By Dipesh Ghimire

EDBL Faces Significant Financial Challenges: Key Insights from Q3 2080/2081

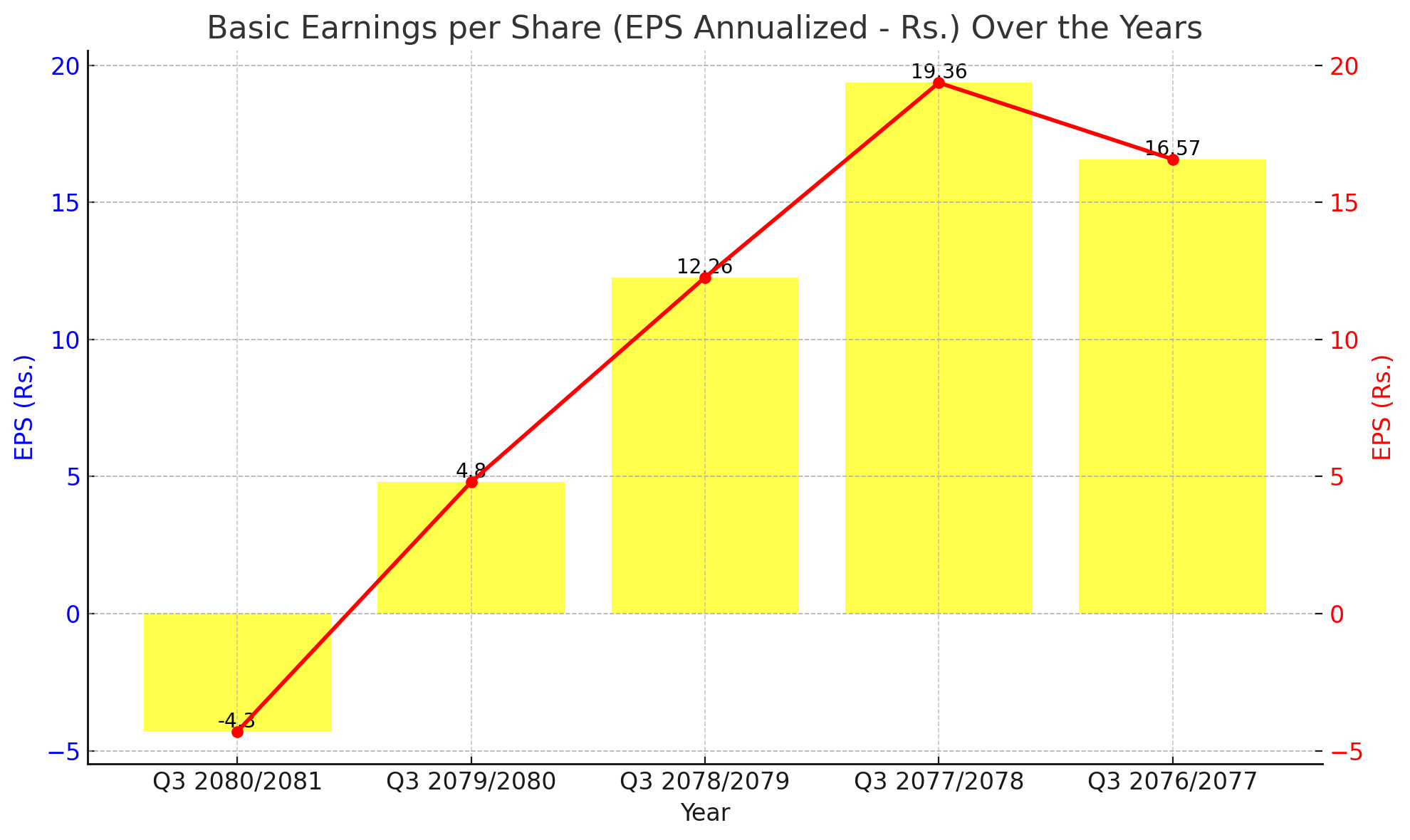

EDBL Reports Significant Decline in EPS for Q3 2080/2081

Excel Development Bank Ltd. (EDBL) has reported a substantial decrease in its Basic Earnings per Share (EPS) for the third quarter of the fiscal year 2080/2081. The bank's EPS has plummeted to -4.3, marking a sharp decline from the previous year's figure of 4.8. This drastic change underscores the financial challenges EDBL has encountered over the past year.

