By Sandeep Chaudhary

Analyzing the Macroeconomic and Financial Trends: Insights from the First Ten Months of 2023/24

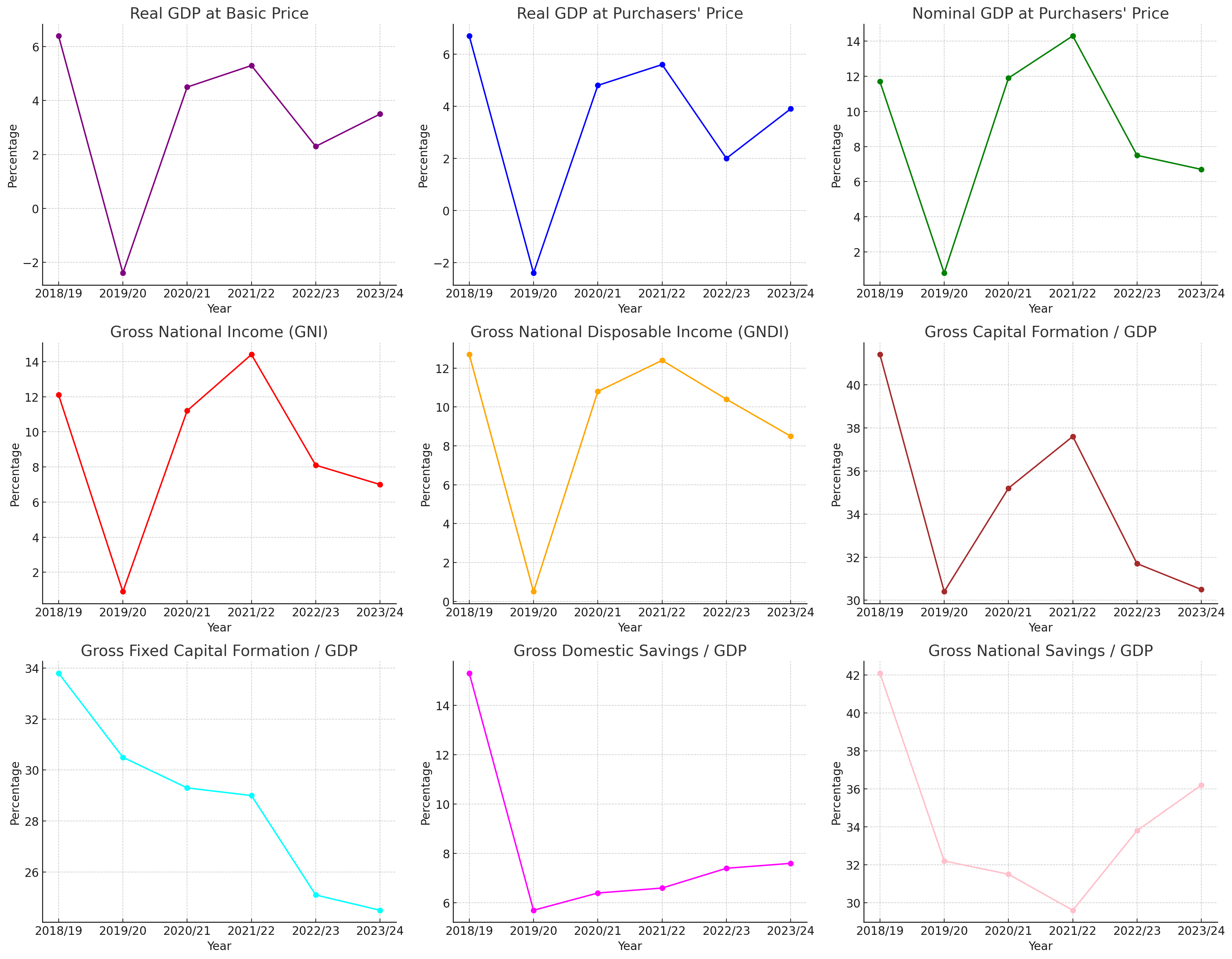

Economic Growth and Trends

The recent macroeconomic indicators present a mixed picture of Nepal's economy over the past few years. Real GDP growth at basic prices shows a significant recovery from the negative growth of -2.4% in 2019/20 to 3.5% in the 2023/24 fiscal year. Similarly, real GDP at purchasers' prices rebounded from -2.4% to 3.9% in the same period. This recovery indicates resilience and gradual economic improvement post the COVID-19 pandemic, despite the challenges.

