By Writer Content

Navigating Financial Fluctuations: Analyzing NMB Bank's Performance Over the Last Five Years

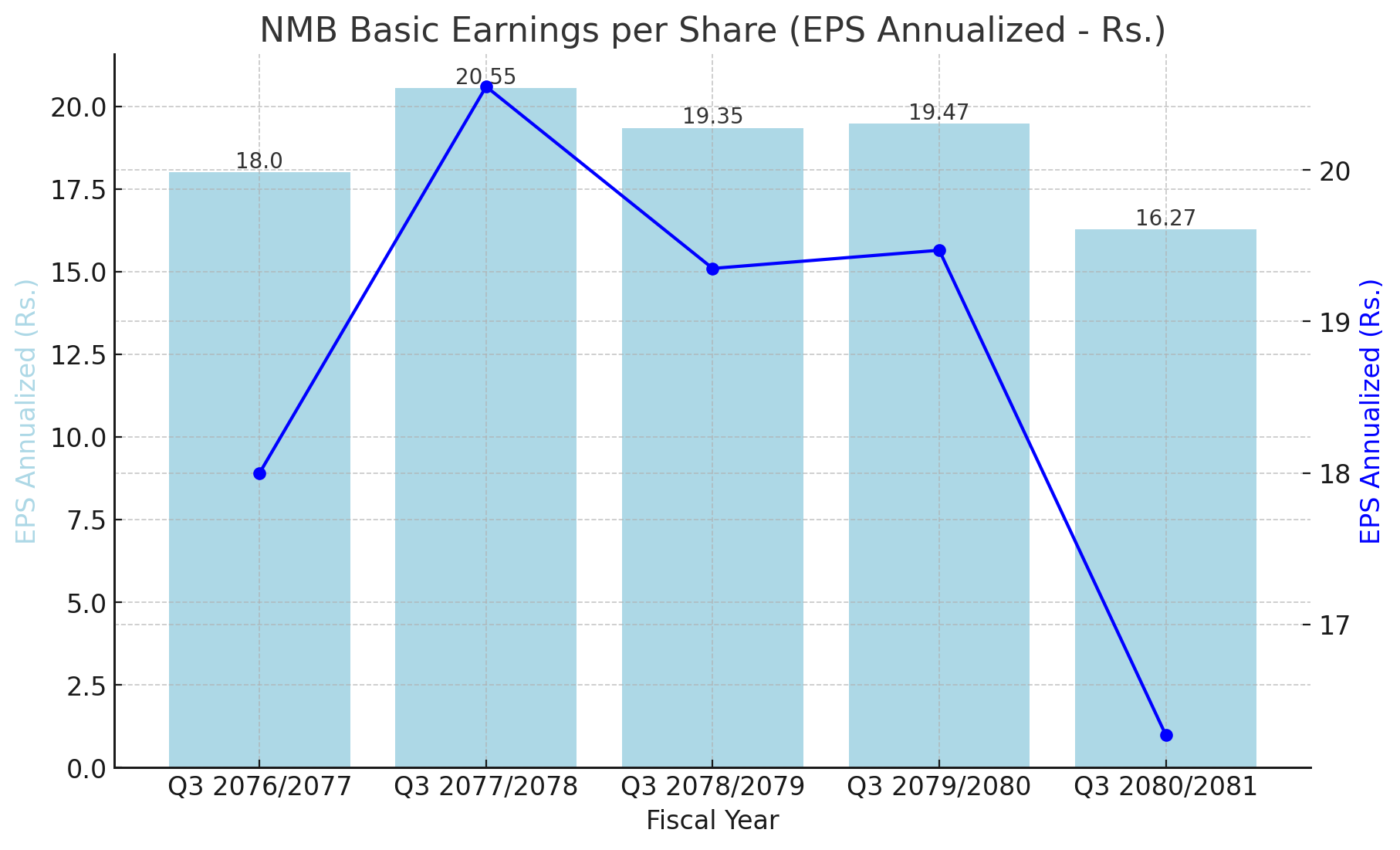

NMB Bank's financial performance over the last five fiscal years, as indicated by its Basic Earnings per Share (EPS) Annualized, has shown notable fluctuations. The EPS is a critical measure of a company's profitability, representing the portion of a company's profit allocated to each outstanding share of common stock.

