By Sandeep Chaudhary

Changes in Tax Rates for Electric Vehicles in Nepal for the Fiscal Year 2081/82

The Nepalese government has introduced a new budget for the fiscal year 2081/82, which includes revised tax rates for electric vehicles (EVs). This move aims to encourage the adoption of eco-friendly vehicles and reduce the nation's carbon footprint. The new tax structure has been adjusted to provide more benefits for lower kilowatt electric vehicles while increasing taxes on higher kilowatt models.

Here's a detailed breakdown of the changes:

New Tax Rates for Electric Vehicles

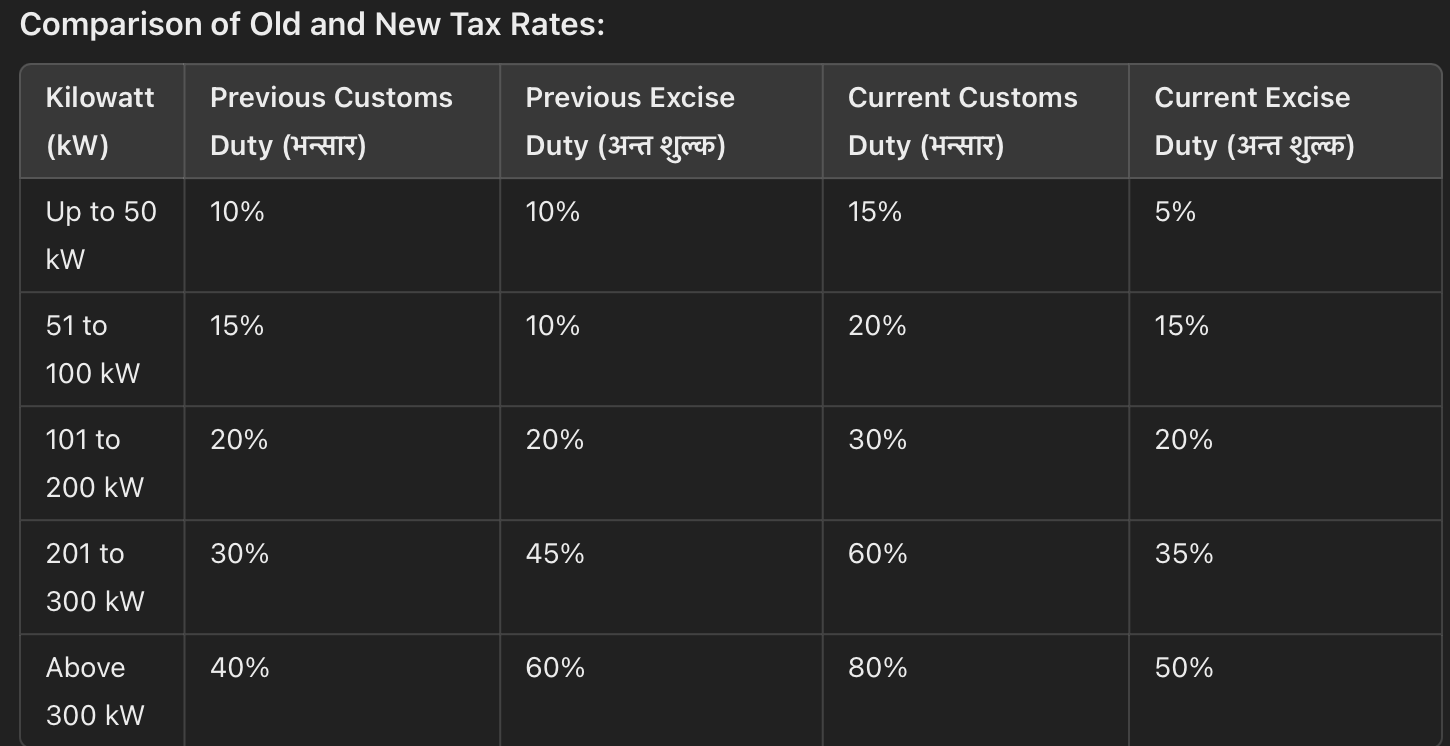

The tax rates for electric vehicles are divided into two main categories: customs duty (भन्सार) and excise duty (अन्त शुल्क). The changes are applied based on the power output of the electric vehicles measured in kilowatts.

Comparison of Old and New Tax Rates:

Kilowatt (kW)Previous Customs Duty (भन्सार)Previous Excise Duty (अन्त शुल्क)Current Customs Duty (भन्सार)Current Excise Duty (अन्त शुल्क)

Key Points of the New Tax Structure:

Increased Customs Duty for All Categories:

The customs duty for electric vehicles has seen an increase across all kilowatt categories. The rate for vehicles up to 50 kW has increased from 10% to 15%, and for those above 300 kW, it has doubled from 40% to 80%.

Modified Excise Duty:

The excise duty for lower kilowatt vehicles (up to 50 kW) has been reduced from 10% to 5%, making them more affordable.

For higher kilowatt vehicles, the excise duty has been adjusted with varying increases. Vehicles in the 201 to 300 kW range will see a rise from 45% to 35%, while those above 300 kW will now incur a 50% excise duty, reduced from 60%.

Encouragement for Lower Power EVs:

The tax adjustments aim to promote the use of lower power electric vehicles by keeping their overall tax rates relatively lower compared to higher power models. This is evident with the reduction in excise duty for vehicles up to 50 kW and the relatively moderate increases for vehicles between 51 to 100 kW.

Implications:

These changes reflect the government's strategy to balance between promoting electric vehicle usage and managing tax revenues. By incentivizing the adoption of lower power electric vehicles, the government hopes to make eco-friendly transportation more accessible to the general public while also controlling the market for higher-end, more powerful EVs.

The new tax structure is expected to drive a significant shift in the electric vehicle market in Nepal, encouraging consumers to opt for more sustainable and economical vehicle options.