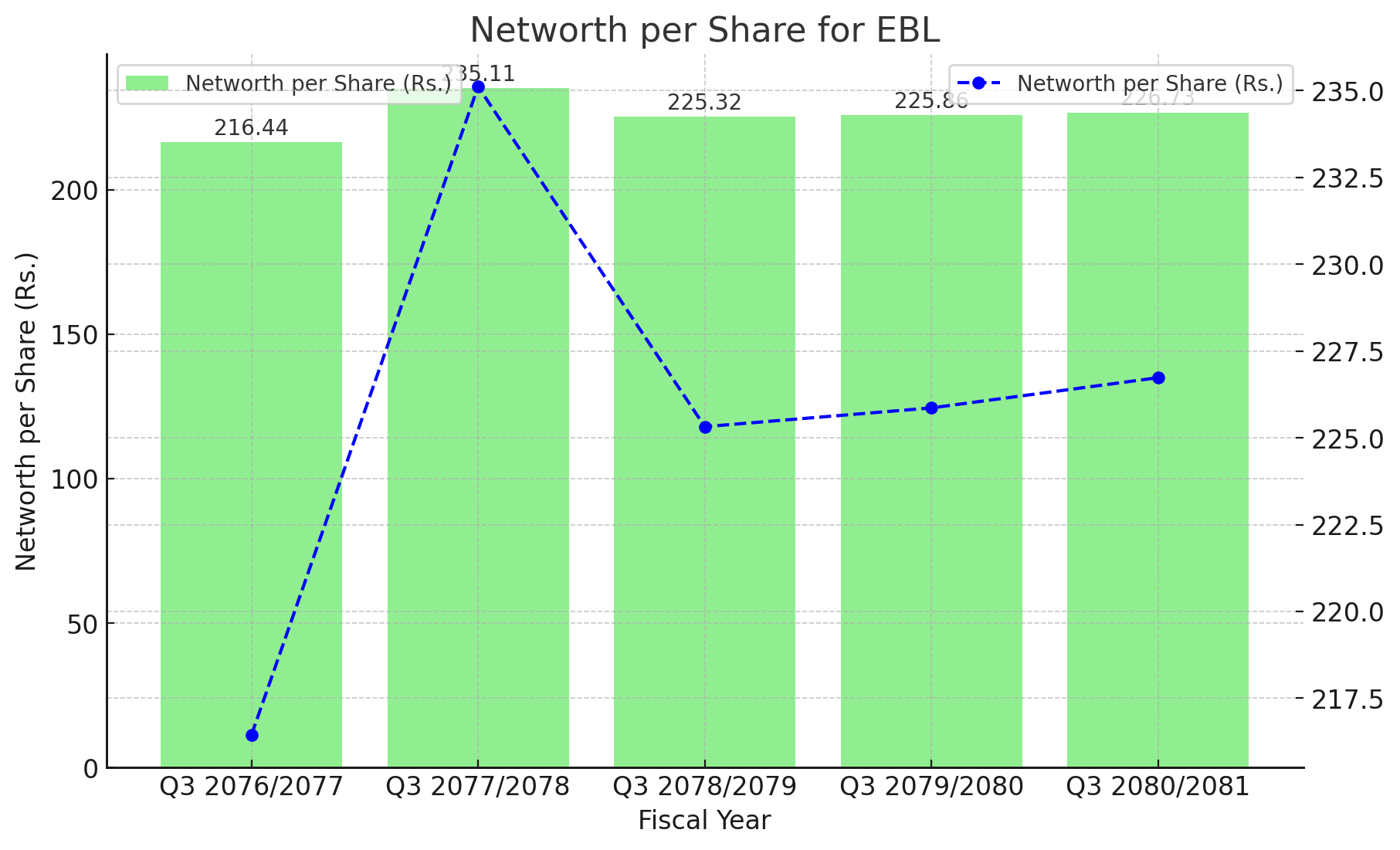

The chart above illustrates the Networth per Share for Everest Bank Limited (EBL) over the last five fiscal years.

Key Observations:

Fiscal Year 2076/2077: The Networth per Share was 216.44 Rs.