Historical Performance and Trends

Analyzing the past five years, EDBL's EPS performance has shown significant variation:

Q3 2079/2080: EPS stood at 4.8, reflecting a decrease from the robust 12.26 reported in Q3 2078/2079.

Q3 2078/2079: EPS was 12.26, showing growth compared to prior years.

Q3 2077/2078: The highest EPS recorded in this period was 19.36, indicating a peak performance year.

Q3 2076/2077: EPS was 16.57, slightly lower than the peak but still strong.

Interpretation of the Decline

The current EPS of -4.3 represents a concerning trend for EDBL. Several factors may have contributed to this decline:

Economic Conditions: The broader economic environment may have worsened, impacting the bank's profitability. This could include factors such as inflation, increased competition, or regulatory changes.

Operational Challenges: EDBL may have faced internal operational issues, such as higher non-performing loans, increased operating costs, or reduced loan demand.

Market Dynamics: Shifts in market conditions, such as changes in interest rates or financial market volatility, could have negatively affected the bank’s earnings.

Future Outlook

To address these challenges, EDBL must implement strategic measures aimed at improving financial health:

Cost-Cutting Initiatives: Reducing unnecessary expenses to improve profitability

Operational Efficiency: Streamlining operations to enhance productivity and reduce inefficiencies.

New Revenue Streams: Exploring and developing new revenue opportunities to diversify income sources.

Additionally, rebuilding investor confidence will be crucial. This involves transparent communication about the bank’s challenges and the steps being taken to address them, as well as demonstrating a robust recovery plan.

Conclusion

The sharp decline in EDBL’s EPS to -4.3 for Q3 2080/2081 is a significant concern, reflecting the financial hurdles the bank faces. Immediate and effective action is necessary to navigate these challenging times and restore the bank's profitability. Stakeholders will be closely monitoring the bank's strategic responses and their effectiveness in the upcoming quarters.