Here are the visual representations of the key indicators for the Real Sector in Nepal:

Real GDP at Basic Price:

The Real GDP at basic prices experienced significant fluctuations, with a notable dip in 2019/20, followed by a recovery and another dip, indicating economic volatility.

Real GDP at Purchasers' Price:

Real GDP at purchasers' prices followed a similar trend to the basic price, with fluctuations highlighting periods of economic recovery and downturn.

Nominal GDP at Purchasers' Price:

Nominal GDP showed a strong growth trend with peaks and troughs, reflecting changes in the economic environment and inflationary effects.

Gross National Income (GNI):

The GNI showed volatility, with a significant dip in 2019/20, followed by recovery and another decline, indicating variability in national income.

Gross National Disposable Income (GNDI):

The GNDI followed a similar trend to GNI, with fluctuations indicating changes in disposable income over the years.

Gross Capital Formation / GDP:

Gross capital formation as a percentage of GDP showed a declining trend, indicating reduced capital investment relative to GDP.

Gross Fixed Capital Formation / GDP:

Fixed capital formation as a percentage of GDP also displayed a declining trend, reflecting lower fixed investment in the economy.

Gross Domestic Savings / GDP:

Domestic savings as a percentage of GDP experienced fluctuations, with periods of increase and stability, indicating variability in savings rates.

Gross National Savings / GDP:

National savings as a percentage of GDP showed significant fluctuations, with peaks and troughs reflecting changes in national savings behavior.

These charts illustrate the dynamic nature of Nepal's real sector, highlighting areas of growth, investment trends, and savings behavior, which are crucial for understanding the overall economic health and development trajectory