In the most recent fiscal year, Q3 2080/2081, NMB Bank reported an EPS of Rs. 16.27, a decline from Rs. 19.47 in Q3 2079/2080. This decrease marks a significant drop in profitability, highlighting a challenging year for the bank. Analysts suggest that this reduction could be attributed to various macroeconomic factors, including market volatility and increased operational costs.

The previous year, Q3 2079/2080, had seen a slight increase in EPS from Rs. 19.35 in Q3 2078/2079, suggesting a stable performance during that period. This consistency was beneficial for stakeholders, reflecting the bank's ability to maintain its earnings despite external pressures.

However, the highest EPS within the five-year span was recorded in Q3 2077/2078 at Rs. 20.55. This peak can be seen as a period of exceptional performance, possibly due to strategic initiatives undertaken by the bank to enhance profitability and operational efficiency. Factors such as effective cost management and favorable market conditions may have contributed to this achievement.

In contrast, Q3 2076/2077 recorded an EPS of Rs. 18, which, while lower than subsequent years, set a foundational baseline for growth. This initial figure indicates that while the bank had a modest start, it had the potential for improvement and expansion.

Overall, the data depicts a fluctuating trend in NMB Bank's EPS over the last five fiscal years. The decline in the latest fiscal year is a cause for concern and may prompt the bank's management to re-evaluate their strategies to stabilize and enhance profitability in the coming years. Stakeholders will be keenly observing the bank's next moves, anticipating how it plans to navigate the current financial landscape to restore and potentially exceed its previous performance highs.

Interpretation: The varying EPS values reflect the bank's dynamic operating environment. The peak in Q3 2077/2078 could signify successful strategic implementations, while the subsequent decline might indicate external pressures or internal inefficiencies. The bank's ability to rebound and stabilize its earnings will be crucial for maintaining investor confidence and ensuring long-term growth. The management's response to the recent downturn will be pivotal in setting the direction for future financial health.