Fiscal Year 2077/2078: It increased significantly to 235.11 Rs, indicating a strong growth in net worth.

Fiscal Year 2078/2079: There was a slight decline to 225.32 Rs.

Fiscal Year 2079/2080: The Networth per Share remained relatively stable at 225.86 Rs.

Fiscal Year 2080/2081: There was a slight increase to 226.73 Rs.

Interpretation:

The data shows that EBL's Networth per Share has generally remained stable over the last five years, with a significant increase observed in the fiscal year 2077/2078. The highest net worth per share was recorded in this year, suggesting a period of strong financial performance and growth in the bank's equity base.

The slight decline in the subsequent years indicates some challenges, but the overall stability in net worth per share suggests that the bank has managed to maintain its financial health. The small increase in the most recent fiscal year 2080/2081 is a positive sign, indicating that the bank is continuing to grow its net worth, albeit at a slower pace.

Overall, the trend in net worth per share reflects the bank's ability to sustain its financial position over time. Investors might interpret this stability as a sign of financial robustness and prudent management practices. Despite the fluctuations in earnings and non-performing loans, the bank's consistent net worth growth suggests a solid foundation for future growth.

Analysis and Interpretation

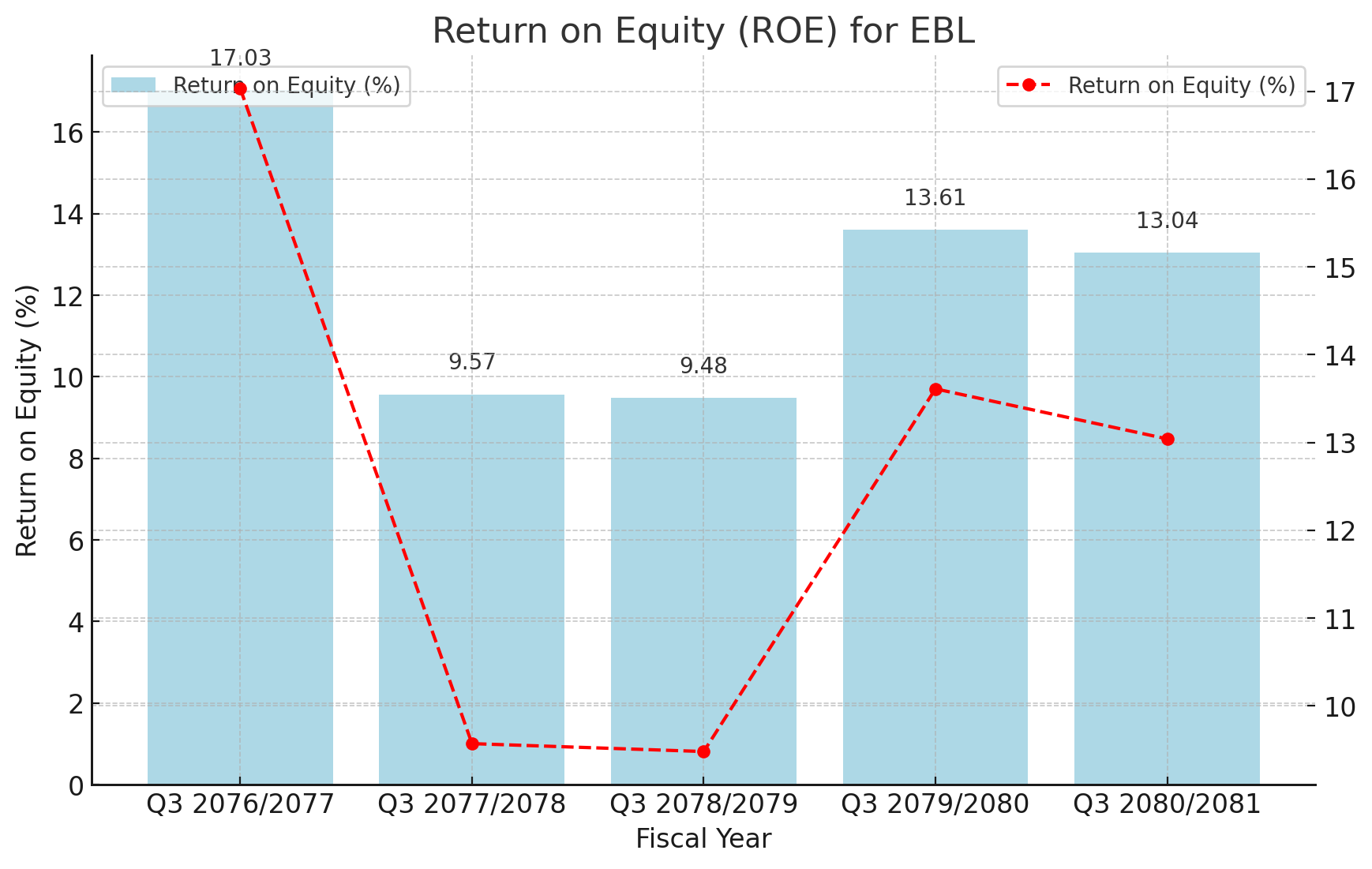

The chart above illustrates the Return on Equity (ROE) for Everest Bank Limited (EBL) over the last five fiscal years.

Key Observations:

Fiscal Year 2076/2077: EBL had a high ROE of 17.03%, indicating strong profitability relative to its equity.

Fiscal Year 2077/2078: The ROE dropped significantly to 9.57%, suggesting a decline in the bank's profitability.

Fiscal Year 2078/2079: The ROE further decreased slightly to 9.48%.

Fiscal Year 2079/2080: There was a notable recovery with the ROE rising to 13.61%.

Fiscal Year 2080/2081: The ROE slightly declined to 13.04%.

Interpretation:

The data reveals that EBL's Return on Equity has experienced significant fluctuations over the last five years. The highest ROE was recorded in the fiscal year 2076/2077, reflecting a period of high profitability. However, the subsequent two years saw a marked decline, which could be attributed to various factors such as decreased earnings, increased equity base, or both.

The recovery in ROE in the fiscal year 2079/2080 indicates that the bank managed to improve its profitability. This improvement could be due to better financial management, increased earnings, or efficient use of equity. The slight decline in the most recent fiscal year 2080/2081 suggests that while the bank remains profitable, it faces challenges in sustaining the high levels of profitability observed earlier.

Overall, the trend in ROE highlights the bank's ability to generate returns on its equity, but also points to periods of instability. Investors might interpret this as a sign of the bank's resilience in recovering its profitability but also a need for caution due to the fluctuations. Maintaining a stable and high ROE will be crucial for EBL to attract and retain investors, signaling robust financial health and effective management practices.

