By Sandeep Chaudhary

Detailed Analysis of NEPSE Share Price Indices: A Three-Year Review

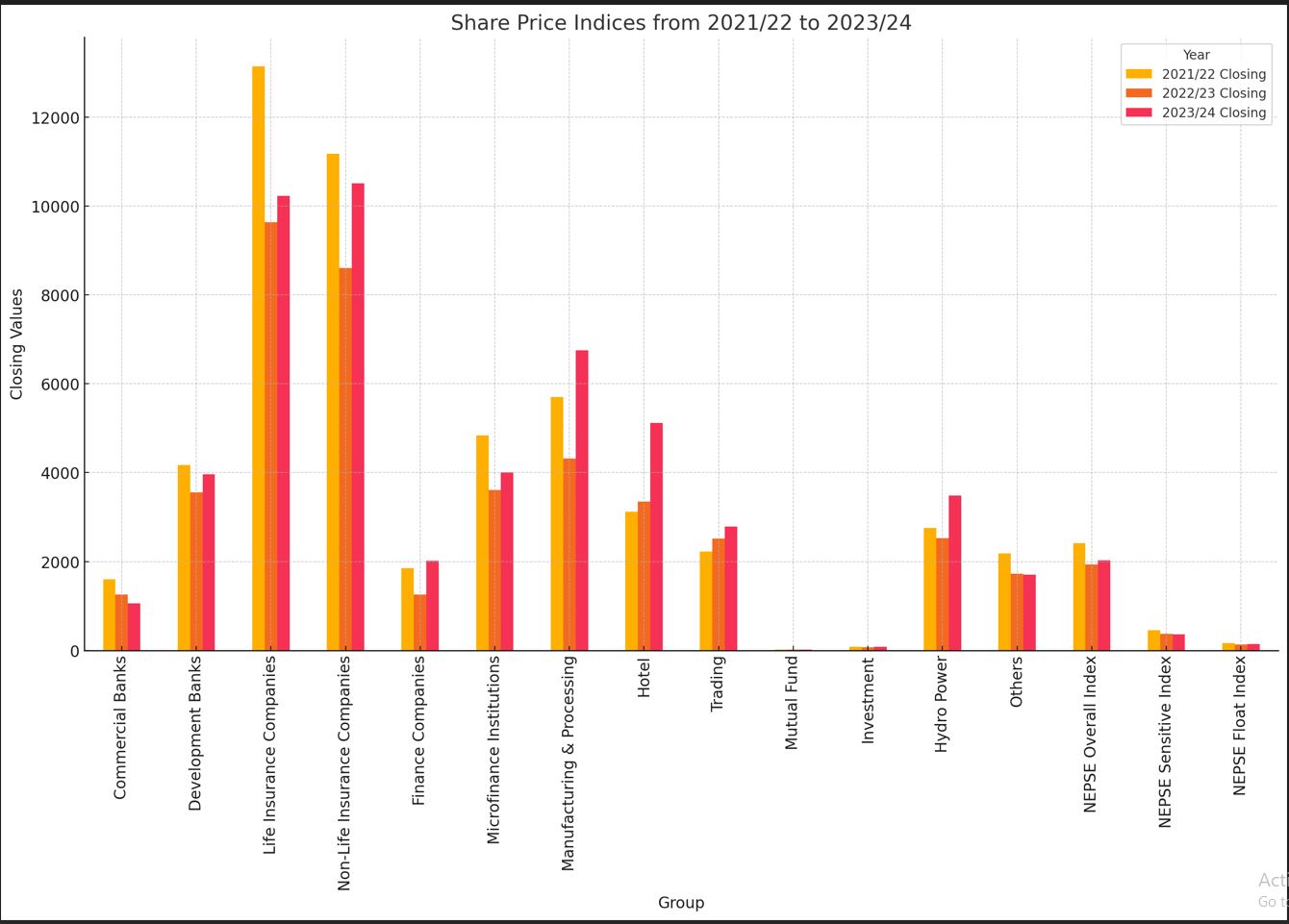

In a comprehensive review of the NEPSE share price indices from 2021/22 to 2023/24, significant trends and shifts in various sectors have been observed. Here's a detailed breakdown of the performance of different groups over the past three years:

Commercial Banks:

The commercial banks sector experienced a notable decline. The closing value dropped from 1604.35 in 2021/22 to 1254.84 in 2022/23, and further to 1059.24 in 2023/24. This reflects a significant downturn, with a 21.8% decrease from 2021/22 to 2022/23 and a 15.6% drop from 2022/23 to 2023/24.

