By Sandeep Chaudhary

Commercial Bank Loans to Government Enterprises Surge by 111.5% Over Nine Months

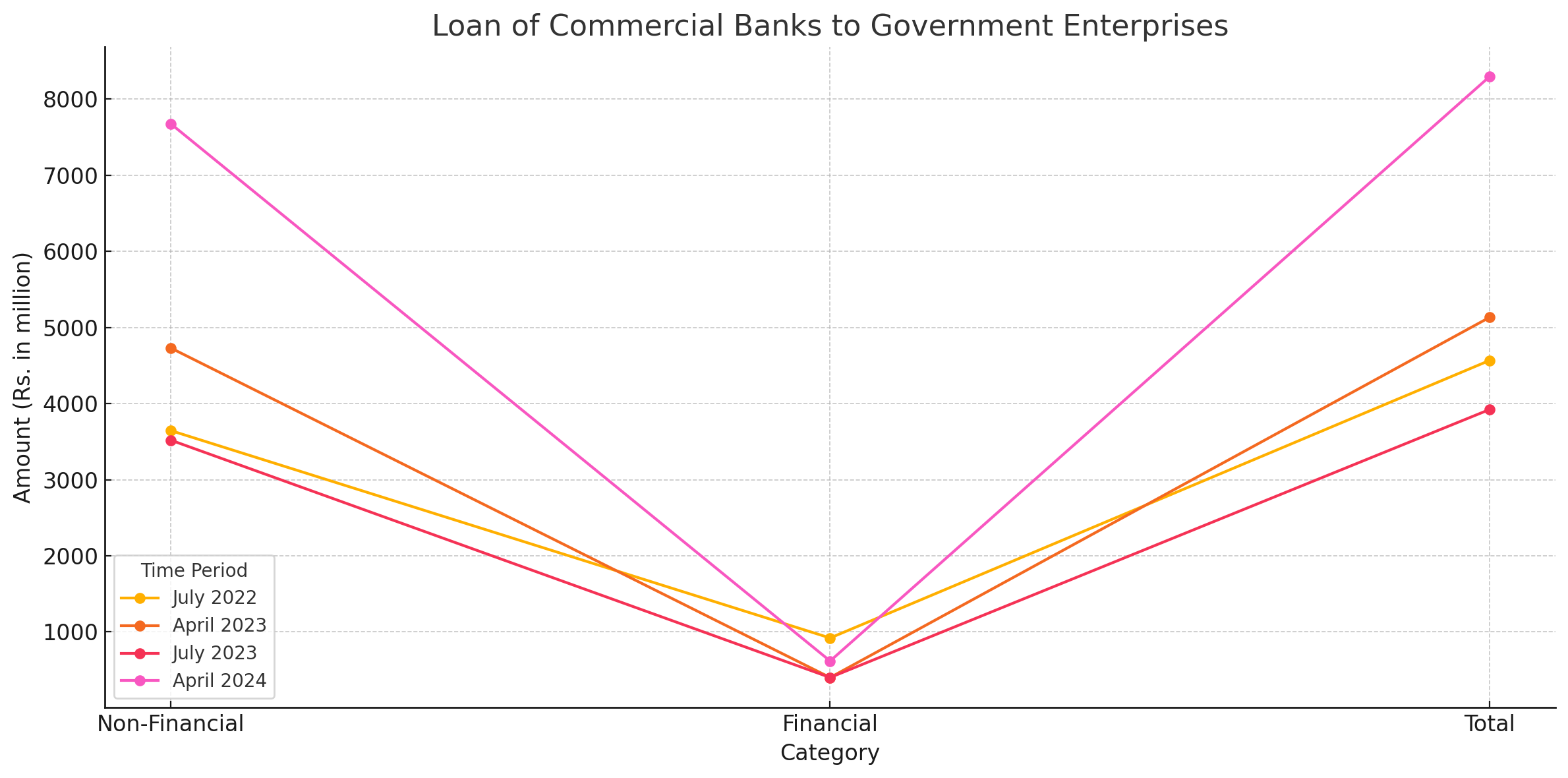

In a significant development, the latest data reveals a substantial increase in loans provided by commercial banks to government enterprises. According to Table 45, which outlines the loans from commercial banks to government enterprises, the total loans surged from Rs. 3,921.4 million in July 2023 to Rs. 8,293.6 million in April 2024. This represents an impressive 111.5% increase over nine months, highlighting a robust rise in financial support to government enterprises.

Non-Financial Sector Analysis

The non-financial sector experienced a remarkable increase in loans, climbing from Rs. 3,519.6 million in July 2023 to Rs. 7,675.1 million in April 2024. This translates to a 118.1% rise, a clear indication of heightened borrowing activity.

Principal Loans: The principal loans saw a substantial growth from Rs. 3,519.2 million to Rs. 7,646.3 million, marking a 117.3% increase. Key contributors to this rise include:

Trading: Loans increased from Rs. 2,074.0 million to Rs. 6,010.1 million, a remarkable 189.8% jump.

Industrial: Despite a decline from Rs. 282.9 million to Rs. 135.2 million, indicating a 52.2% decrease, this sector saw overall borrowing reductions.

Service: Loans decreased from Rs. 246.4 million to Rs. 389.1 million, a 57.9% decline, reflecting reduced demand in this sector.

Other Corporations: A moderate rise from Rs. 915.9 million to Rs. 1,111.9 million, translating to a 21.4% increase.

Interest: Interest payments showed a minor decline from Rs. 0.4 million to Rs. 0.0 million, indicating a 94.3% decrease, suggesting a lower interest burden.

Financial Sector Overview

The financial sector, on the other hand, witnessed a contrasting trend. Loans dropped significantly from Rs. 401.8 million in July 2023 to Rs. 618.6 million in April 2024, registering a 53.9% increase.

Principal Loans: These saw a rise from Rs. 401.6 million to Rs. 618.4 million, a 53.9% increase.

Interest: There was a slight increase in interest payments from Rs. 0.0 million to Rs. 0.2 million, marking a 111.1% rise, indicating an increase in borrowing costs.

Aggregate Insights

The total loans, encompassing both non-financial and financial sectors, surged from Rs. 3,921.4 million to Rs. 8,293.6 million, reflecting a 111.5% increase. Principal loans dominated this growth, rising from Rs. 3,921.0 million to Rs. 8,264.6 million, a 110.7% increase. Meanwhile, interest payments, despite a minor decline, indicated significant financial shifts in borrowing patterns.

Interpretation

This substantial rise in loans to government enterprises underscores a robust demand for financial support across various sectors. The trading sector, in particular, has seen exponential growth, likely driven by increased commercial activities and economic recovery post-pandemic. However, the industrial and service sectors reflect a mixed scenario, with significant declines in loan uptake, suggesting areas of concern or shifts in sectoral financial strategies.

The overall increase in loans indicates a positive outlook for economic activities supported by government enterprises. However, the contrasting trends in the financial sector loans and interest payments highlight the need for careful financial management and strategic planning to sustain this growth trajectory.

As the economic landscape evolves, monitoring these trends will be crucial for policymakers and financial institutions to ensure balanced and sustainable economic development