NMB Bank's NPL Ratio Trends Over Five Fiscal Years

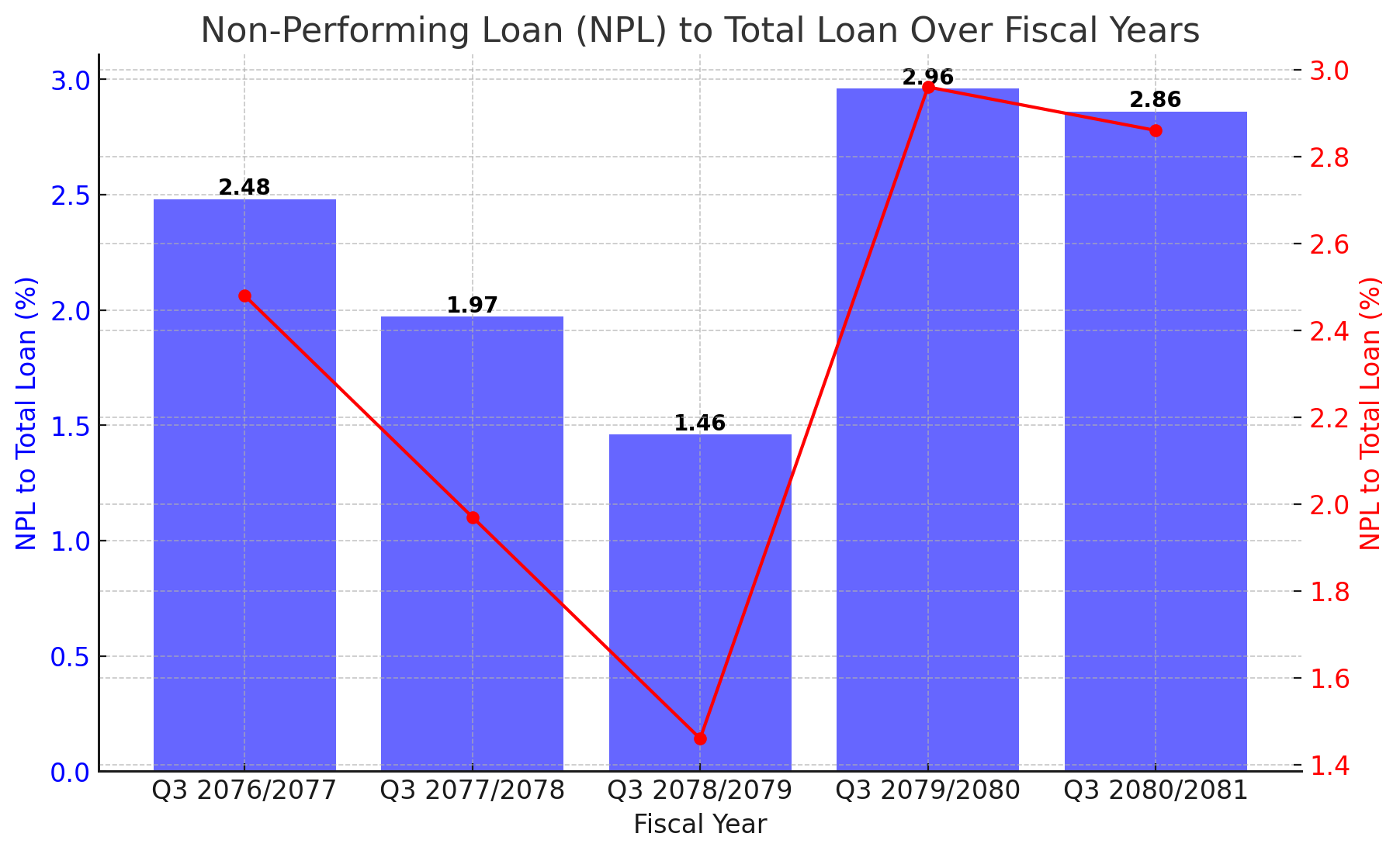

Kathmandu, June 19, 2024 - The Non-Performing Loan (NPL) to Total Loan ratio of NMB Bank has shown significant fluctuations over the past five fiscal years, reflecting varying degrees of asset quality and lending risk management.

Key Highlights:

Recent Increase in NPL Ratio: As of Q3 2080/2081, the NPL ratio stands at 2.86%, a slight decrease from the 2.96% recorded in Q3 2079/2080. This recent trend suggests that while the bank has managed to slightly improve its loan recovery processes, there are still challenges in maintaining a low level of non-performing assets.

Historical Fluctuations: The NPL ratio has experienced notable fluctuations:

Q3 2078/2079: The ratio saw a significant drop to 1.46%, indicating a period of effective loan management and possibly stricter credit policies.

Q3 2077/2078: Prior to the drop, the NPL ratio was at 1.97%. This indicates an improvement in the following year.

Q3 2076/2077: The NPL ratio was at 2.48%, which is relatively high, reflecting challenges in the lending environment and asset quality during that period.

Interpretation:

The data highlights the bank's ongoing efforts to manage and mitigate credit risk. The fluctuations in the NPL ratio suggest that NMB Bank has periodically faced difficulties in maintaining consistent asset quality. The significant drop in NPL ratio in Q3 2078/2079 might be attributed to more rigorous credit risk assessment and enhanced loan recovery mechanisms during that period. However, the subsequent increase in the following years points to external economic factors or changes in the bank's loan portfolio that impacted loan performance.

The recent improvement from 2.96% to 2.86% indicates a positive but cautious trend towards better asset quality management. It underscores the importance of continuous monitoring and strategic adjustments in the bank's credit policies to sustain this improvement.

Overall, NMB Bank's fluctuating NPL ratios underscore the dynamic nature of credit risk management in the banking sector. Continuous efforts in enhancing credit policies and loan recovery processes are crucial for maintaining financial stability and fostering growth.