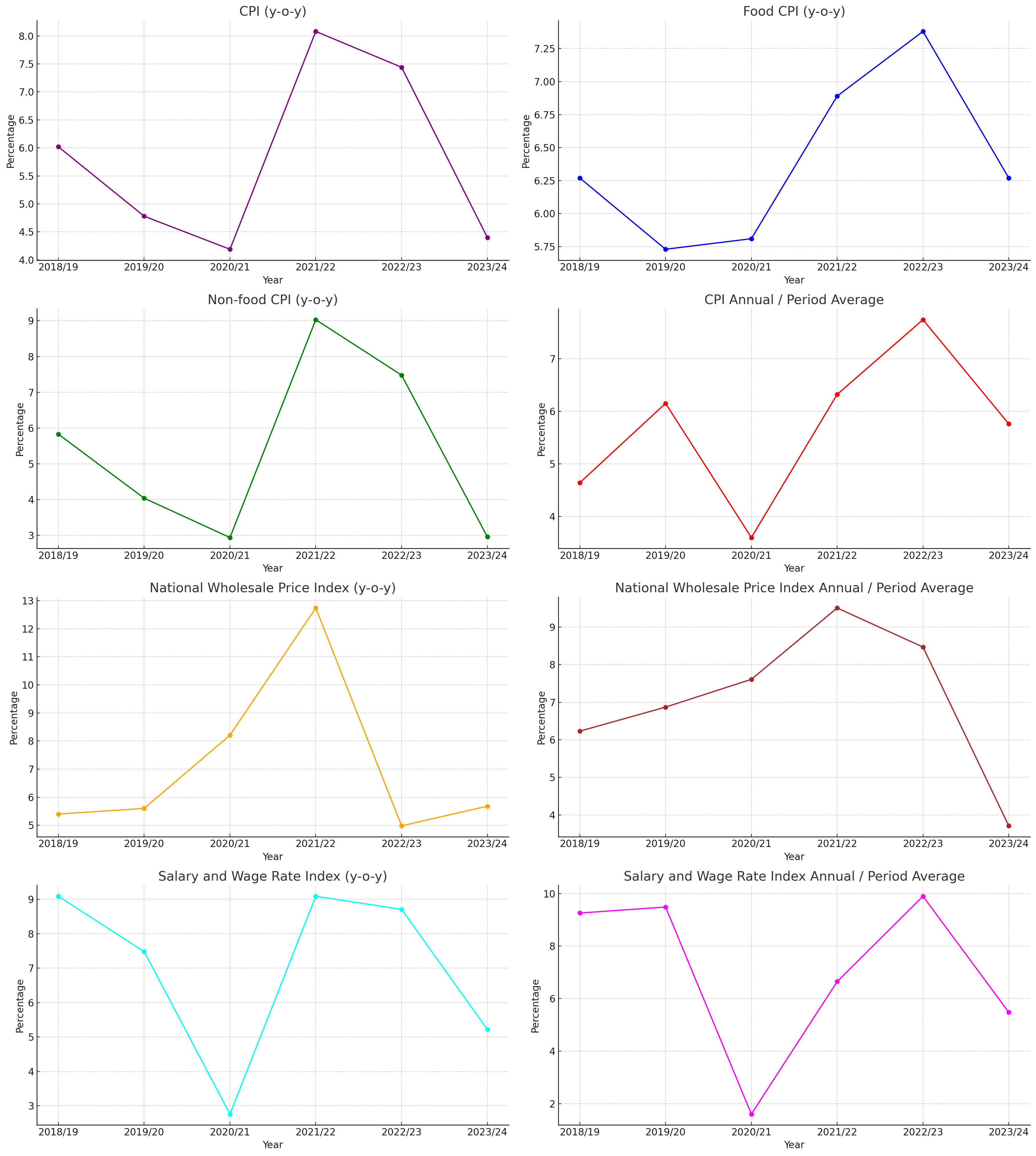

Inflation and Price Changes

Inflation, as measured by the Consumer Price Index (CPI), has seen fluctuations. The year-on-year CPI peaked at 8.08% in 2021/22 before declining to 4.40% in mid-May 2023/24. Food prices have also varied, with significant increases followed by stabilization, reflecting global supply chain disruptions and domestic agricultural output variations. Non-food CPI showed a dramatic rise to 9.03% in 2021/22, indicating pressures from non-agricultural sectors.

Here are the visual representations of the key indicators for Price Changes in Nepal:

CPI (Year-on-Year):

The Consumer Price Index (CPI) year-on-year showed significant fluctuations, peaking in 2021/22 and then declining in recent years, indicating periods of inflationary pressure followed by stabilization.

Food CPI (Year-on-Year):

The Food CPI followed a similar pattern to the overall CPI, with a peak in 2022/23 and a subsequent decline, reflecting changes in food prices.

Non-food CPI (Year-on-Year):

The Non-food CPI displayed high volatility, with a significant peak in 2021/22 and a sharp decline thereafter, indicating variability in non-food prices.

CPI Annual / Period Average:

The CPI annual or period average also showed fluctuations, with peaks and troughs corresponding to the overall CPI trends, reflecting average inflation rates over the period.

National Wholesale Price Index (Year-on-Year):

The National Wholesale Price Index year-on-year peaked in 2021/22, indicating wholesale price inflation, followed by a decline in the subsequent years.

National Wholesale Price Index Annual / Period Average:

The annual or period average of the National Wholesale Price Index showed a rising trend until 2021/22 and then a decline, reflecting average wholesale price changes.

Salary and Wage Rate Index (Year-on-Year):

The Salary and Wage Rate Index year-on-year displayed fluctuations, with notable peaks and troughs indicating changes in wage and salary growth rates.

Salary and Wage Rate Index Annual / Period Average:

The annual or period average of the Salary and Wage Rate Index showed significant variability, reflecting average changes in wages and salaries over the period.

