By Sandeep Chaudhary

Monetary Indicators Reflect Gradual Stabilization in Nepal's Economy

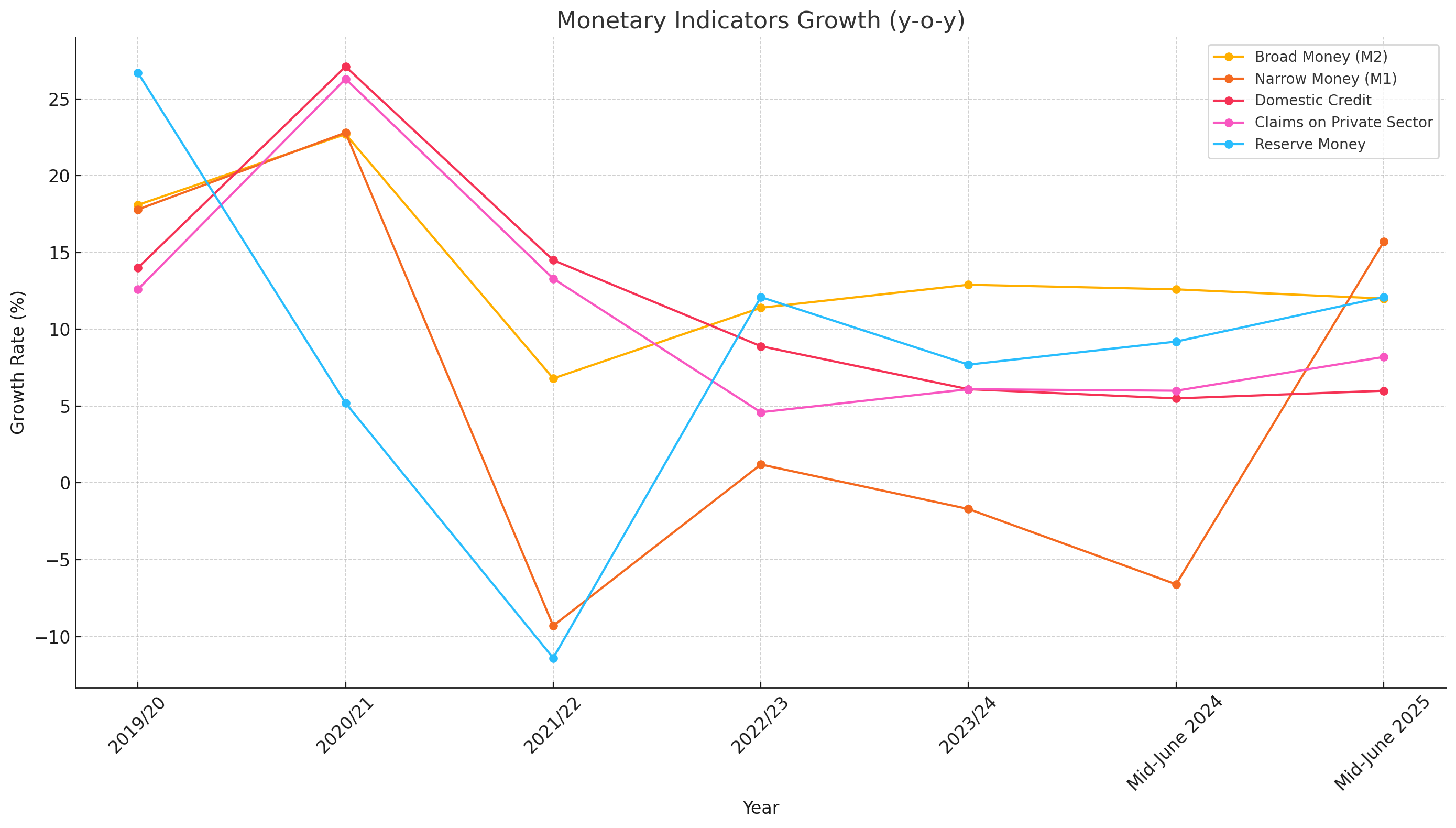

Kathmandu, July 8 – Recent data from Nepal Rastra Bank reveals a cautiously optimistic trajectory for Nepal’s monetary sector as of mid-June 2025. Key monetary aggregates such as Broad Money (M2), Narrow Money (M1), Domestic Credit, Private Sector Claims, and Reserve Money show signs of stabilization and modest growth compared to previous years, signaling improving liquidity conditions and monetary recovery post-COVID disruptions.

Broad Money (M2) growth stands at 12.0% in mid-June 2025, slightly down from 12.6% a year earlier, yet relatively consistent with the annual rise of 12.9% in FY 2023/24. This indicates sustained growth in overall liquidity, driven by improvements in bank deposits and credit expansion, though still below the pre-pandemic highs of over 22% seen in FY 2020/21.

Narrow Money (M1) experienced a sharp rebound, growing by 15.7% in mid-June 2025 after contracting by -6.6% in mid-June 2024. This reversal suggests a resurgence in demand deposits and currency in circulation, reflecting improved economic sentiment and consumption behavior after several years of weak momentum, including a drastic -9.3%contraction in FY 2021/22.

Domestic Credit growth remains subdued at 6.0% in mid-June 2025, slightly improving from 5.5% a year earlier. This sluggish pace, compared to the robust 27.1% in FY 2020/21, shows ongoing caution in credit disbursement and relatively low private sector borrowing amid elevated risk perceptions and tighter lending conditions.

Claims on the Private Sector increased by 8.2% as of mid-June 2025, marking a moderate recovery from 6.0% in the same month last year and 4.6% in FY 2022/23. While still far below the 26.3% peak in FY 2020/21, this growth highlights renewed business activity and gradual normalization of private sector credit demand.

Reserve Money, a measure of base liquidity controlled by the central bank, registered a notable uptick of 12.1% in mid-June 2025, up from 9.2% the previous year. This aligns with the central bank’s policy to maintain sufficient liquidity to support economic growth without triggering inflationary pressures. The current figure also mirrors the annual growth in FY 2022/23, following a sharp contraction of -11.4% in FY 2021/22.

Overall, these indicators collectively portray a slowly recovering financial environment, with positive signals in monetary expansion and renewed credit flow. The resurgence in M1 and Reserve Money growth could signal increased economic confidence and transaction volumes. However, the continued modest performance of Domestic Credit and Private Sector Claims suggests that caution persists among lenders and borrowers alike, warranting supportive yet prudent monetary policies going forward.