By Sandeep Chaudhary

Commercial Bank Interest Rate Trends Indicate Declining Cost of Credit in Nepal

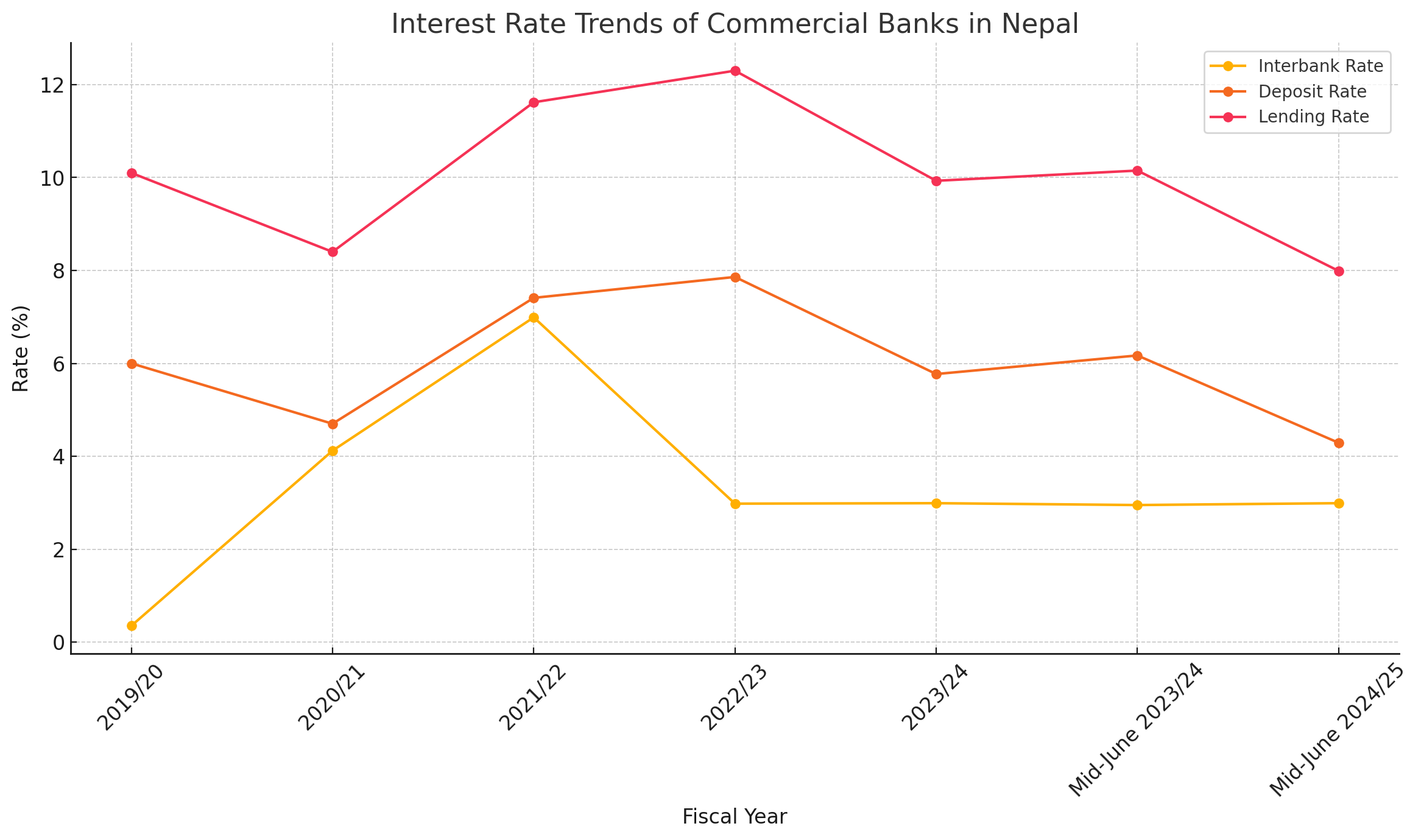

Nepal Rastra Bank's latest monetary data reveals a notable shift in the interest rate landscape among commercial banks over the past fiscal years, with a significant decline observed in both deposit and lending rates in the latest mid-June update of 2024/25. This indicates a loosening monetary environment and improved liquidity conditions in the banking sector.

The Weighted Average Interbank Rate, which reflects the cost at which banks lend to each other, stood at 2.99% in mid-June 2024/25, nearly unchanged from mid-June 2023/24 (2.95%). This stability follows a sharp fall from the peak of 6.99% recorded in 2021/22, a period marked by tight liquidity and high credit demand. The drop from the 2021/22 level to under 3% suggests sustained improvements in interbank liquidity and relatively stable short-term funding costs.

Similarly, the Weighted Average Deposit Rate has fallen to 4.29% in mid-June 2024/25 from 6.17% a year earlier. This downward movement reflects banks’ reduced need to attract high-cost deposits amid subdued credit demand and surplus liquidity. Notably, the deposit rate had reached a recent peak of 7.86% in 2022/23, triggered by aggressive competition among banks to shore up liquidity during a credit crunch.

The Weighted Average Lending Rate has also declined markedly to 7.99% in mid-June 2024/25 from 10.15% in mid-June 2023/24. This is a significant reversal from the 12.30% high observed in 2022/23. The fall in lending rates implies a lower cost of borrowing for businesses and consumers and aligns with Nepal Rastra Bank’s accommodative monetary stance intended to stimulate investment and economic activity.

Overall, the interest rate trends suggest easing financial conditions in the banking system. Declining rates on deposits and loans point to reduced stress in the credit market and a better capital position among commercial banks. However, while lower lending rates may support economic recovery, they also signal subdued loan demand, highlighting the need for renewed private sector confidence and investment appetite to accelerate growth.