By Sandeep Chaudhary

Government Revenue Payment Limits in Nepal: Updated Digital & Banking Thresholds Explained

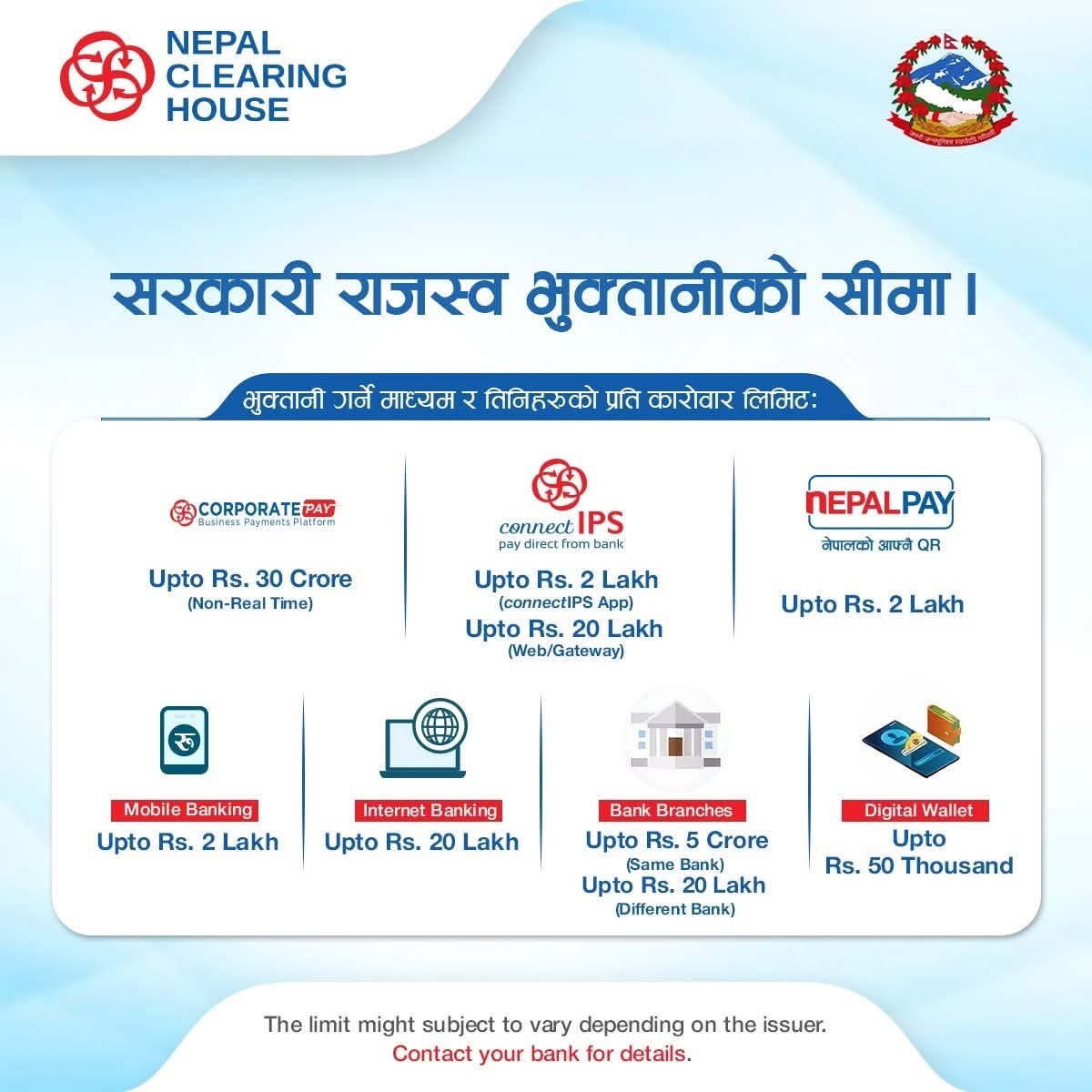

The Nepal Clearing House (NCHL) has outlined the transaction limits for paying government revenue through various digital and banking channels. These limits determine the maximum amount a user or business can pay in a single transaction while settling taxes, fees, customs duties, fines, or other government-related payments.

CorporatePay, which is primarily used by businesses and institutions, allows government revenue payment of up to NPR 30 crore (300 million) per transaction in non–real-time mode. This facility is particularly beneficial for large organizations, public institutions, and high-value government transactions.

Through connectIPS, one of Nepal’s most widely used interbank payment platforms, the transaction limit depends on the access channel. The connectIPS mobile application allows payments up to NPR 2 lakh, while the connectIPS web gateway enables higher-value payments of up to NPR 20 lakh per transaction. This flexibility helps both individuals and businesses pay government revenue in a secure, real-time manner.

Using NepalPay QR, citizens can pay up to NPR 2 lakh per transaction. This supports the growing QR-based payment ecosystem in Nepal and makes government revenue collection more digital and accessible.

For traditional banking channels, mobile banking apps of various banks offer a government revenue payment limit of up to NPR 2 lakh. Meanwhile, internet banking provides a higher ceiling of up to NPR 20 lakh, enabling more significant payments for businesses and high-net-worth individuals.

Bank branches also play a crucial role in revenue collection. Payments made through the same bank allow a maximum of NPR 5 crore in a single transaction. However, if the revenue is paid to the government through a different bank, the limit is reduced to NPR 20 lakh per transaction.

Digital wallets—convenient for retail users—have a relatively smaller limit of up to NPR 50,000 per transaction for government revenue payments. This is suitable for smaller taxes, renewal fees, fines, and other low-value government services.

The transaction limits may vary depending on the policy of the specific bank or financial institution issuing the service. Users are therefore advised to consult their bank for exact limits and any additional requirements or validations before initiating large payments.