By Trading view

Major Adjustments on Electric Vehicles, Tobacco, and Consumer Goods

The Government of Nepal has announced significant changes to the excise duty structure for the Fiscal Year 2081/82, as part of its broader tax reform agenda. This update, detailed in the recent budget disclosure, brings modifications across various sectors, including electric vehicles, tobacco products, consumer electronics, and specific daily-use items.

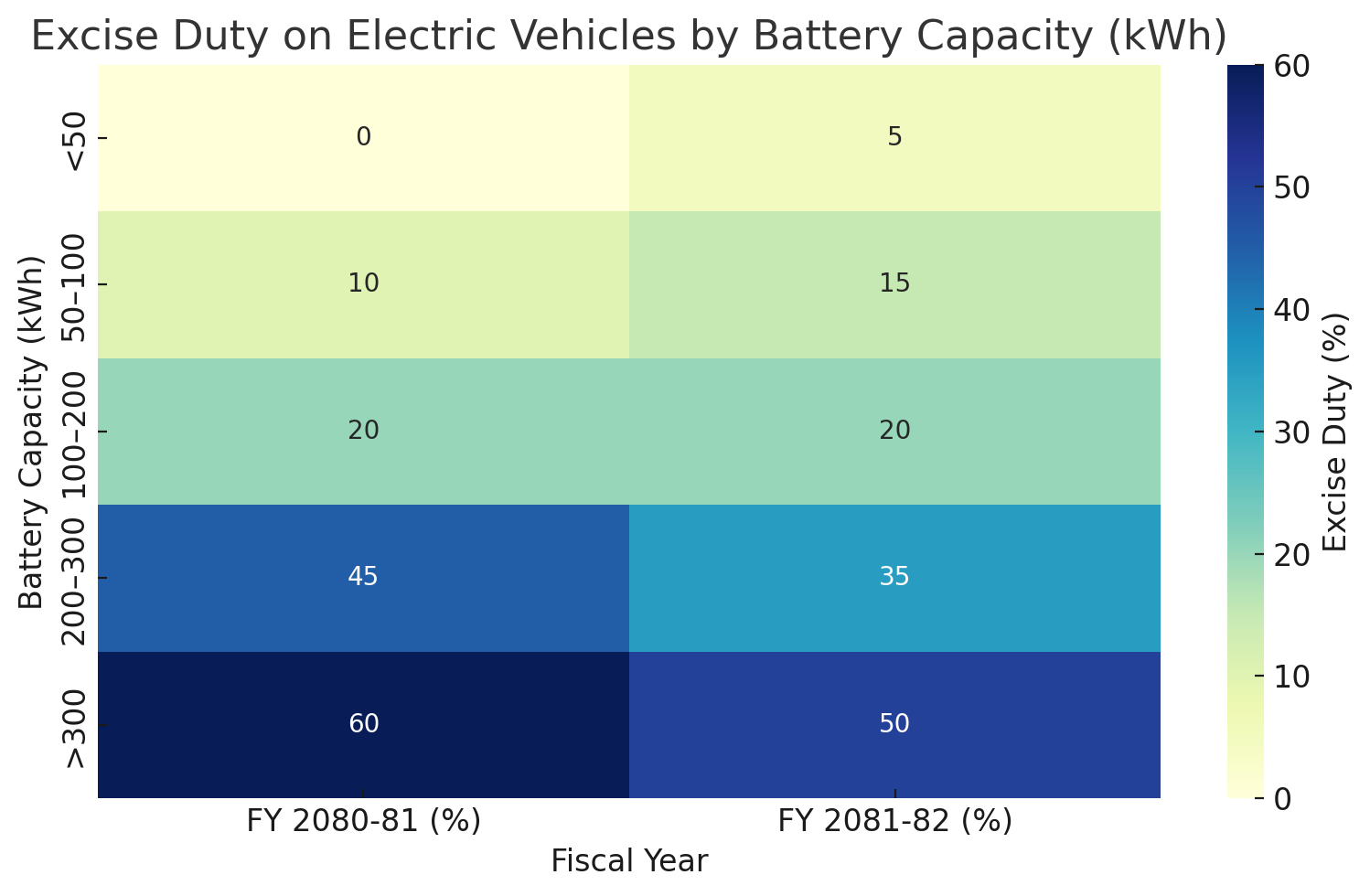

Revised Excise Duty on Electric Vehicles

In an effort to encourage the use of electric vehicles (EVs) while maintaining revenue balance, the government has made upward and downward revisions to the excise duty rates on EVs based on their battery capacity (kWh). For vehicles below 50 kWh, the duty which was previously exempt will now be charged at 5%. Vehicles between 50–100 kWh will see an increase from 10% to 15%, and those between 100–200 kWh will face a revised duty of 20%, down from 25%. Meanwhile, duty for vehicles in the 200–300 kWh range has decreased from 45% to 35%, and those above 300 kWh have been reduced from 60% to 50%. Additionally, a 5% excise duty has now been introduced on four-wheeled transportation vehicles used for commercial purposes.

It is important to note that unassembled electric vehicles will be taxed under the same rate as their assembled counterparts, ensuring tax parity across the import and manufacturing sectors.

Hike in Tobacco and Alcohol-Based Excise

A major revision has been made in the tobacco sector. Excise duty on electric cigarettes has now been fixed at 40% per kg or Rs. 475, whichever is higher. This move is accompanied by duty hikes across a range of products including fruit juices, energy drinks, and alcoholic beverages — particularly those containing malt or distilled spirits such as whisky, rum, gin, vodka, and Geneva. Additionally, traditional and flavored tobacco products like Jarda, Khaini, Snuff, Gutka, Hukka Flavor, and other areca nut-based consumables will now be taxed at higher rates.

Introduction of New Excise Duties

The fiscal reform also expands the excise net to cover new product categories that were previously untaxed:

Supplements used for cement, mortar, or concrete will now carry an excise duty.

Non-refractory mortars and concretes also fall under the new excise scope.

Laptops and notebooks, previously untaxed, are now included in the excise list.

Hydraulic brake fluids, an essential automotive fluid, will face new excise charges.

Eco-friendly utensils such as trays, plates, and cups made of paper and bamboo will now attract a 10% duty.

Ice cream, which previously carried a 20% duty, will now be taxed at 30%.

Excise Duty Removal

In a progressive move, the government has removed excise duty on tempered or laminated safety glass used in vehicles, aircraft, spacecraft, or vessels. This initiative aims to promote safety technology adoption and reduce costs for domestic assemblers and importers of safety-grade transport components.

These changes reflect the government’s focus on balancing environmental incentives with revenue optimization and controlling consumption of health-risk products. The updates are also in line with the broader fiscal and trade policies designed to promote cleaner transportation, health safety, and local industrial competitiveness.

The excise policy shift is expected to have ripple effects across sectors, from EV manufacturers and importers to consumers and small-scale traders. With effective implementation, the changes could support Nepal’s goals for economic diversification, sustainability, and public health.