By Sandeep Chaudhary

Nepal’s Current Account Rebounds Sharply Amid Continued External Sector Improvement

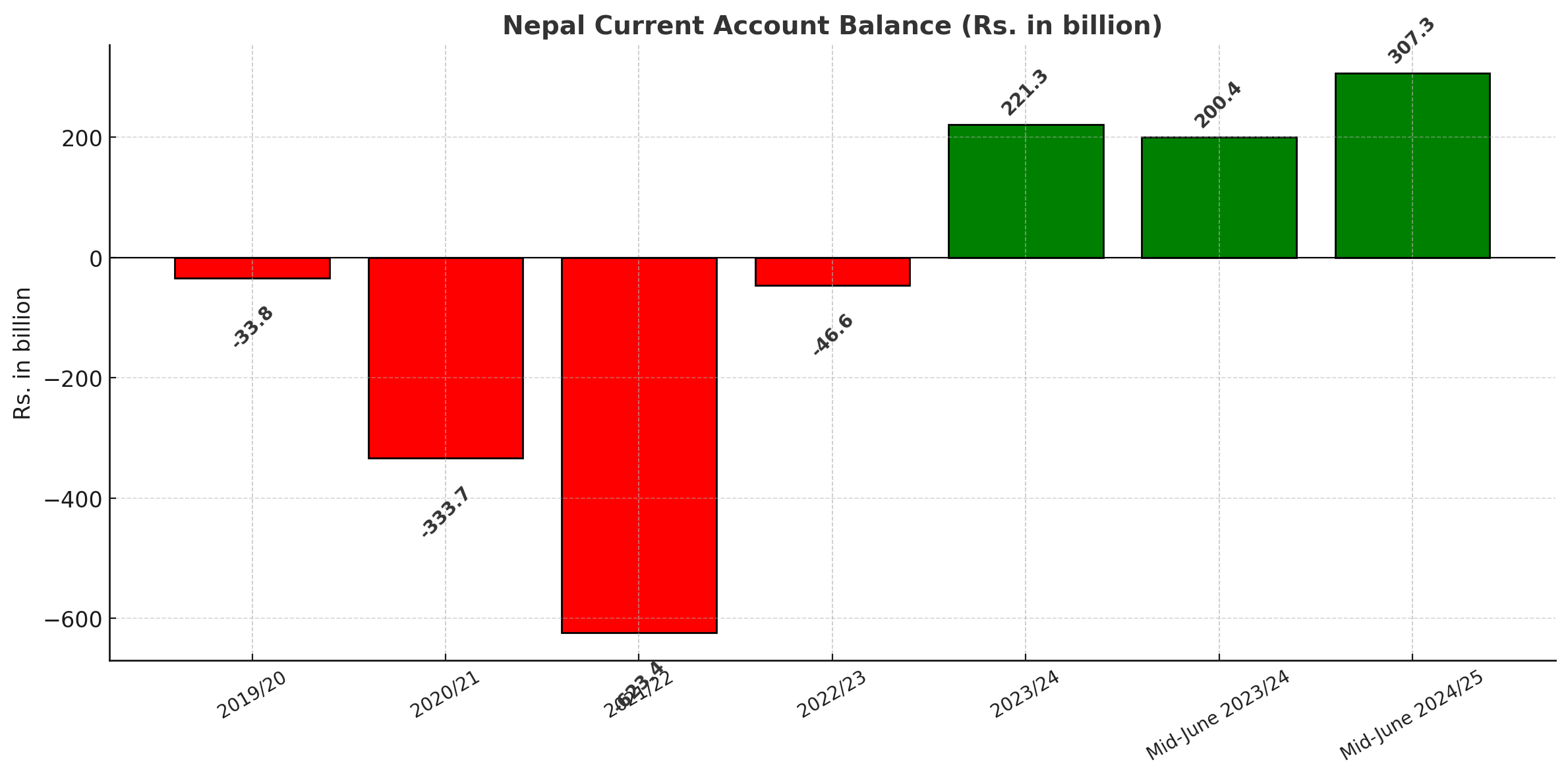

Kathmandu, July 8 — Nepal’s external sector has shown remarkable improvement in the current fiscal year, with the current account balance turning significantly positive after years of deep deficits. According to data released by Nepal Rastra Bank, the current account recorded a surplus of Rs. 307.3 billion by mid-June 2024/25, reflecting sustained improvement in the country’s external financial health.

Over the past five fiscal years, Nepal's current account had been mired in substantial deficits. In 2019/20, the deficit stood at Rs. 33.8 billion, which ballooned to Rs. 333.7 billion in 2020/21 and hit a record low of Rs. 623.4 billion in 2021/22. This sharp deterioration was primarily driven by soaring imports and sluggish remittance inflows amid the pandemic-induced slowdown.

The tide began to turn in 2022/23, with the deficit narrowing drastically to Rs. 46.6 billion. Aided by policy reforms, better control over imports, and recovery in remittances and tourism, the current account finally swung into surplus in 2023/24, registering Rs. 221.3 billion by the end of the fiscal year.

The mid-June figures for 2024/25 indicate further strengthening, with the surplus climbing to Rs. 307.3 billion. This improvement underscores growing inflows from remittances, moderated import growth, and a stable balance in services and income accounts. Compared to the same period last year (mid-June 2023/24), when the surplus stood at Rs. 200.4 billion, the growth represents a significant 53.3% year-on-year increase.

This turnaround in the current account is a critical positive signal for Nepal’s macroeconomic stability. It boosts foreign exchange reserves, supports currency stability, and enhances the country's capacity to finance development expenditure without external vulnerabilities. The government and central bank are expected to continue policies that promote export growth, formal remittance channels, and service sector expansion to sustain this trend.