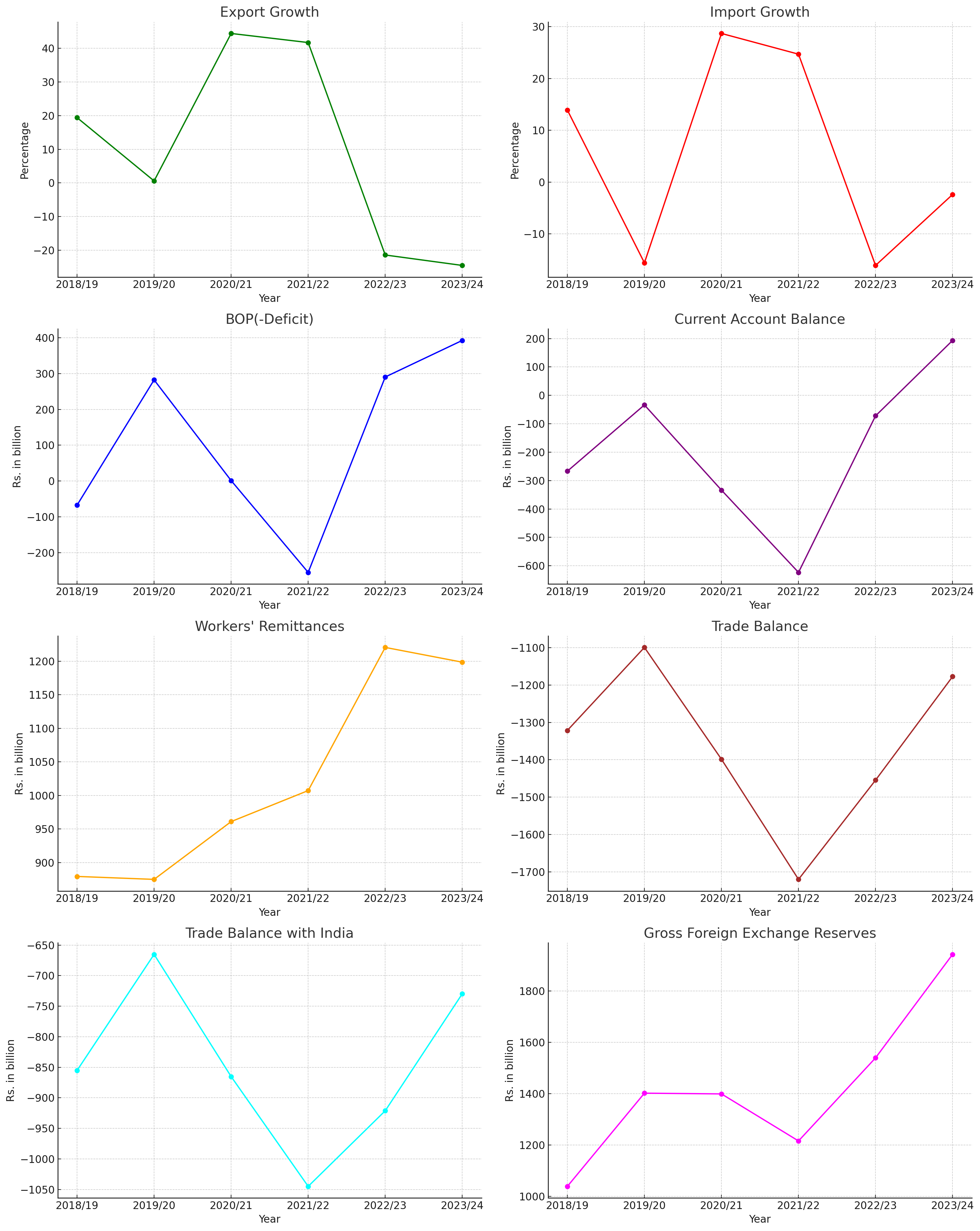

External Sector Dynamics

The external sector displayed notable volatility. Export growth was strong in 2020/21 and 2021/22, reaching 44.4% and 41.7%, respectively, but experienced a sharp decline to -24.5% in 2022/23. Import growth similarly fluctuated, showing a significant drop in recent years, highlighting the impact of global economic conditions and domestic demand. The Balance of Payments (BOP) and current account balance have also improved, moving into surplus territory in recent times

Here are the visual representations of the key indicators in Nepal's External Sector:

Export Growth:

The export growth saw a dramatic increase in 2020/21 and 2021/22, reaching peaks, but faced a significant decline in the following years, indicating volatility in export performance.

Import Growth:

Import growth showed similar fluctuations with a peak in 2020/21 but experienced negative growth in recent years, reflecting changes in domestic demand and international trade dynamics.

BOP (Balance of Payments - Deficit):

The Balance of Payments showed considerable improvement in recent years, moving from a deficit to a significant surplus by 2023/24, highlighting better management of foreign exchange and trade balances.

Current Account Balance:

The current account balance has shown substantial recovery, moving from large deficits to a positive balance in 2023/24, indicating improved external trade and remittance inflows.

