By Sandeep Chaudhary

Nepalese Banking Sector: A Snapshot of Total Deposits as on Chait End, 2080 (Mid-April 2024)

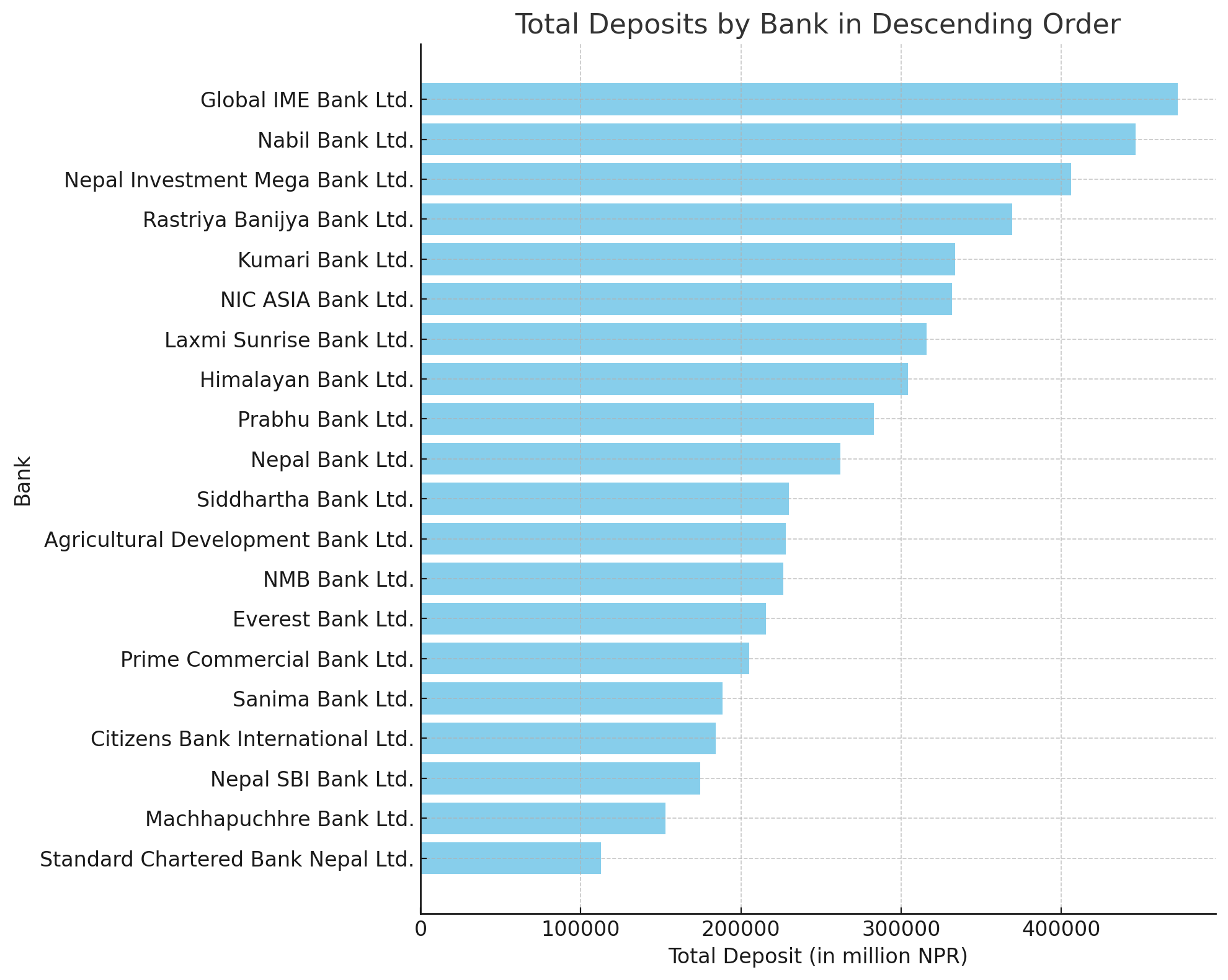

As the fiscal year draws to a close, the latest data on total deposits across Nepalese banks provides an insightful glimpse into the financial health and competitive landscape of the country's banking sector. The figures as on Chait end, 2080 (mid-April 2024), reveal a diverse range of deposit holdings among various banks, indicating varying levels of customer trust and market penetration.

Leading the Pack

At the forefront is Global IME Bank Ltd., boasting the highest total deposits at NPR 472,868 million. This substantial figure underscores the bank's robust ability to attract and retain deposits, positioning it as a formidable player in the Nepalese banking industry. Close on its heels is Nabil Bank Ltd., with a total deposit of NPR 446,428 million, reflecting its strong market presence and customer confidence.

Strong Contenders

Nepal Investment Mega Bank Ltd. also demonstrates a significant deposit base, holding NPR 406,409 million. This places it among the top three banks, emphasizing its competitive edge. Meanwhile, Rastriya Banijya Bank Ltd. and Kumari Bank Ltd. follow with deposits of NPR 369,521 million and NPR 333,654 million, respectively, showcasing their substantial foothold in the market.

Mid-Tier Banks

Banks such as NIC ASIA Bank Ltd. and Laxmi Sunrise Bank Ltd. continue to secure a strong position with total deposits of NPR 331,754 million and NPR 315,860 million, respectively. These institutions represent the middle tier of the market, where competition remains fierce and customer loyalty is pivotal.

Challengers and Opportunities

On the lower end of the spectrum, Standard Chartered Bank Nepal Ltd. records the lowest deposits at NPR 112,552 million. Despite being an established name, this figure suggests opportunities for strategic improvements and market expansion.

Strategic Implications

The variation in total deposits among these banks not only highlights their competitive standings but also offers insights into their strategic approaches. Banks with higher deposits are better positioned to innovate and enhance their service offerings, thereby attracting even more customers. Conversely, banks with lower deposits might focus on niche markets, personalized services, or digital banking innovations to bolster their deposit base.

Conclusion

As we analyze these figures at the close of the fiscal year, it becomes evident that the Nepalese banking sector is characterized by a dynamic and competitive environment. The banks that manage to align their strategies with customer expectations and market demands will likely continue to thrive and expand their deposit bases in the coming years.