By Sandeep Chaudhary

Comprehensive Analysis of Securities Market Turnover in the Nepal Stock Exchange (NEPSE)

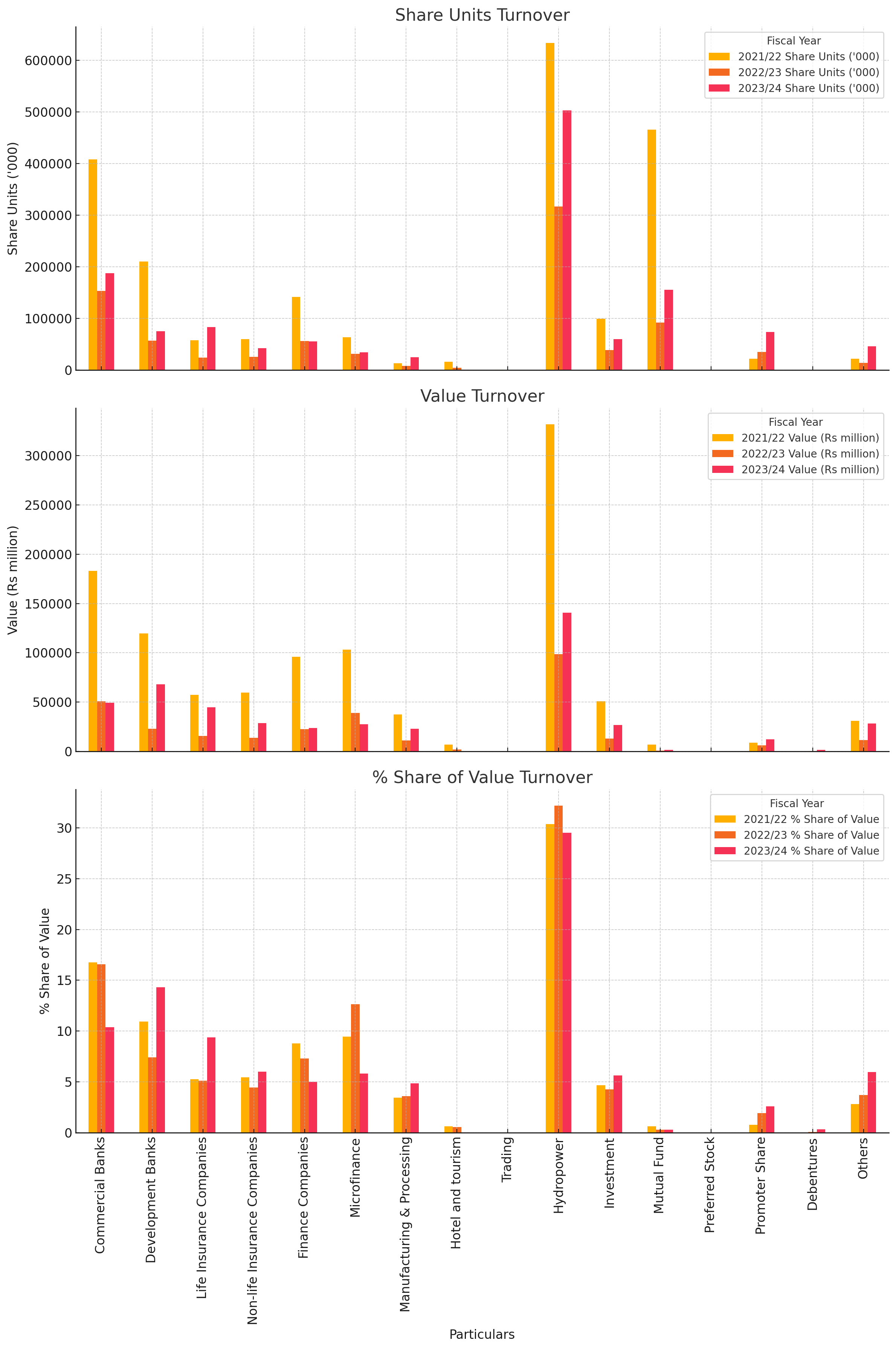

The securities market turnover for different categories from mid-July to mid-April over three fiscal years: 2021/22, 2022/23, and 2023/24. Here's a detailed interpretation of the data:

Overview

The table is divided into three main columns for each fiscal year, further subdivided into:

Share Units (in thousands)

Value (in Rs million)

% Share of Value

Key Insights

2021/22

Total Turnover: 2,211,211.92 thousand units, valued at Rs 1,101,124.80 million.