Workers' Remittances:

Workers' remittances have steadily increased over the years, providing a crucial source of foreign exchange and supporting the economy's external sector.

Trade Balance:

The trade balance has consistently been in deficit, with the gap narrowing in 2023/24, indicating a persistent challenge in balancing imports and exports.

Trade Balance with India:

The trade balance with India also shows a deficit, with fluctuations over the years but improving in recent periods.

Gross Foreign Exchange Reserves:

Gross foreign exchange reserves have increased significantly, reaching the highest levels in 2023/24, reflecting stronger external financial health and better reserve management.

Financial Sector Overview

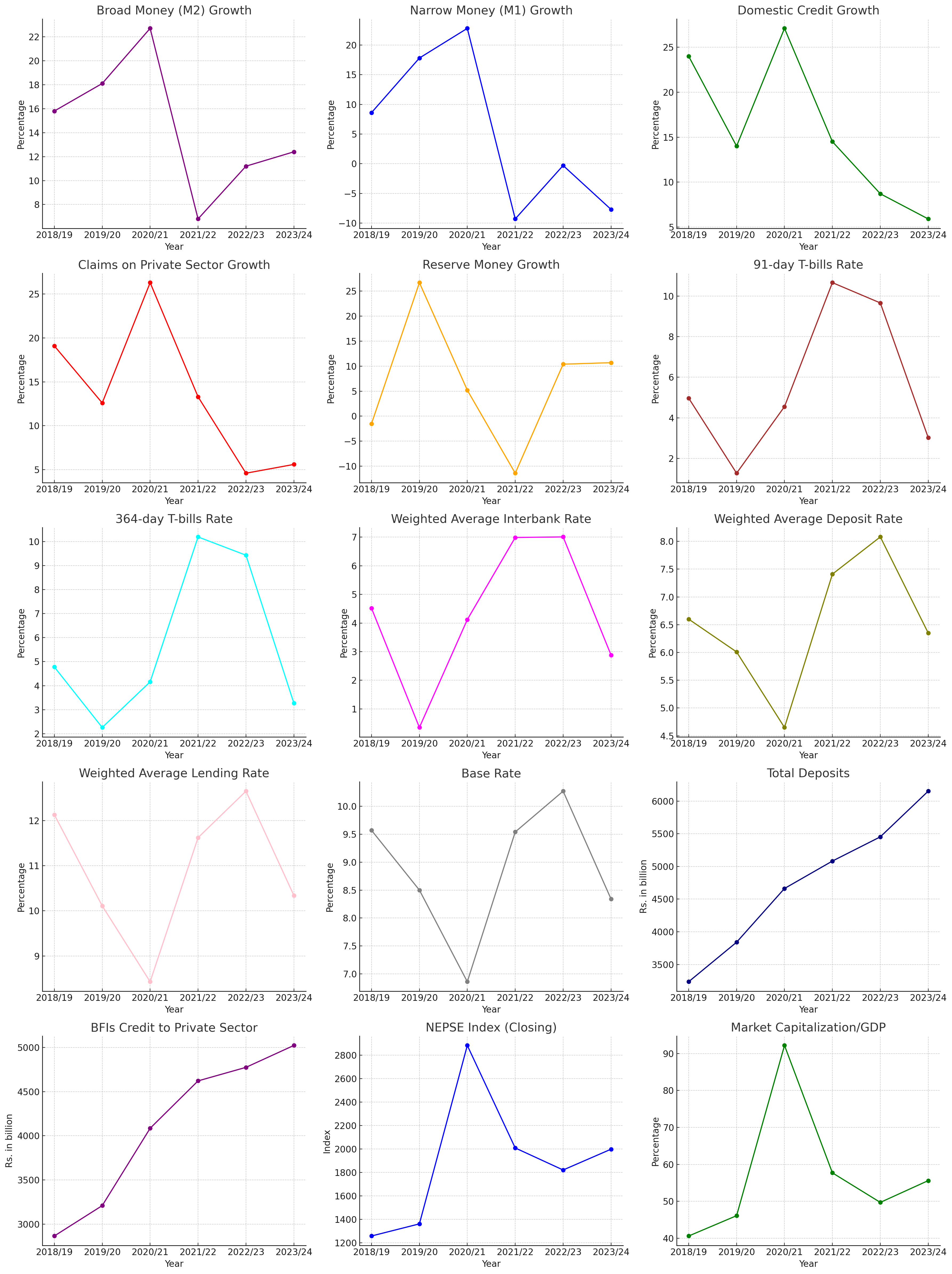

The financial sector showed robust growth in broad money (M2), which consistently expanded, although the pace slowed to 10.1% in 2022/23. Domestic credit growth moderated to 8.4%, reflecting cautious lending amidst economic uncertainties. Interest rates for government securities such as 91-day and 364-day T-bills have seen marked increases, reflecting tightening monetary policies to combat inflation.

Here are the visual representations of the key indicators in Nepal's Financial Sector:

Broad Money (M2) Growth:

Broad Money (M2) growth saw significant fluctuations, peaking in 2020/21 but showing a more stable trend in the recent years.

Narrow Money (M1) Growth:

Narrow Money (M1) growth also experienced high volatility, with a notable drop in 2021/22 and negative growth in recent years.

Domestic Credit Growth:

Domestic credit growth showed strong performance in 2020/21 but moderated in the following years, reflecting changes in credit demand and financial sector policies.

Claims on Private Sector Growth:

Growth in claims on the private sector peaked in 2020/21 but showed a downward trend in subsequent years, indicating cautious lending.