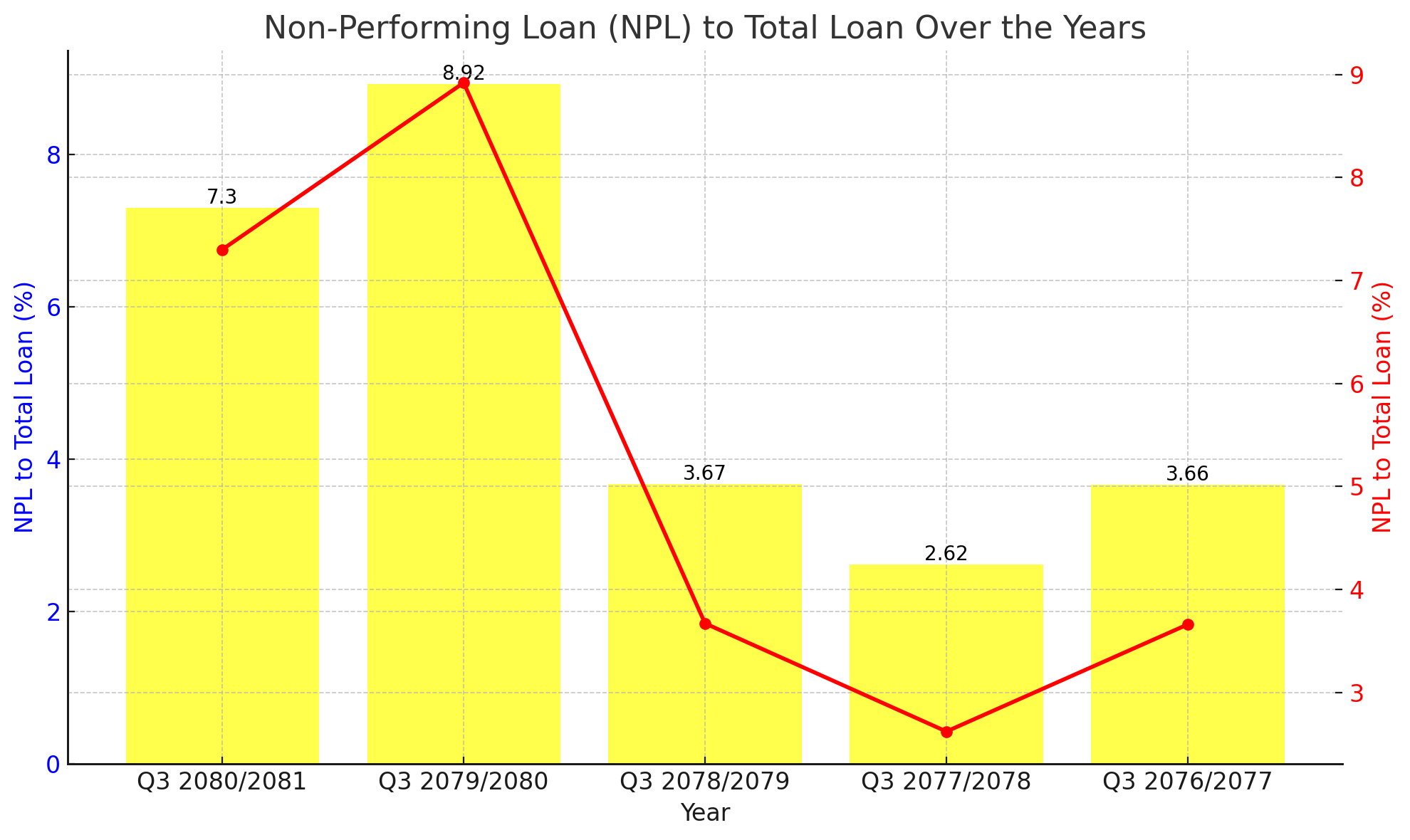

EDBL Reports Fluctuations in Non-Performing Loans Over the Years

Excel Development Bank Ltd. (EDBL) has reported its Non-Performing Loan (NPL) to Total Loan ratio for the third quarter of the fiscal year 2080/2081. The latest figures indicate that the NPL ratio stands at 7.3%, a slight improvement from the previous year's 8.92%, but still significantly higher than the historical lows of 2.62% recorded in Q3 2077/2078.

Historical Performance and Trends

The bank's NPL ratio has shown notable fluctuations over the past five years:

Q3 2080/2081: The NPL ratio is at 7.3%, a decrease from 8.92% in the previous year, indicating a partial recovery.

Q3 2079/2080: The highest NPL ratio in the past five years, at 8.92%, signifying financial distress.

Q3 2078/2079: A significantly lower NPL ratio of 3.67%, suggesting better loan performance.

Q3 2077/2078: The lowest NPL ratio recorded at 2.62%, reflecting optimal loan management.

Q3 2076/2077: A moderate NPL ratio of 3.66%, indicating stable loan quality.

Interpretation of NPL Trends

The fluctuations in EDBL's NPL ratio highlight several underlying issues and improvements:

Economic Conditions: Economic instability and market conditions may have contributed to higher NPL ratios in recent years, particularly during Q3 2079/2080.

Loan Management: Variations in loan management strategies, including credit assessment and recovery processes, have influenced the NPL ratios.

Operational Efficiency: Operational challenges and efficiencies have also played a role in the changing NPL ratios, with better management practices resulting in lower NPLs.

Future Outlook

EDBL must continue to address the high NPL ratio through strategic measures:

Improved Credit Assessment: Enhancing the credit assessment process to ensure better loan quality.

Effective Recovery Strategies: Implementing more effective loan recovery strategies to reduce the NPL ratio.

Operational Enhancements: Streamlining operations to improve overall efficiency and loan performance.

Conclusion

The current NPL ratio of 7.3% for Q3 2080/2081 indicates some improvement but remains a concern for EDBL. The bank must focus on maintaining and improving loan quality to ensure financial stability. Stakeholders will be closely monitoring the bank's efforts to manage its loan portfolio and reduce the NPL ratio in the coming quarters.

