By Dipesh Ghimire

How Does an Economy Function?

An economy operates in a cyclical flow involving financial sectors, government bodies, external investments, production, supply, consumption, imports, and exports. Developing countries are often focused on achieving high economic growth rates, while developed nations are concerned with maintaining consistent growth. Strong economic growth forms the backbone of democracy. However, if activities like production, employment, and supply do not adequately support democracy, the concept becomes theoretical and lacks practical value. Democracy's functionality lies in directly addressing the daily lives of citizens through the creation and distribution of economic opportunities. Freedom without economic opportunities is incomplete.

Economy refers to the system of production, distribution, and consumption of goods and services using scarce resources in an ideal manner. Traditionally, the factors of production included land, labor, capital, and raw materials. Today, knowledge and technology are also considered essential resources. These resources are termed "scarce" because they are limited relative to aspirations and cannot be expanded instantly. Effective use of these resources leads to higher economic growth and development.

While people often express concerns about economic stagnation, they often overlook the underlying processes and stages. The economy functions as a relationship between production and consumption, where demand and supply determine production levels. Historically, markets were localized, but globalization has expanded their scope. Economic operation depends on several factors: the availability of resources (natural, human, capital, and technological), production levels, monetary behavior (savings and loans), market prices, and government taxation policies.

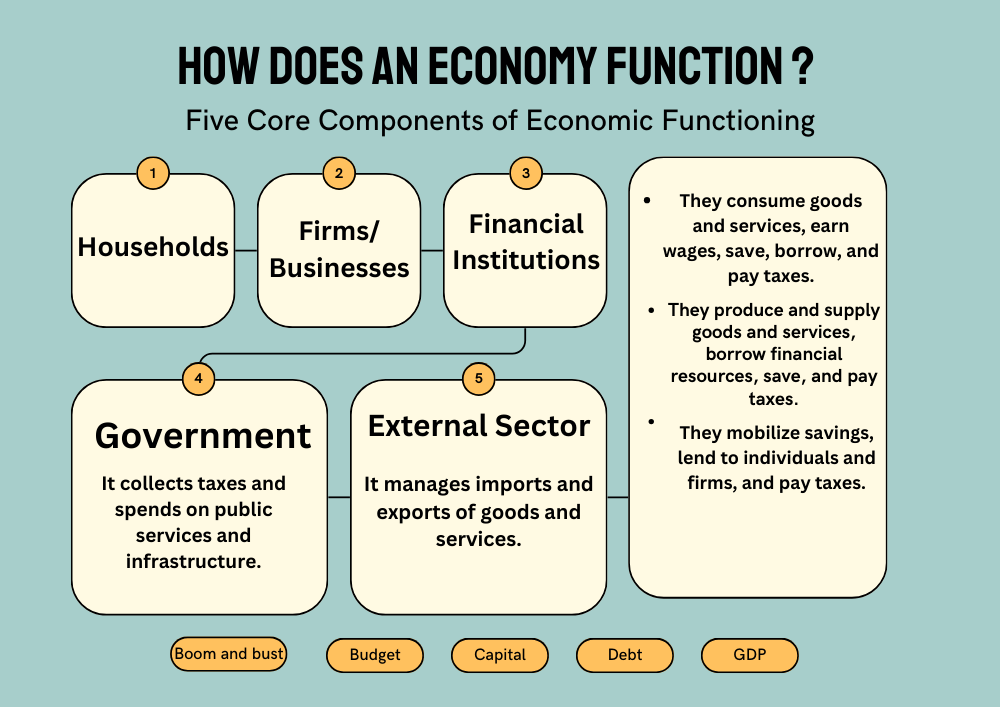

Five Core Components of Economic Functioning

Households: They consume goods and services, earn wages, save, borrow, and pay taxes.

Firms/Businesses: They produce and supply goods and services, borrow financial resources, save, and pay taxes.

Financial Institutions: They mobilize savings, lend to individuals and firms, and pay taxes.

Government: It collects taxes and spends on public services and infrastructure.

External Sector: It manages imports and exports of goods and services.

The economy is a cyclical system where households, businesses, financial institutions, government, and external sectors interact through investment, production, supply, consumption, and trade. Economists classify these flows into two categories: injections (investment, government spending, exports) and leakages (savings, taxes, imports). Economic growth occurs when the total injections exceed total leakages, leading to an expansion in economic size.

Measuring Economic Growth

Economic growth is reflected in the increase in investment, production, and employment, often measured by Gross Domestic Product (GDP). For instance, an economy doubling its size in seven to eight years indicates robust economic activity. China achieved this through rapid "economic doubling," positioning itself as a leading global economy. India is similarly working toward this goal.

Interdependence of Economic Components

Each component influences the others. For example:

Government taxation and expenditure affect household savings, business activities, financial markets, and international trade.

Household spending or savings create effective demand, impacting businesses, government revenue, and the financial sector.

Firms’ production levels and pricing strategies influence households, government revenue, and trade.

The globalized nature of modern economies makes external factors increasingly significant. The flow of labor and capital, facilitated by multinational corporations, underscores the growing importance of external sectors.

Policies for Economic Dynamism

Balancing supply-side and demand-side policies is key. Measures include tax cuts, public spending, reduced interest rates, business-friendly environments, and social security provisions. However, despite significant potential, Nepal's economic dynamism remains underwhelming, constrained by insufficient trust, coordination, and proactive policies.

Strengthening Nepal's Economy

To revitalize Nepal's economy, several steps are essential:

Recognizing early warning signs and responding proactively.

Ensuring strong regulatory frameworks for banks and financial institutions.

Balancing risks with sustainable growth.

Strengthening coordination among economic policymakers.

Promoting local economic activities and fostering collaboration between small-scale enterprises and large businesses.

Creating an environment of trust and innovation.

By implementing these measures, Nepal can pave the way for sustainable and inclusive economic growth, ensuring long-term stability and resilience in the face of challenges.