Reserve Money Growth:

Reserve money growth displayed significant volatility, with periods of both high and negative growth, highlighting changes in monetary policy and liquidity management.

91-day T-bills Rate:

The rate for 91-day T-bills showed an increasing trend, peaking in 2021/22 before stabilizing at a lower rate in 2023/24.

364-day T-bills Rate:

The 364-day T-bills rate followed a similar pattern to the 91-day T-bills, with a peak in 2021/22 and stabilization in recent years.

Weighted Average Interbank Rate:

The weighted average interbank rate displayed fluctuations, with notable peaks and troughs reflecting interbank market conditions.

Weighted Average Deposit Rate:

The deposit rates for commercial banks showed a rising trend in recent years, indicating increasing cost of deposits for banks.

Weighted Average Lending Rate:

Lending rates also showed volatility, with an upward trend in recent periods, reflecting higher borrowing costs.

Base Rate:

The base rate, which influences lending and borrowing rates, showed significant fluctuations, indicating adjustments in monetary policy.

Total Deposits (Rs. in billion):

Total deposits consistently increased, reflecting growing savings and financial sector stability.

BFIs Credit to Private Sector (Rs. in billion):

Credit to the private sector by Banks and Financial Institutions (BFIs) showed a steady increase, although the growth rate moderated in recent years.

NEPSE Index (Closing):

The NEPSE index, representing the stock market performance, showed significant fluctuations, with a peak in 2020/21 followed by a correction and recovery in recent years.

Market Capitalization/GDP:

Market capitalization as a percentage of GDP showed a peak in 2020/21, reflecting high stock market valuations, followed by a correction and stabilization.