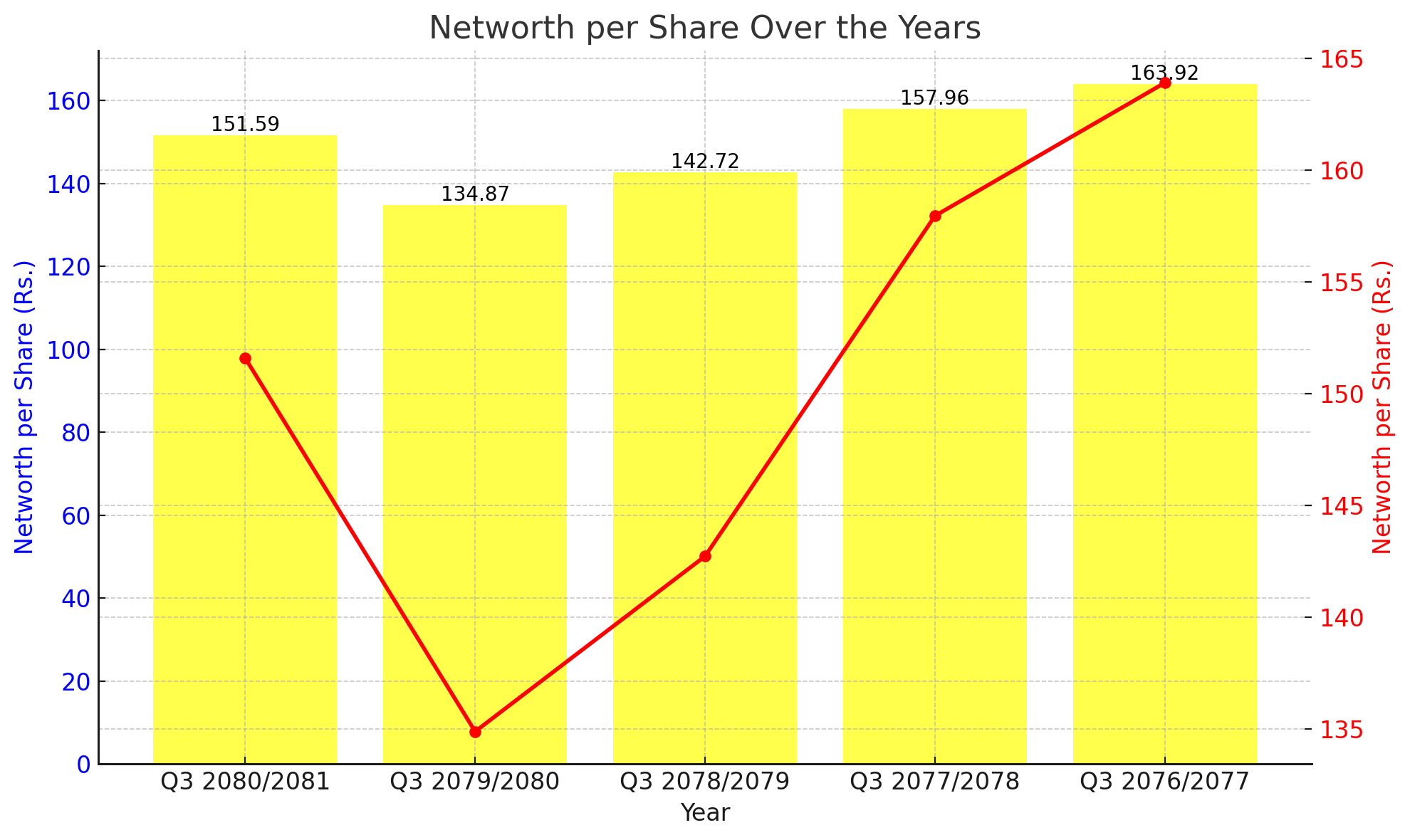

EDBL Shows Stability in Networth per Share Despite Economic Challenges

Excel Development Bank Ltd. (EDBL) has reported its Networth per Share for the third quarter of the fiscal year 2080/2081. The latest figures show a Networth per Share of Rs. 151.59, reflecting a steady performance amidst a challenging economic environment.

Historical Performance and Trends

Over the past five years, EDBL's Networth per Share has demonstrated a general trend of stability with minor fluctuations:

Q3 2080/2081: Rs. 151.59, showing an improvement from Rs. 134.87 in Q3 2079/2080.

Q3 2079/2080: Rs. 134.87, a decrease from Rs. 142.72 in Q3 2078/2079.

Q3 2078/2079: Rs. 142.72, lower than the Rs. 157.96 recorded in Q3 2077/2078.

Q3 2077/2078: Rs. 157.96, a slight decline from the peak of Rs. 163.92 in Q3 2076/2077.

Q3 2076/2077: The highest Networth per Share recorded at Rs. 163.92.

