By Sandeep Chaudhary

Nepal T-Bill Rates Reflect Eased Liquidity Pressure in FY 2024/25

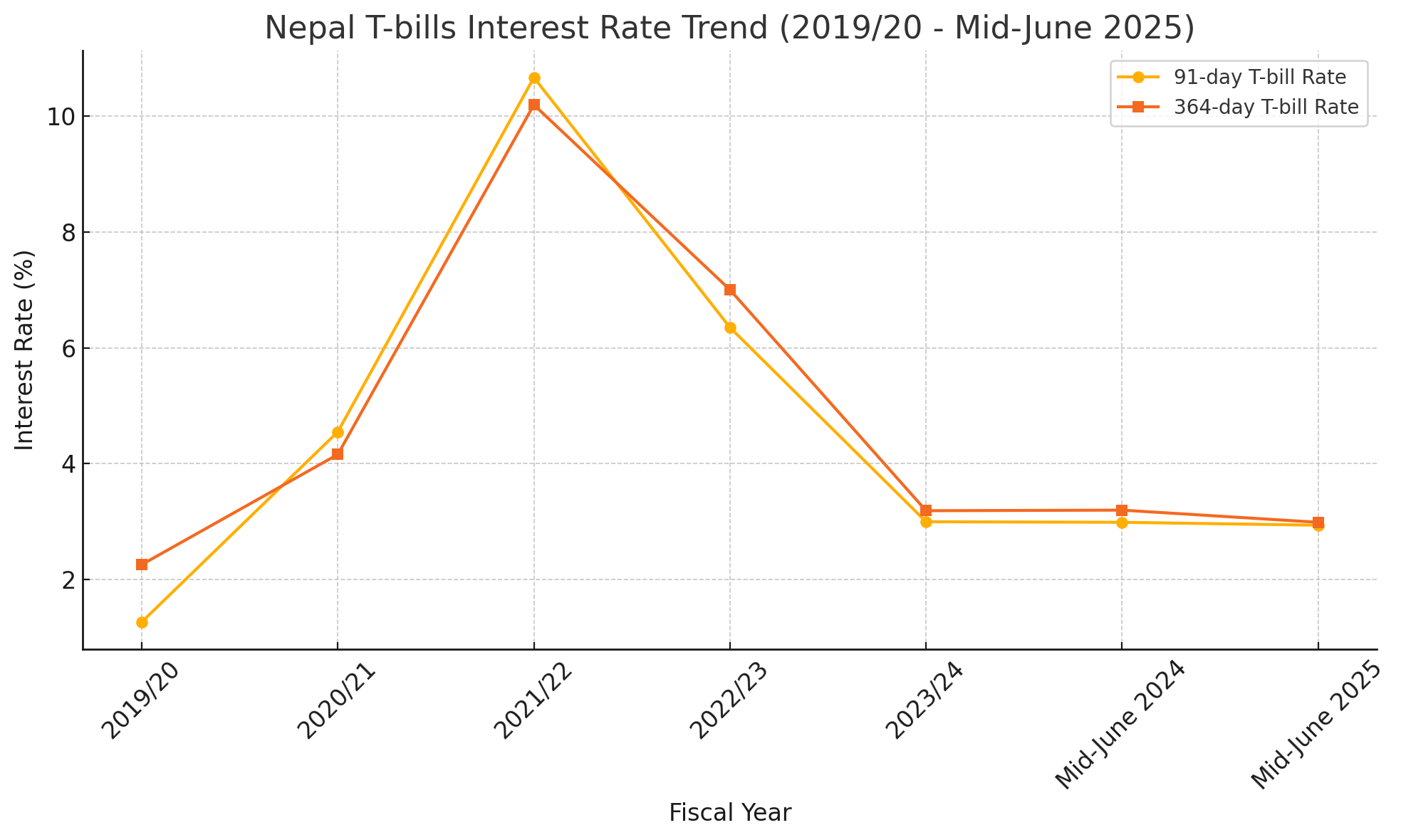

Kathmandu, July 8 — The interest rates on Nepal’s short-term government securities, namely 91-day and 364-day Treasury bills (T-bills), have shown a significant downward adjustment over the past two fiscal years, reflecting improved liquidity conditions in the banking system and a softened monetary stance by Nepal Rastra Bank.

As per the latest mid-June 2025 data published by the central bank, the 91-day T-bills rate has declined to 2.94%, a marginal drop from 2.99% recorded in mid-June 2024. Similarly, the 364-day T-bills rate also dipped slightly to 2.99%from 3.20% during the same period last year.

Historically, both instruments had seen a sharp spike during fiscal year 2021/22 when tight liquidity conditions and aggressive monetary tightening pushed the 91-day T-bill rate to a peak of 10.66%, and the 364-day rate to 10.19%. These were the highest levels in recent years and indicative of a stressed credit environment during that period. However, since 2022/23, both rates have been on a declining trajectory. By 2023/24, the annual averages had fallen to 3.00% (91-day) and 3.19% (364-day), respectively.

The persistent fall in T-bill rates over the past two fiscal years suggests easing of the short-term credit crunch, declining demand for high-yield short-term instruments, and possibly lower inflationary expectations. It also indicates that the central bank's open market operations have been effective in injecting adequate liquidity into the banking sector without triggering excessive inflation.

In essence, the current stability and mild softness in T-bill yields reflect an accommodative monetary environment and growing investor confidence in the macroeconomic stability of the country. However, close monitoring remains essential as external sector pressures, fiscal deficits, or unforeseen global shocks could reverse this trend.