By Sandeep Chaudhary

Capital Adequacy of Nepalese BFIs Shows Stable Health as of Mid-May 2025

As of Baisakh End, 2082 (Mid-May, 2025), the capital adequacy ratios of Nepal's Banks and Financial Institutions (BFIs) indicate a stable and healthy position in terms of risk coverage and regulatory compliance. The Capital Adequacy Ratio (CAR), a key measure of a bank's capital in relation to its risk-weighted assets (RWA), helps gauge the institution’s ability to absorb potential losses.

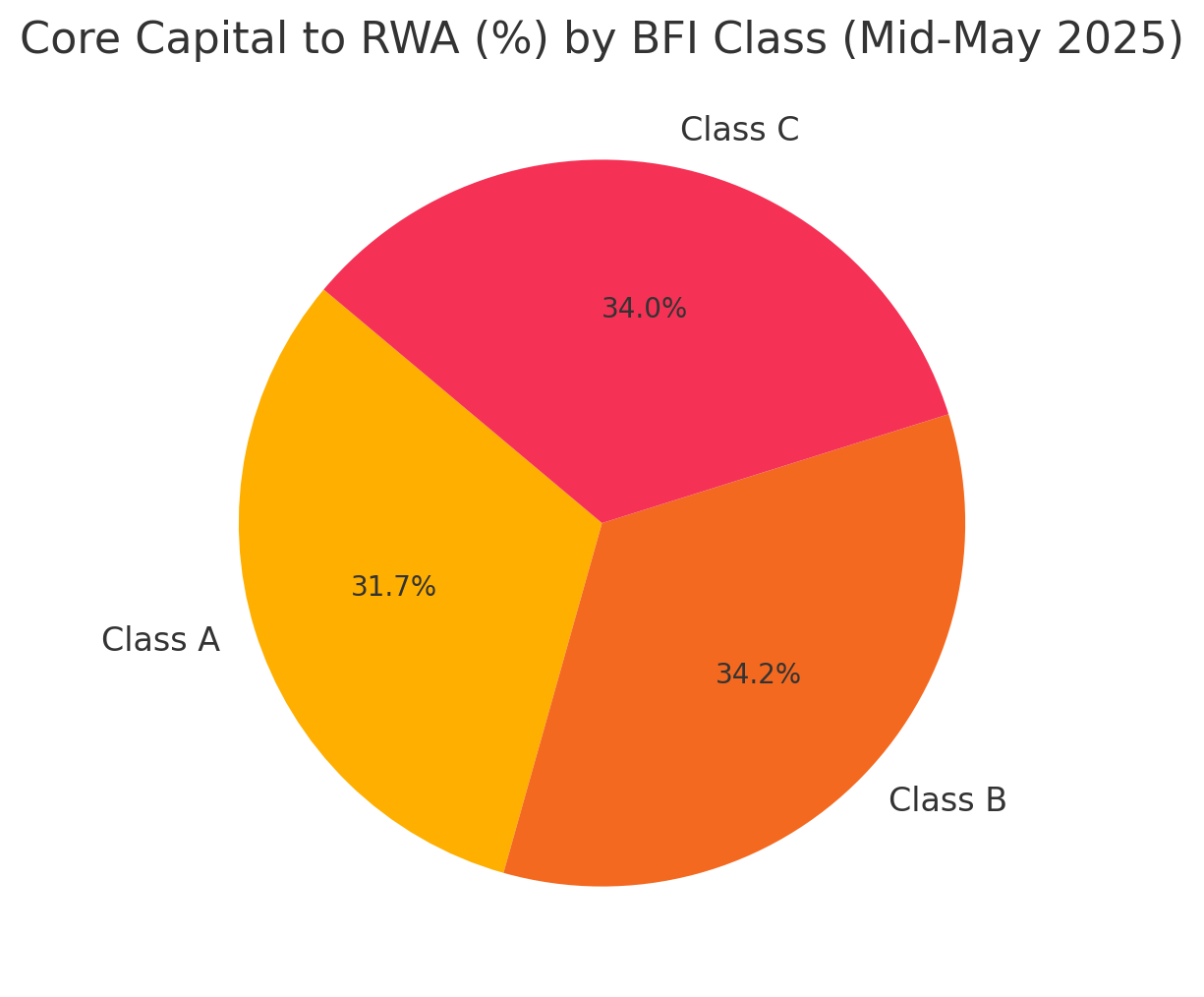

Core Capital to RWA, also known as Tier 1 capital ratio, stood at 9.57% overall, slightly above the regulatory minimum set by Nepal Rastra Bank. Breaking it down by institution class:

Class “A” commercial banks posted a ratio of 9.50%,

Class “B” development banks achieved 10.24%, and

Class “C” finance companies reported 10.19%.

This suggests that development and finance companies have maintained a relatively higher cushion of core equity and retained earnings compared to commercial banks, which is crucial for absorbing immediate financial stress without external support.

Total Capital to RWA, which includes both Tier 1 and Tier 2 capital (such as subordinated debt, hybrid capital instruments), was 12.42% on average across all BFIs:

Class “A” banks posted 12.39%,

Class “B” banks recorded 12.87%, and

Class “C” companies stood at 12.33%.

All these figures are comfortably above the minimum regulatory thresholds, reflecting prudent capital management and moderate risk exposure. The strong capital base across all three classes of BFIs enhances the resilience of Nepal’s financial system and its capacity to support credit growth and economic expansion.

In summary, the capital adequacy position of Nepalese BFIs as of mid-May 2025 remains robust, contributing to overall financial stability and investor confidence in the banking sector.