Interpretation of Networth Trends

The observed stability in EDBL’s Networth per Share indicates the bank's resilience in maintaining shareholder value despite economic fluctuations:

Economic Resilience: EDBL's ability to sustain a relatively high Networth per Share suggests robust financial management and resilience against economic downturns.

Strategic Management: Effective strategic decisions have likely contributed to sustaining the bank’s net worth, including prudent financial policies and careful risk management.

Market Conditions: While market conditions have impacted financial performance, EDBL's strategic initiatives have mitigated adverse effects, ensuring steady shareholder value.

Future Outlook

To further enhance its financial stability and shareholder value, EDBL must continue focusing on strategic measures:

Financial Prudence: Maintaining prudent financial policies to manage risks and sustain net worth.

Growth Initiatives: Implementing growth-oriented initiatives to drive profitability and enhance net worth.

Operational Efficiency: Streamlining operations to improve efficiency and financial performance.

Conclusion

EDBL’s Networth per Share of Rs. 151.59 for Q3 2080/2081 highlights the bank's stability and effective financial management amidst economic challenges. Stakeholders can remain optimistic about the bank's future performance, provided it continues to implement sound financial and strategic measures.

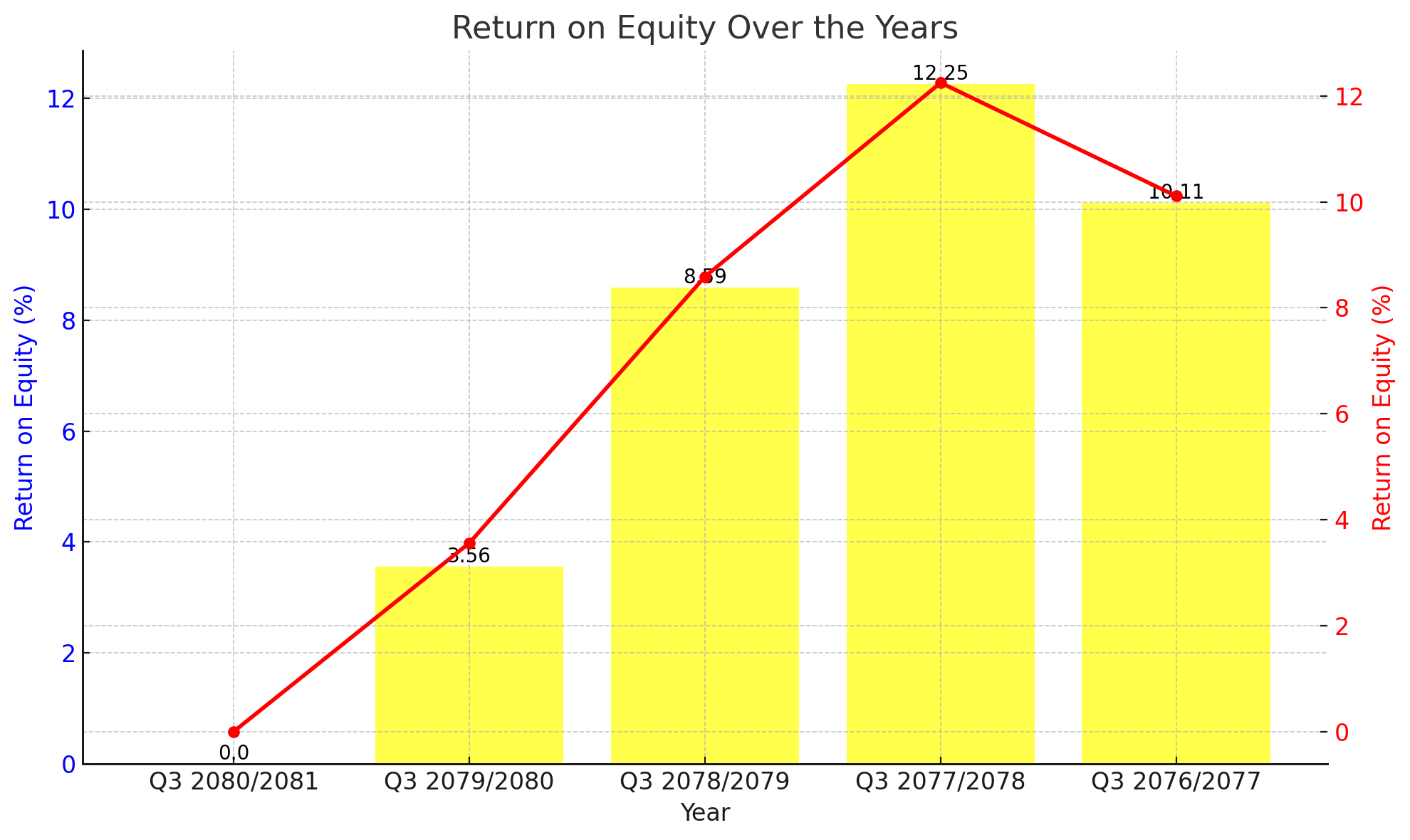

EDBL Faces Challenges in Return on Equity Performance

Excel Development Bank Ltd. (EDBL) has reported its Return on Equity (ROE) for the third quarter of the fiscal year 2080/2081. The bank's ROE has dropped to 0%, marking a significant decline from previous years, and indicating substantial financial challenges.