NMB Bank’s Financial Performance: Steady Growth in Net Worth Per Share

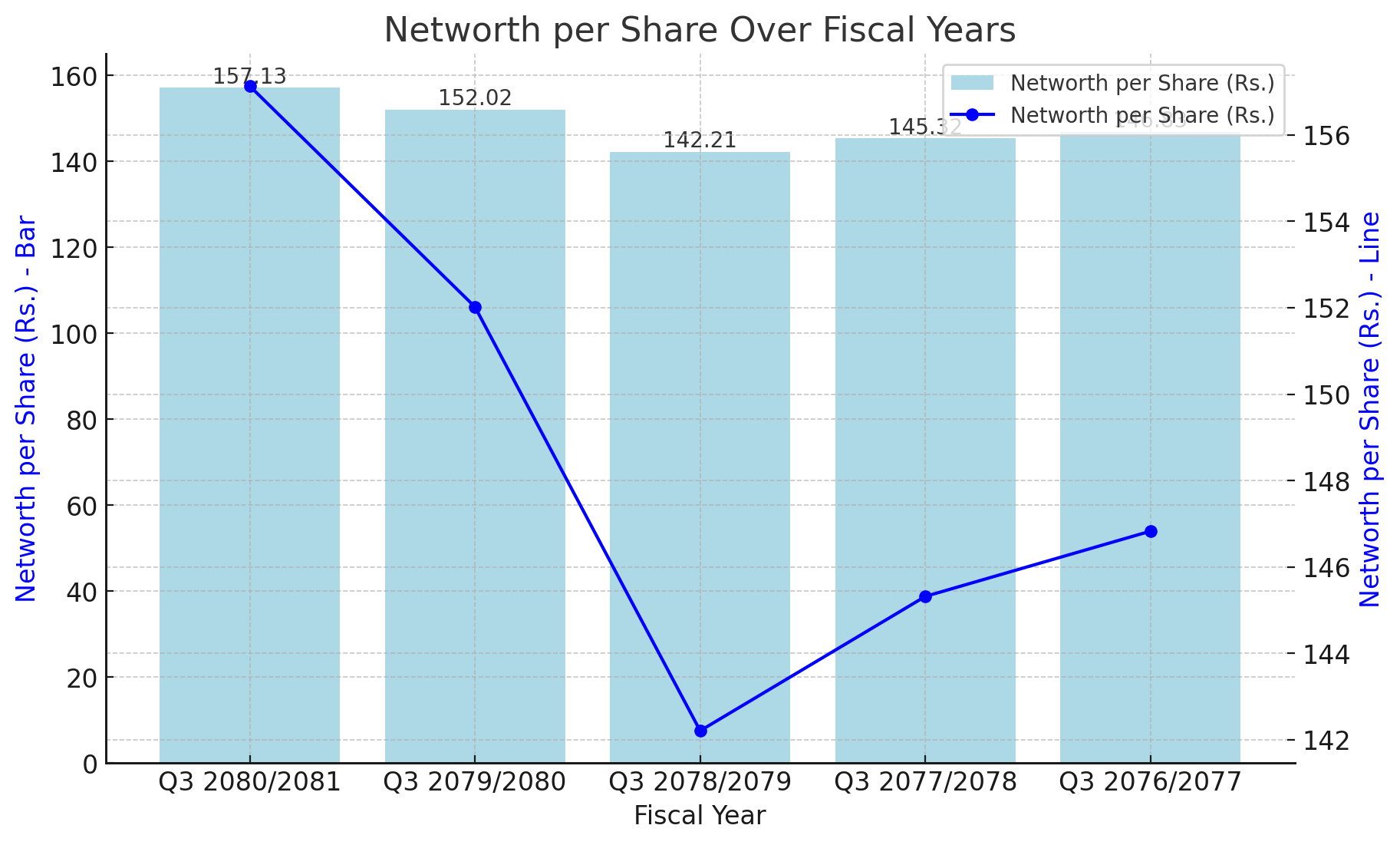

NMB Bank has demonstrated consistent financial performance over the past five fiscal years, as reflected in the net worth per share data. The bank's latest figures show a net worth per share of Rs. 157.13 for Q3 2080/2081, marking an increase from Rs. 152.02 in Q3 2079/2080. This upward trend is a positive indicator of the bank's financial health and stability.

Key Highlights:

Q3 2080/2081: The net worth per share reached Rs. 157.13, the highest in the five-year period. This reflects the bank's effective financial management and growth strategies, despite the challenging economic environment.

Q3 2079/2080: The net worth per share was Rs. 152.02, showing a steady increase from the previous year's Rs. 142.21 in Q3 2078/2079. This growth indicates a positive trajectory in the bank's asset accumulation and shareholder equity.

Q3 2078/2079: A dip in the net worth per share to Rs. 142.21 from Rs. 145.32 in Q3 2077/2078 was observed. This decline could be attributed to increased operational costs or investment in new ventures that are expected to yield returns in the long term.

Q3 2077/2078: The net worth per share was Rs. 145.32, slightly decreasing from Rs. 146.83 in Q3 2076/2077. Despite this minor decline, the bank maintained a strong net worth, indicating resilience in its financial strategy.

Q3 2076/2077: With a net worth per share of Rs. 146.83, the bank set a solid foundation for future growth. This period marked the beginning of a strategic phase that has contributed to the current financial stability.