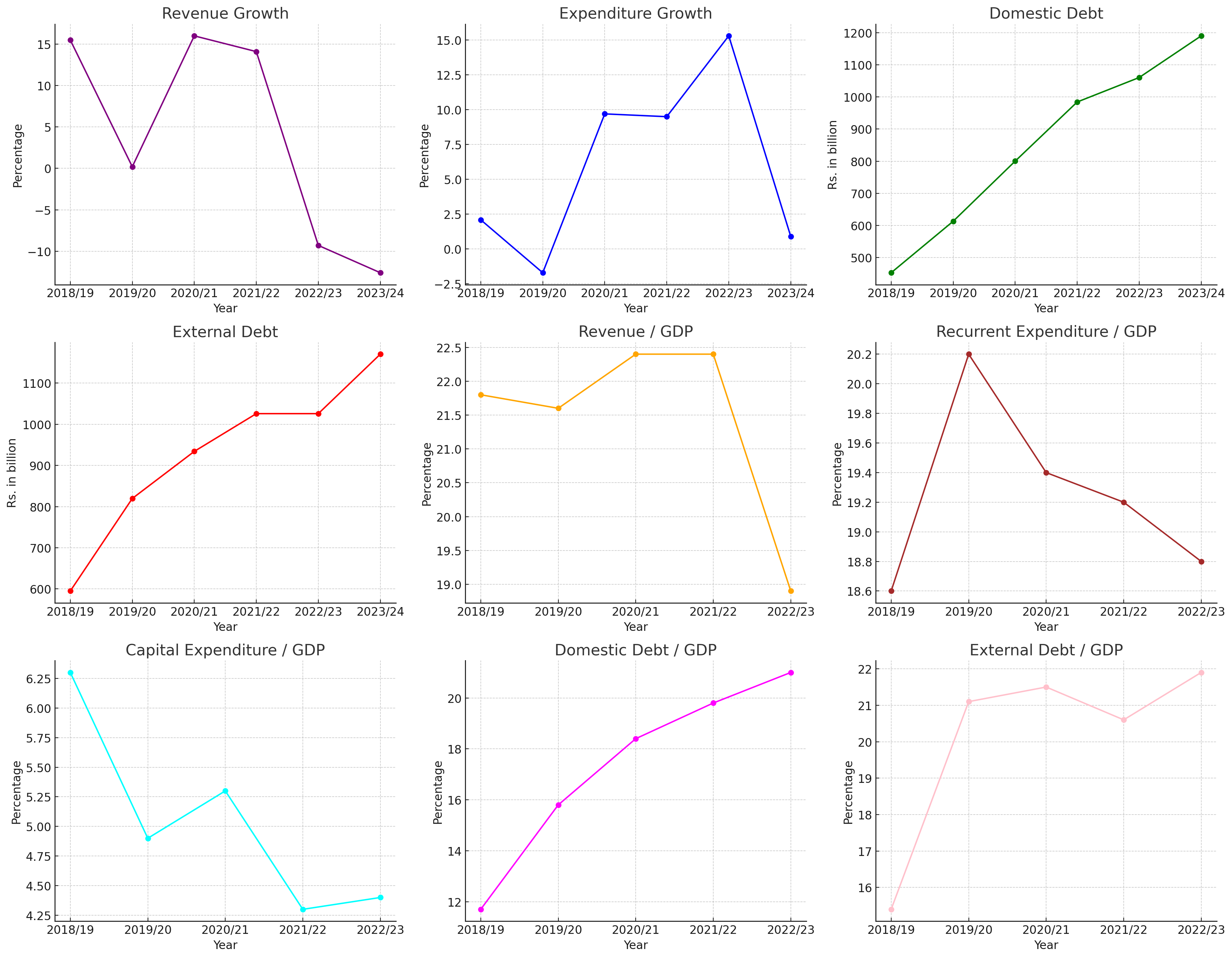

Public Finance and Debt

Public finance data reveals a challenging scenario with revenue growth turning negative at -12.6% in 2022/23, highlighting fiscal pressures. Expenditure growth remained positive but modest. Both domestic and external debts have increased, indicating higher borrowing to finance fiscal deficits. The ratio of debt to GDP has risen, emphasizing the need for prudent fiscal management.

Here are the visual representations of the key indicators in Nepal's Public Finance:

Revenue Growth:

Revenue growth showed a robust increase until 2020/21 but turned negative in recent years, indicating fiscal challenges.

Expenditure Growth:

Expenditure growth experienced fluctuations, with a notable peak in 2022/23, reflecting changes in government spending patterns.

Domestic Debt:

Domestic debt has been steadily increasing, indicating higher borrowing to finance government expenditure.

External Debt:

External debt has also shown a consistent upward trend, reflecting increasing reliance on foreign loans.

Revenue / GDP:

The revenue as a percentage of GDP showed stability but dropped in 2022/23, indicating reduced revenue collection relative to economic output.

Recurrent Expenditure / GDP:

Recurrent expenditure as a percentage of GDP peaked in 2019/20 but showed a declining trend in subsequent years, suggesting efforts to manage recurring costs.

Capital Expenditure / GDP:

Capital expenditure as a percentage of GDP showed volatility, with a declining trend in recent years, indicating potential constraints in capital investment.

Domestic Debt / GDP:

Domestic debt as a percentage of GDP has been increasing, indicating rising domestic borrowing relative to economic output.

External Debt / GDP:

External debt as a percentage of GDP showed fluctuations, reflecting changes in foreign borrowing relative to the size of the economy.