Historical Performance and Trends

Analyzing the past five years, EDBL's ROE has shown a downward trend:

Q3 2080/2081: ROE stands at 0%, a sharp decline from 3.56% in Q3 2079/2080.

Q3 2079/2080: ROE was 3.56%, showing a significant decrease from 8.59% in Q3 2078/2079.

Q3 2078/2079: ROE stood at 8.59%, reflecting a reduction from the high of 12.25% in Q3 2077/2078.

Q3 2077/2078: The highest ROE in this period at 12.25%, indicating peak financial performance.

Q3 2076/2077: A strong ROE of 10.11%, showcasing consistent profitability.

Interpretation of ROE Trends

The observed decline in EDBL’s ROE suggests several underlying issues:

Profitability Challenges: The significant drop to 0% ROE in Q3 2080/2081 indicates challenges in maintaining profitability.

Economic Impact: Broader economic conditions may have adversely affected the bank’s profitability, leading to lower ROE.

Operational Efficiency: Potential inefficiencies in operations and financial management could have contributed to the declining ROE.

Future Outlook

To address these challenges and improve ROE, EDBL must focus on strategic initiatives:

Enhancing Profitability: Implementing measures to boost profitability, such as expanding revenue streams and reducing costs.

Operational Improvements: Streamlining operations to improve efficiency and financial performance.

Strategic Investments: Making strategic investments to drive growth and enhance shareholder value.

Conclusion

EDBL’s ROE of 0% for Q3 2080/2081 highlights significant financial challenges that need to be addressed. The bank must undertake effective strategic measures to improve its profitability and financial performance. Stakeholders will be closely monitoring the bank’s efforts to enhance its ROE in the coming quarters.