Analysis and Interpretation

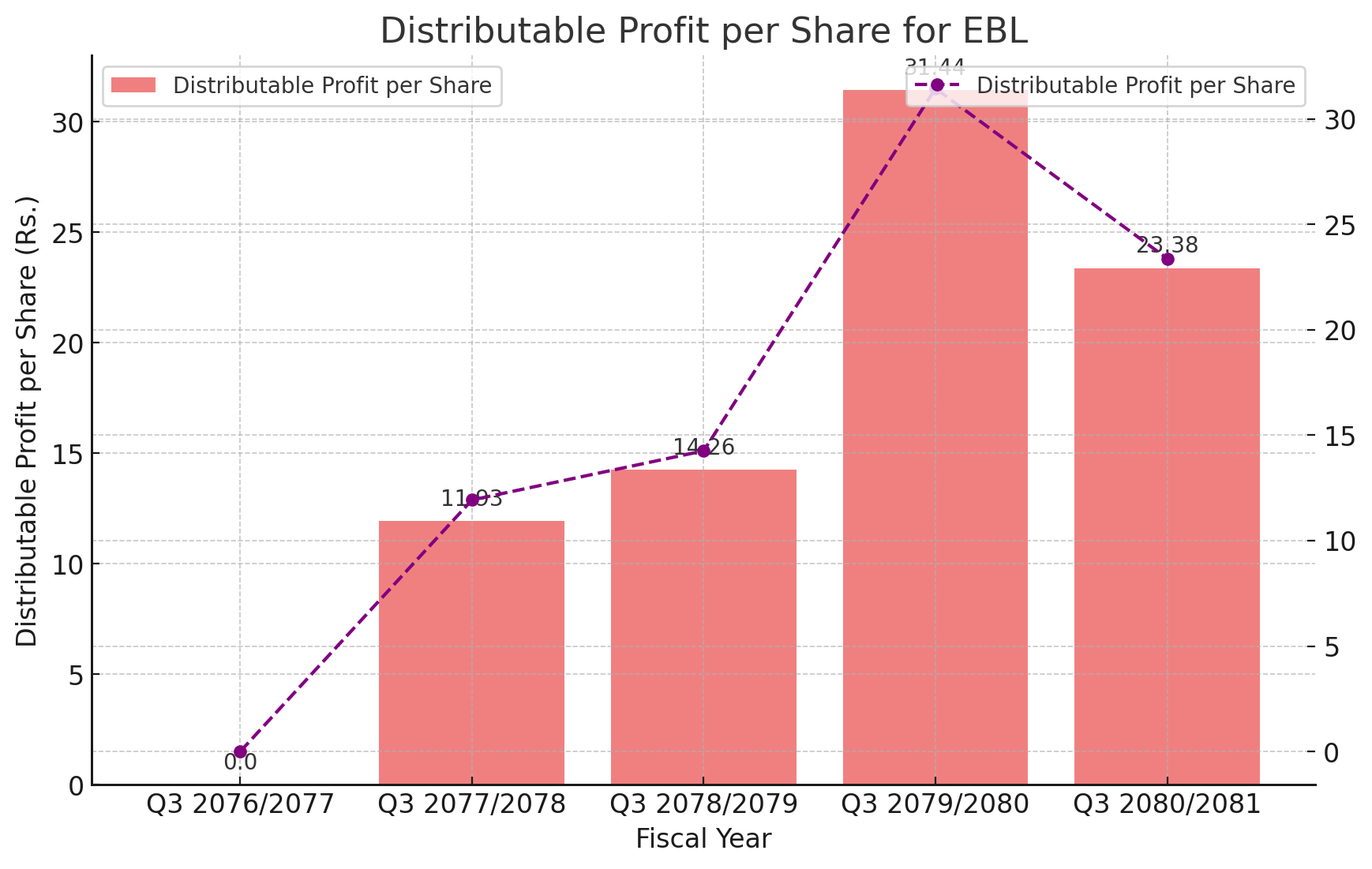

The chart above illustrates the Distributable Profit per Share for Everest Bank Limited (EBL) over the last five fiscal years.

Key Observations:

Fiscal Year 2076/2077: No distributable profit per share was recorded.

Fiscal Year 2077/2078: The distributable profit per share increased to 11.93 Rs.

Fiscal Year 2078/2079: It further increased to 14.26 Rs, indicating a positive trend.

Fiscal Year 2079/2080: The distributable profit per share reached a peak of 31.44 Rs.

Fiscal Year 2080/2081: There was a decline to 23.38 Rs, though still higher than the values in earlier years.

Interpretation:

The data shows a remarkable improvement in the distributable profit per share for EBL over the last five years, starting from zero in the fiscal year 2076/2077. The steady increase in the following years reflects the bank's ability to generate higher profits available for distribution to shareholders.

The peak in the fiscal year 2079/2080 suggests a period of exceptional profitability for the bank. However, the subsequent decline in the fiscal year 2080/2081, while still maintaining a high level of distributable profit per share, indicates a slight reduction in the profits available for distribution compared to the peak year.

Overall, the trend in distributable profit per share is a positive sign for investors, showing that the bank has been able to increase its profits over time and distribute them to shareholders. The high values in the most recent years suggest strong financial performance and effective management practices, despite the minor decline in the latest fiscal year. This stability and growth in distributable profits highlight EBL's potential for providing returns to its shareholders and maintaining investor confidence.