Interpretation:

The overall trend in NMB Bank's net worth per share over the past five years highlights the institution's robust financial framework and prudent management practices. The notable increase to Rs. 157.13 in the most recent fiscal year underscores the bank's successful navigation through economic uncertainties and its commitment to enhancing shareholder value.

The slight fluctuations in the middle years reflect common challenges faced by financial institutions, such as market volatility and investment expenditures. However, the bank's ability to rebound and achieve the highest net worth per share in the latest fiscal year is commendable.

Conclusion:

NMB Bank's consistent growth in net worth per share is a testament to its strong financial health and strategic foresight. Shareholders can remain optimistic about the bank's future prospects, given its demonstrated capability to enhance value and sustain growth amidst varying economic conditions.

NMB Bank's Return on Equity Shows Mixed Performance Over the Years

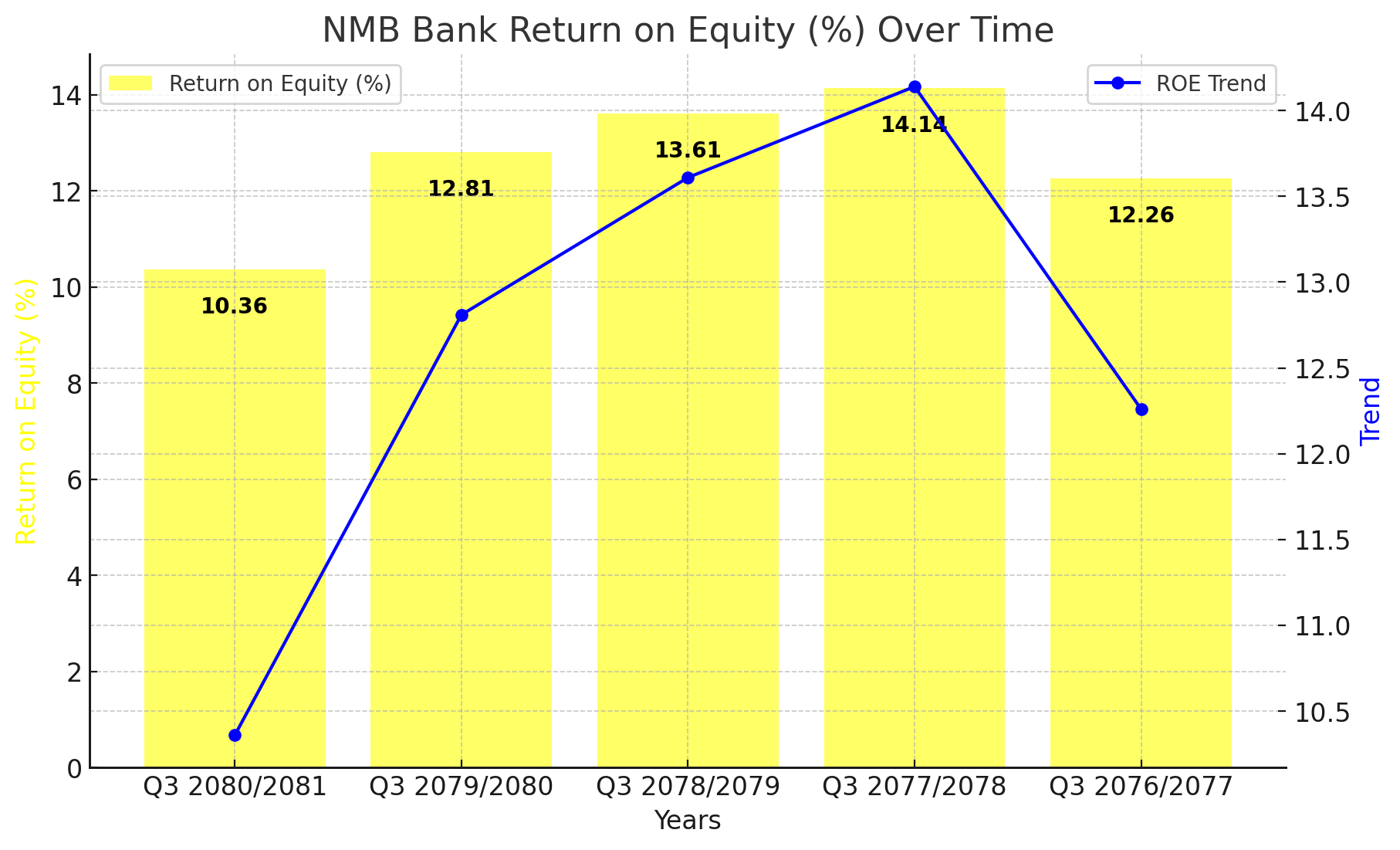

NMB Bank has demonstrated a fluctuating Return on Equity (ROE) over the past five years, revealing both strengths and areas for potential improvement in its financial performance.