EDBL Reports Fluctuating Distributable Profit per Share Over the Years

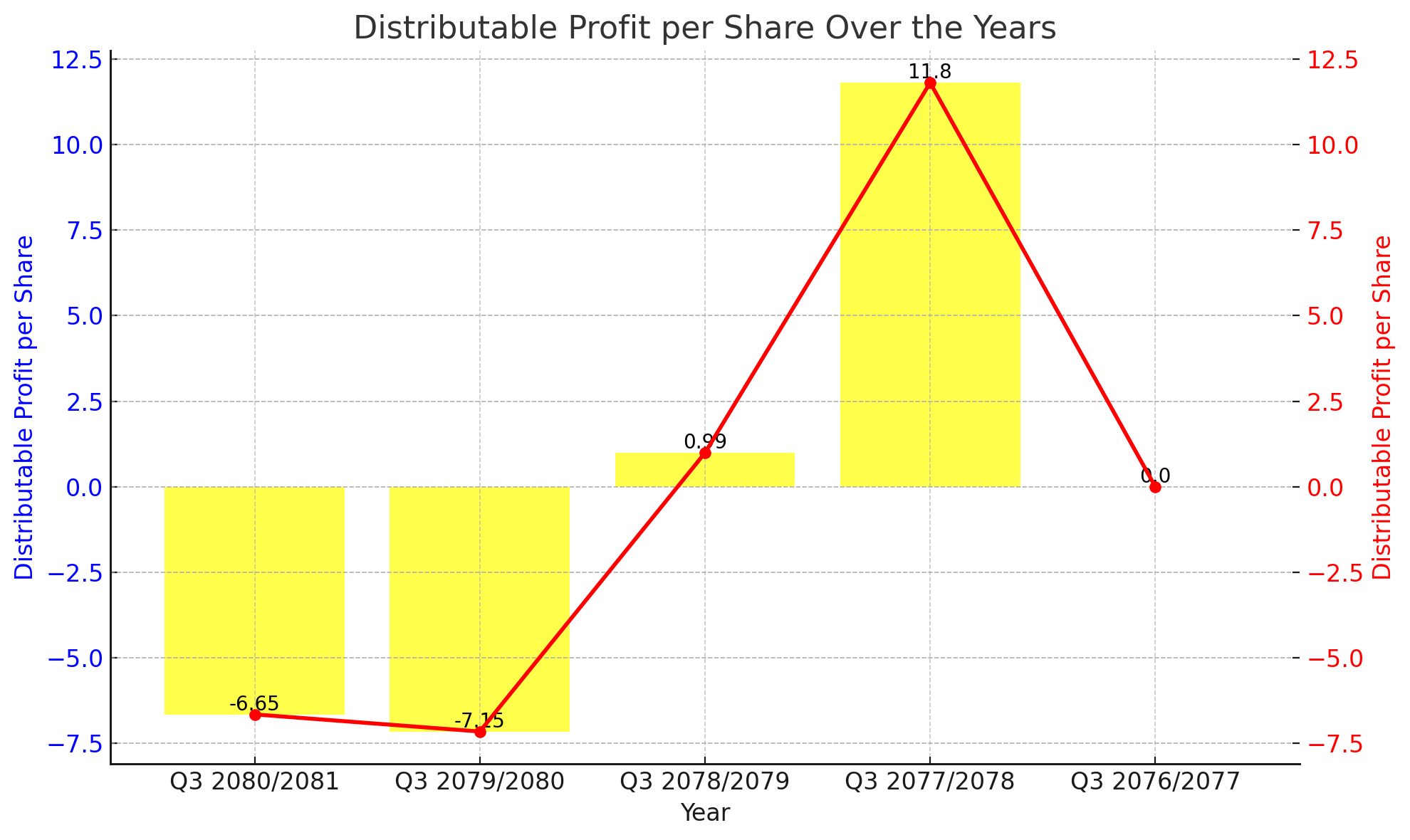

Excel Development Bank Ltd. (EDBL) has reported its Distributable Profit per Share for the third quarter of the fiscal year 2080/2081. The latest figures show a Distributable Profit per Share of -6.65, indicating a slight improvement from the previous year's -7.15, but still reflecting financial difficulties.

Historical Performance and Trends

Analyzing the past five years, EDBL's Distributable Profit per Share has shown significant fluctuations:

Q3 2080/2081: -6.65, a slight improvement from -7.15 in Q3 2079/2080.

Q3 2079/2080: -7.15, a decrease from 0.99 in Q3 2078/2079.

Q3 2078/2079: 0.99, showing a decline from 11.8 in Q3 2077/2078.

Q3 2077/2078: 11.8, the highest distributable profit per share recorded in this period.

Q3 2076/2077: 0, indicating no distributable profit.

Interpretation of Trends

The observed trends in EDBL’s Distributable Profit per Share highlight several key points:

Economic Challenges: The negative values in recent years suggest that EDBL has faced economic challenges affecting its profitability.

Operational Issues: Variations in profit figures indicate potential operational inefficiencies and financial management issues.

Recovery Potential: The slight improvement from -7.15 to -6.65 in the past year may signal the beginning of a recovery phase.

Future Outlook

To address these challenges and improve distributable profit, EDBL must focus on strategic initiatives:

Improving Profitability: Implementing measures to boost profitability, such as optimizing revenue streams and controlling costs.

Operational Efficiency: Streamlining operations to reduce inefficiencies and enhance financial performance.

Strategic Investments: Investing in growth opportunities to drive profitability and shareholder value.

Conclusion

EDBL’s Distributable Profit per Share of -6.65 for Q3 2080/2081 indicates ongoing financial challenges, though there is a slight improvement from the previous year. The bank must continue to implement effective strategic measures to enhance its financial performance and profitability. Stakeholders will be closely monitoring the bank’s efforts to improve its distributable profit in the coming quarters.