Development Banks:

Development banks showed a mixed performance. The sector's closing value fell from 4169.16 in 2021/22 to 3556.32 in 2022/23. However, it recovered to 3960.52 in 2023/24, marking a 14.7% decline initially, followed by an 11.4% increase in the subsequent year.

Life Insurance Companies:

Life insurance companies faced a steep decline from 13152.06 in 2021/22 to 9643.18 in 2022/23. The sector then saw a modest recovery to 10228.92 in 2023/24. Despite the recovery, the overall decline from 2021/22 to 2022/23 was 26.7%, with a 6.1% increase in the following year.

Non-Life Insurance Companies:

Non-life insurance companies mirrored a similar trend with a drop from 11183.17 in 2021/22 to 8608.37 in 2022/23, and a recovery to 10518.49 in 2023/24. The sector recorded a 23.1% decline initially, followed by a significant 22.2% increase.

Finance Companies:

The finance companies sector experienced extreme volatility, with the closing value plummeting from 1847.15 in 2021/22 to 1257.82 in 2022/23, before surging to 2015.01 in 2023/24. This sector witnessed a substantial 31.9% decline, followed by a remarkable 60.2% increase.

Microfinance Institutions:

Microfinance institutions saw their closing value decrease from 4840.58 in 2021/22 to 3611.61 in 2022/23, then improve to 4004.77 in 2023/24. This sector faced a 25.4% decline initially, with a 10.9% recovery in the next year.

Manufacturing & Processing:

The manufacturing & processing sector displayed resilience, dropping from 5698.15 in 2021/22 to 4316.55 in 2022/23, and then rising sharply to 6751.62 in 2023/24. The sector showed a 24.3% decline, followed by a 56.4% increase.

Hotel:

The hotel sector witnessed growth, moving from 3121.47 in 2021/22 to 3344.60 in 2022/23, and then jumping to 5117.97 in 2023/24. This represents a 7.1% increase initially and a significant 53.0% increase subsequently.

Trading:

The trading sector increased from 2228.53 in 2021/22 to 2518.42 in 2022/23, and further to 2791.37 in 2023/24. This sector saw a 13.0% increase initially, followed by a 10.8% increase.

Mutual Fund:

Mutual funds experienced fluctuations, decreasing from 15.20 in 2021/22 to 13.74 in 2022/23, then recovering to 16.92 in 2023/24. The sector faced a 9.6% decline, followed by a 23.2% increase.

Investment:

The investment sector saw a decline from 79.61 in 2021/22 to 65.36 in 2022/23, before rising to 76.59 in 2023/24. This sector experienced a 17.9% decline, followed by a 17.2% increase.

Hydro Power:

Hydro power displayed strong growth, decreasing slightly from 2758.52 in 2021/22 to 2525.35 in 2022/23, then surging to 3482.86 in 2023/24. The sector faced an 8.4% decline, followed by a 37.9% increase.

Others:

The 'Others' category saw a steady decline from 2187.52 in 2021/22 to 1723.97 in 2022/23, and a slight decrease to 1704.76 in 2023/24. This represents a 21.2% decline initially, followed by a 1.1% decrease.

Index-wise Analysis

NEPSE Overall Index:

The NEPSE Overall Index declined from 2415.58 in 2021/22 to 1934.48 in 2022/23, then slightly recovered to 2025.70 in 2023/24. This index saw a 19.9% decline, followed by a 4.7% increase.

NEPSE Sensitive Index:

The NEPSE Sensitive Index dropped from 456.09 in 2021/22 to 367.99 in 2022/23, then decreased further to 358.19 in 2023/24. This index faced a 19.3% decline initially, followed by a 2.7% decrease.

NEPSE Float Index:

The NEPSE Float Index fell from 164.63 in 2021/22 to 135.50 in 2022/23, then slightly increased to 137.04 in 2023/24. This index experienced a 17.7% decline, followed by a 1.1% increase.

In summary, while some sectors have shown resilience and recovery, others continue to face challenges. The overall market sentiment reflects a period of significant volatility with signs of recovery in certain sectors.