Highest Turnover by Value: Commercial Banks with Rs 183,278.1 million (16.6% of total value).

Significant Categories:

Hydropower: 301,915.6 thousand units, Rs 331,915.6 million (30.1% of total value).

Microfinance: Rs 103,275.5 million (9.4% of total value).

Development Banks: Rs 119,628.0 million (10.9% of total value).

2022/23

Total Turnover: 885,289.05 thousand units, valued at Rs 322,113.71 million.

Highest Turnover by Value: Commercial Banks with Rs 50,809.9 million (15.8% of total value).

Significant Categories:

Hydropower: 316,658.8 thousand units, Rs 98,788.2 million (30.7% of total value).

Development Banks: Rs 22,729.5 million (7.1% of total value).

Life Insurance Companies: Rs 15,677.5 million (4.9% of total value).

2023/24

Total Turnover: 1,413,434.02 thousand units, valued at Rs 473,006.05 million.

Highest Turnover by Value: Hydropower with Rs 140,523.1 million (29.7% of total value).

Significant Categories:

Commercial Banks: Rs 49,346.7 million (10.4% of total value).

Microfinance: Rs 27,671.5 million (5.9% of total value).

Development Banks: Rs 68,901.5 million (14.6% of total value).

Trends and Observations

Hydropower Sector:

Consistently showing high turnover by value across all three years, maintaining a significant share of the market turnover.

Commercial Banks:

Although the share of value decreased from 16.6% in 2021/22 to 10.4% in 2023/24, it remains a prominent category.

Microfinance:

Fluctuating but maintains a steady presence with significant turnover in all years.

Development Banks:

Increased its share significantly in 2023/24 compared to previous years.

Life and Non-life Insurance Companies:

Both categories show stable turnover but have a relatively smaller share compared to other major sectors.

Mutual Fund:

A consistent but small share in the total turnover.

Summary

The securities market turnover data shows significant activity in sectors like Hydropower, Commercial Banks, Development Banks, and Microfinance.

Hydropower sector appears to be leading in market value share, especially in the latest fiscal year (2023/24).

The overall turnover value and share units indicate the market's fluctuating nature, with notable increases in total turnover in the 2023/24 fiscal year.

Interpretation of the Charts

Share Units Turnover

Hydropower consistently shows the highest number of share units traded across all three years, peaking in 2021/22 and remaining strong in subsequent years.

Commercial Banks and Development Banks also show significant share units turnover, with a noticeable increase in 2023/24 for both sectors.

Other categories such as Microfinance, Investment, and Mutual Fund display moderate activity in terms of share units traded.

Value Turnover

Hydropower leads in value turnover, especially prominent in 2021/22 and 2023/24, indicating high investor interest and significant market activity in this sector.

Commercial Banks and Development Banks also maintain high value turnover, reflecting their importance in the market.

The Microfinance sector shows consistent value turnover, highlighting its steady performance.

Life Insurance Companies and Non-life Insurance Companies have lower but stable value turnovers across the years.

% Share of Value Turnover

Hydropower dominates the % share of value turnover, especially in 2021/22 and 2023/24, underscoring its critical role in the securities market.

Commercial Banks and Development Banks show a decrease in % share of value turnover over the years, but they still hold significant portions.

The Microfinance sector's share of value turnover remains stable, reflecting its consistent market presence.

Other sectors like Manufacturing & Processing and Investment have smaller but noteworthy shares of the market value turnover.

Summary

The charts highlight the dominance of the Hydropower sector in both share units and value turnover, indicating strong investor interest and activity.

Commercial Banks and Development Banks also play significant roles in the market, though their relative share of value has decreased over time.

Microfinance remains a consistent performer across all three years.

The overall trends indicate that while some sectors like Hydropower see substantial activity and value, others maintain a steady but smaller presence in the market.