Steady Improvement with Recent Decline

The ROE for NMB Bank saw a consistent increase from Q3 2076/2077 to Q3 2077/2078, rising from 12.26% to 14.14%. This upward trend highlights the bank's ability to generate profit from its shareholders' equity efficiently during this period. The peak ROE in Q3 2077/2078 signifies a period of robust financial health and operational efficiency.

Fluctuations and Recent Decrease

However, post-Q3 2077/2078, there has been a noticeable decline. The ROE decreased to 13.61% in Q3 2078/2079 and further to 12.81% in Q3 2079/2080. The most recent data from Q3 2080/2081 shows a further drop to 10.36%. This downward trend indicates potential challenges that NMB Bank may have faced, affecting its profitability and efficiency.

Interpretation and Outlook

The initial increase in ROE suggests that NMB Bank successfully leveraged its resources to maximize returns, which could be attributed to effective management practices, favorable economic conditions, or successful strategic initiatives. However, the subsequent decline points to possible issues such as increased competition, higher operational costs, or economic downturns impacting the bank's profitability.

The recent drop to 10.36% in Q3 2080/2081 is significant and may be a cause for concern for stakeholders. It suggests that the bank's efficiency in using its equity to generate profits has decreased, which could impact investor confidence and the bank's overall market standing.

Strategic Considerations

To address this, NMB Bank may need to re-evaluate its strategies, focusing on cost optimization, enhancing operational efficiency, and exploring new revenue streams. Additionally, improving customer engagement and satisfaction could play a critical role in reversing the downward trend in ROE.

In conclusion, while NMB Bank has shown periods of strong performance, the recent decline in ROE highlights the need for strategic adjustments to regain and surpass previous levels of profitability. Stakeholders will be keenly observing the bank's next moves to see how it navigates these challenges and works towards sustainable growth.

