By Trading view

Corporate Tax Rates and Cooperative Tax Reforms for FY 2081/82 in Nepal

The Government of Nepal has officially published the updated corporate tax rates and cooperative tax structure applicable for the fiscal year 2081/82. The revision aims to maintain fiscal discipline while optimizing revenue collection from various sectors and aligning with evolving economic activities. The updated provisions under Schedule 1 Section 2(2) and Schedule 2 Section 6 highlight targeted tax brackets for specific industries and activities.

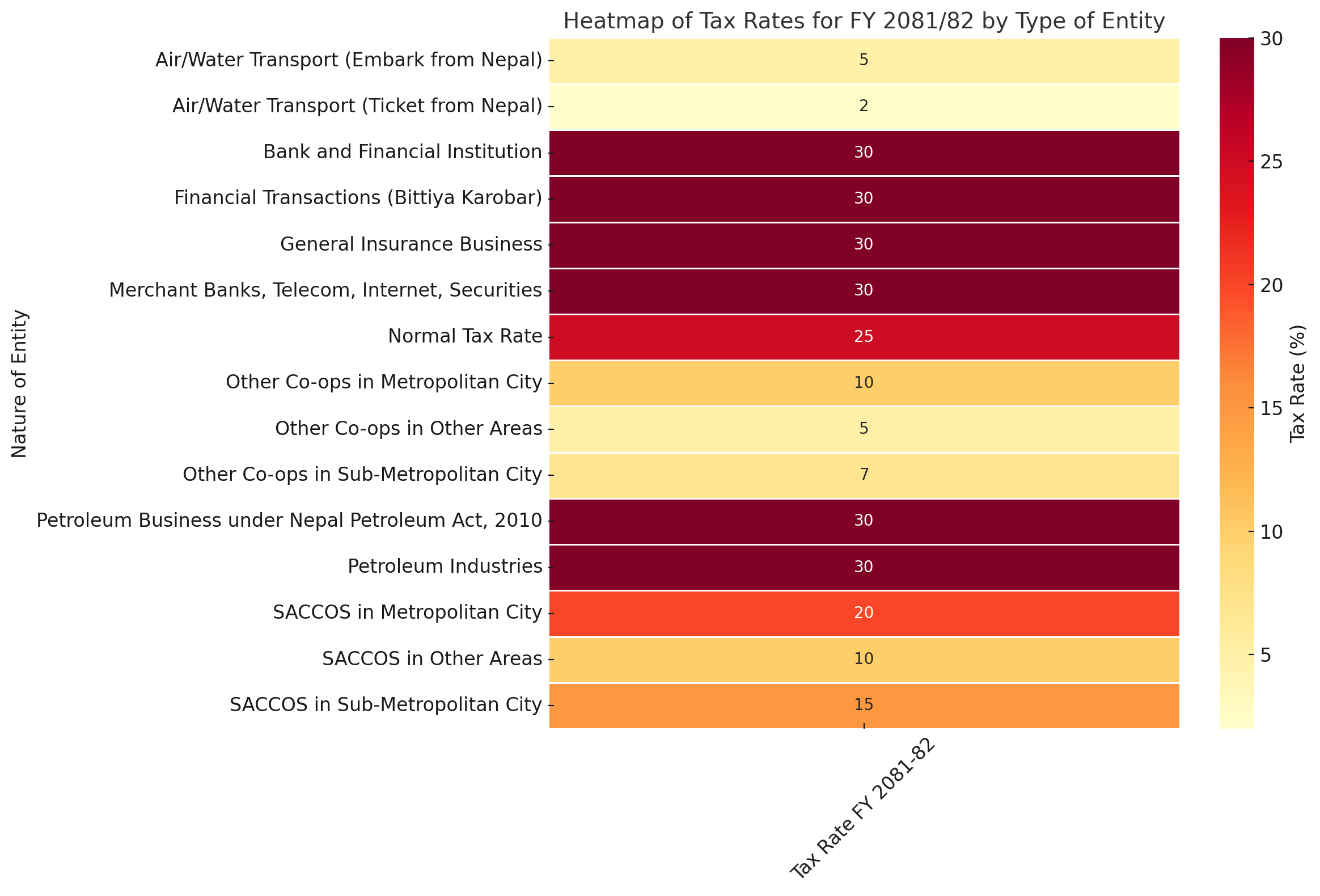

Under the corporate tax category, the normal tax rate remains at 25%. However, various sectors with higher revenue potential or regulatory complexities are subjected to a higher tax rate of 30%. This includes banks and financial institutions, entities engaged in financial transactions such as "Bittiya Karobar", general insurance businesses, petroleum industries, and companies involved in petroleum operations governed by the Nepal Petroleum Act, 2010. Additionally, sectors such as merchant banking, telecommunication services, internet services, money transfer operations, capital markets, commodity futures trading, and securities-related businesses also face a 30% tax rate for FY 2081/82.

Moreover, the tax structure for non-resident entities involved in air and water transport or telecommunication services within Nepal has been clarified. These entities are taxed at differentiated rates based on the nature of the transaction. If goods or passengers embark from Nepal, a tax rate of 5% is applicable. However, if a ticket is booked from Nepal but the journey originates from a foreign country, the applicable tax rate is reduced to 2%. These changes ensure a more transparent framework for taxing international service providers operating in or through Nepal.

In addition to corporate taxation, the tax regime for cooperatives has also been outlined with distinct slabs based on the operational geography and type. Cooperatives exempt under Section 11 continue to enjoy nil taxation. Savings and Credit Cooperatives (SACCOS) operating in metropolitan areas are taxed at 20%, while those operating in sub-metropolitan cities face a reduced rate of 15%. For SACCOS in other areas, the rate is further reduced to 10%.

Other cooperatives, excluding exempt or savings and credit types, are taxed based on their locality. Those operating in metropolitan cities face a 10% tax rate, which is consistent with the previous fiscal year. Similarly, such entities in sub-metropolitan areas are taxed at 7%, while in other regions, the rate stands at 5%. No changes have been made to these rates from FY 2080/81 to FY 2081/82, reflecting stability in taxation for the cooperative sector.

These tax policies indicate the government's strategic direction in managing sector-specific fiscal responsibilities while fostering compliance and fair contribution from high-revenue and specialized business entities. The differential taxation for cooperatives reflects an effort to support financial inclusion and promote local-level economic activities across Nepal.