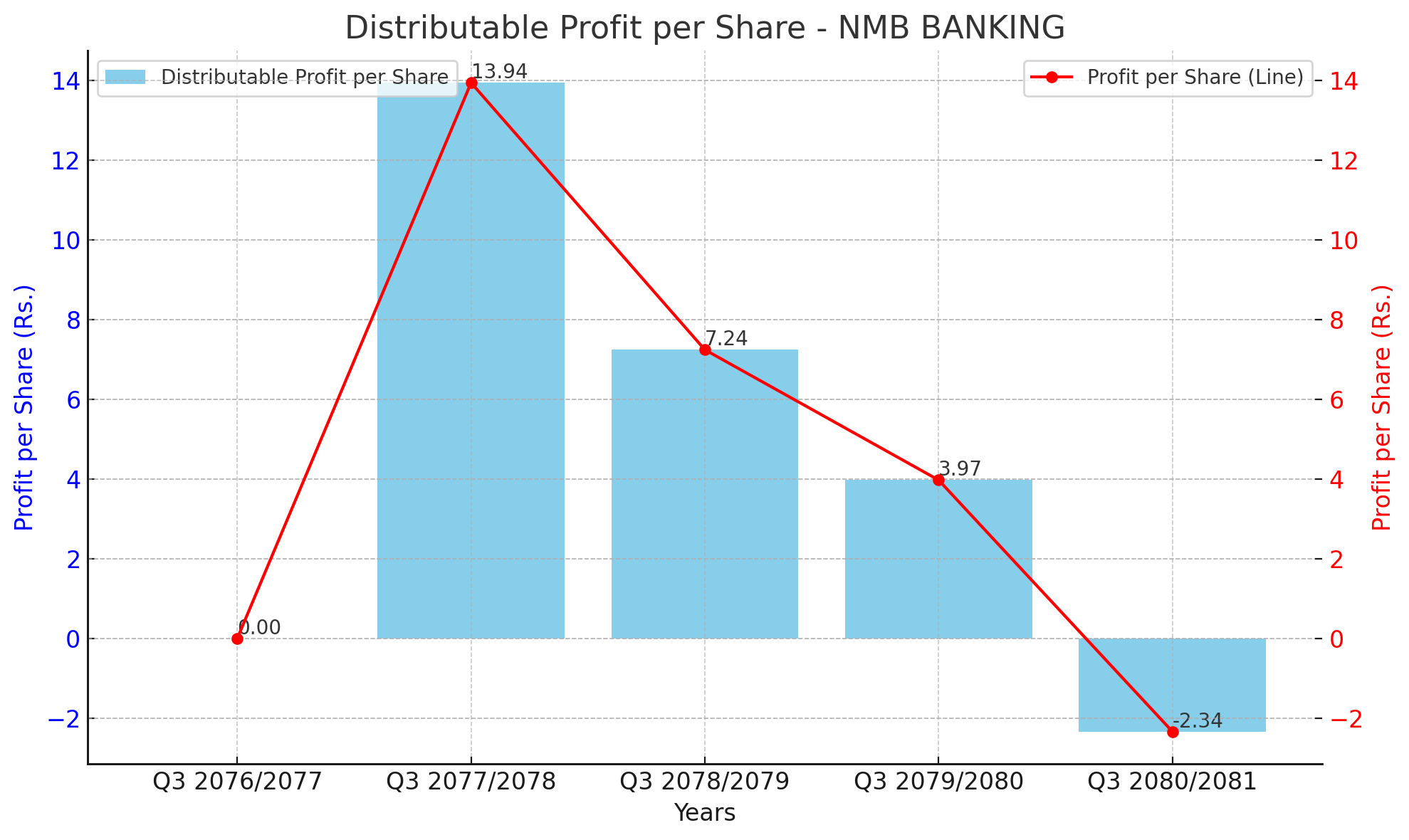

### NMB Bank's Distributable Profit per Share Declines: A Comprehensive Analysis

NMB Bank has recently released its distributable profit per share data for the past five fiscal years, revealing a concerning downward trend. This metric is essential for investors as it represents the profit available to be distributed among shareholders. Here's a detailed look at the data:

Key Observations:

1. Initial Growth and Peak Performance: In Q3 2077/2078, NMB Bank saw a significant increase in distributable profit per share, reaching Rs. 13.94. This was a substantial rise from the previous year's Rs. 0.00, marking a period of robust financial performance and efficient management.

2. Gradual Decline: After peaking in Q3 2077/2078, the distributable profit per share began to decline. By Q3 2078/2079, it had decreased to Rs. 7.24, nearly halving from the previous year. This trend continued into Q3 2079/2080, with profits further falling to Rs. 3.97.

3. Negative Profit: The most alarming figure comes from the latest data for Q3 2080/2081, where the distributable profit per share dropped to -Rs. 2.34. This negative value indicates a loss, suggesting that the bank not only failed to generate distributable profit but also incurred losses.

Interpretation and Analysis:

- Economic Factors: The decline in distributable profit per share could be attributed to several economic factors, including market volatility, changes in regulatory policies, and economic downturns. The financial sector has been particularly susceptible to these influences, which may have impacted NMB Bank's profitability.

- Operational Challenges: Operational inefficiencies, increased competition, and higher operating costs might have also contributed to the declining profits. Banks often face challenges in maintaining profit margins due to rising costs and the need to innovate continuously.

- Strategic Shifts: Strategic missteps, such as poor investment choices or ineffective risk management strategies, could have further exacerbated the financial decline. The bank's management will need to re-evaluate its strategies to address these issues and restore profitability.

Looking Ahead:

NMB Bank's negative distributable profit per share in the most recent fiscal year is a cause for concern. For investors, this trend signals the need for caution and a deeper analysis of the bank's financial health and strategic direction. The bank's management will need to implement effective measures to reverse the downward trend and regain investor confidence.

Future strategies could include cost-cutting measures, diversification of revenue streams, and enhancing operational efficiency. Additionally, focusing on customer-centric services and leveraging technology could help NMB Bank navigate the challenging economic landscape and achieve sustainable growth.

Conclusion:

The downward trajectory of NMB Bank's distributable profit per share over the past five years highlights significant financial challenges. Addressing these issues will be crucial for the bank's future stability and growth. Investors and stakeholders will be closely monitoring the bank's performance and strategic decisions in the coming quarters.