By Sandeep Chaudhary

Nepal's Government Budgetary Operations: A Historical Overview

Nepal's fiscal journey from 1974/75 to 2022/23 showcases a significant evolution in government budgetary operations, reflecting broader economic trends and policy shifts over the decades. Analyzing data on government expenditures, revenues, foreign assistance, and domestic loans reveals key insights into the country's financial health and strategic priorities.

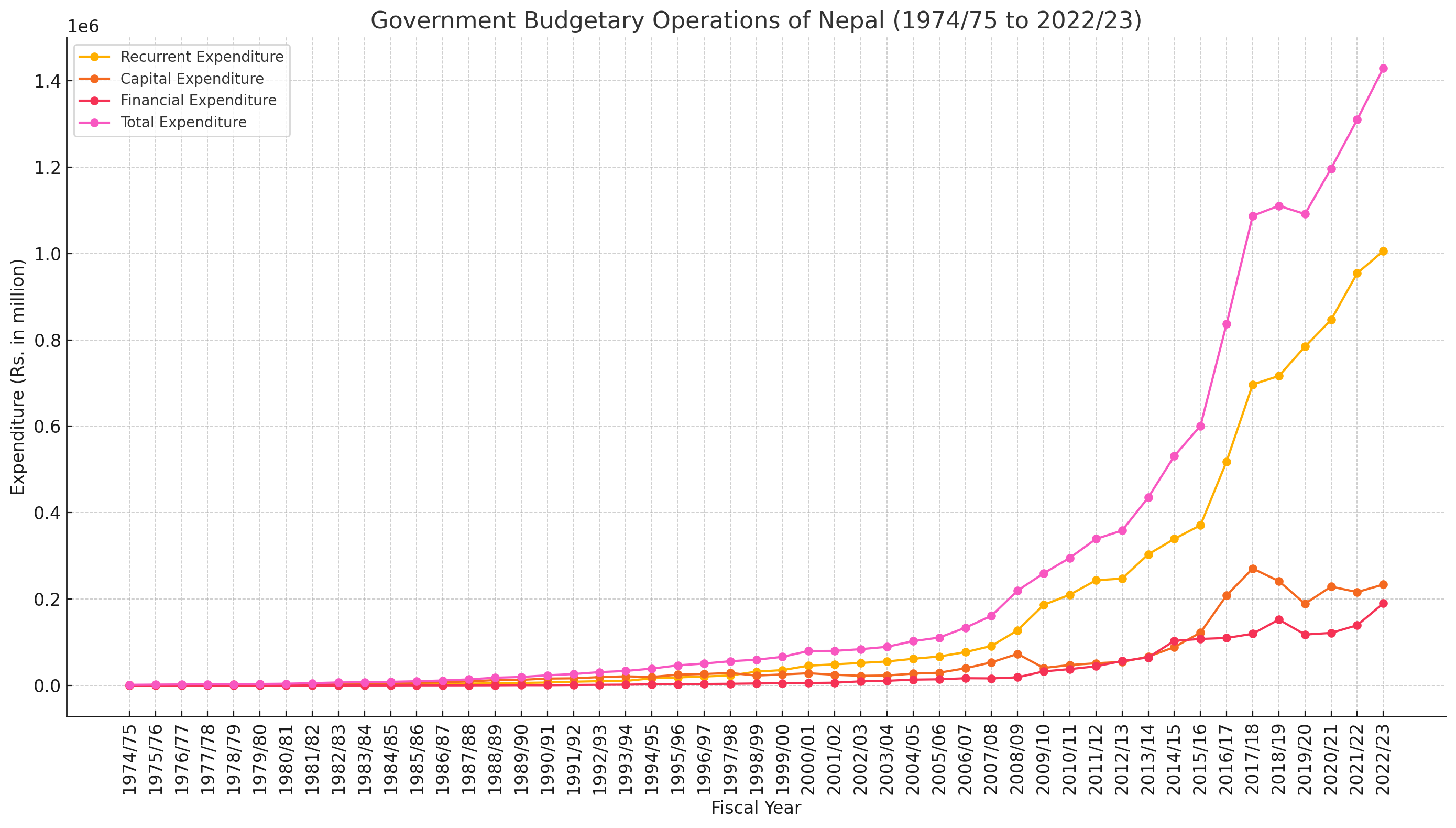

Key Trends in Government Expenditure

The data indicates a consistent increase in government expenditure over the years. In 1974/75, total government expenditure was Rs. 1,513.8 million, which surged to Rs. 1,429,564.0 million by 2022/23. This rise can be attributed to several factors, including increased recurrent and capital spending, as well as financial outlays.

Recurrent Expenditure: This category, which covers day-to-day government operational costs, grew from Rs. 532.0 million in 1974/75 to Rs. 1,005,759.4 million in 2022/23. The exponential rise reflects expanded government services, higher public sector wages, and inflation adjustments.

Capital Expenditure: Spending on infrastructure and development projects also saw a significant increase, from Rs. 967.3 million in 1974/75 to Rs. 233,695.9 million in 2022/23. This underscores the government's focus on long-term economic growth through investment in infrastructure, education, and health services.

Financial Expenditure: Although financial outlays have been relatively modest compared to recurrent and capital expenditures, they grew considerably, reaching Rs. 190,108.7 million in 2022/23 from a mere Rs. 14.5 million in 1974/75. This category often includes debt servicing and other financial obligations.

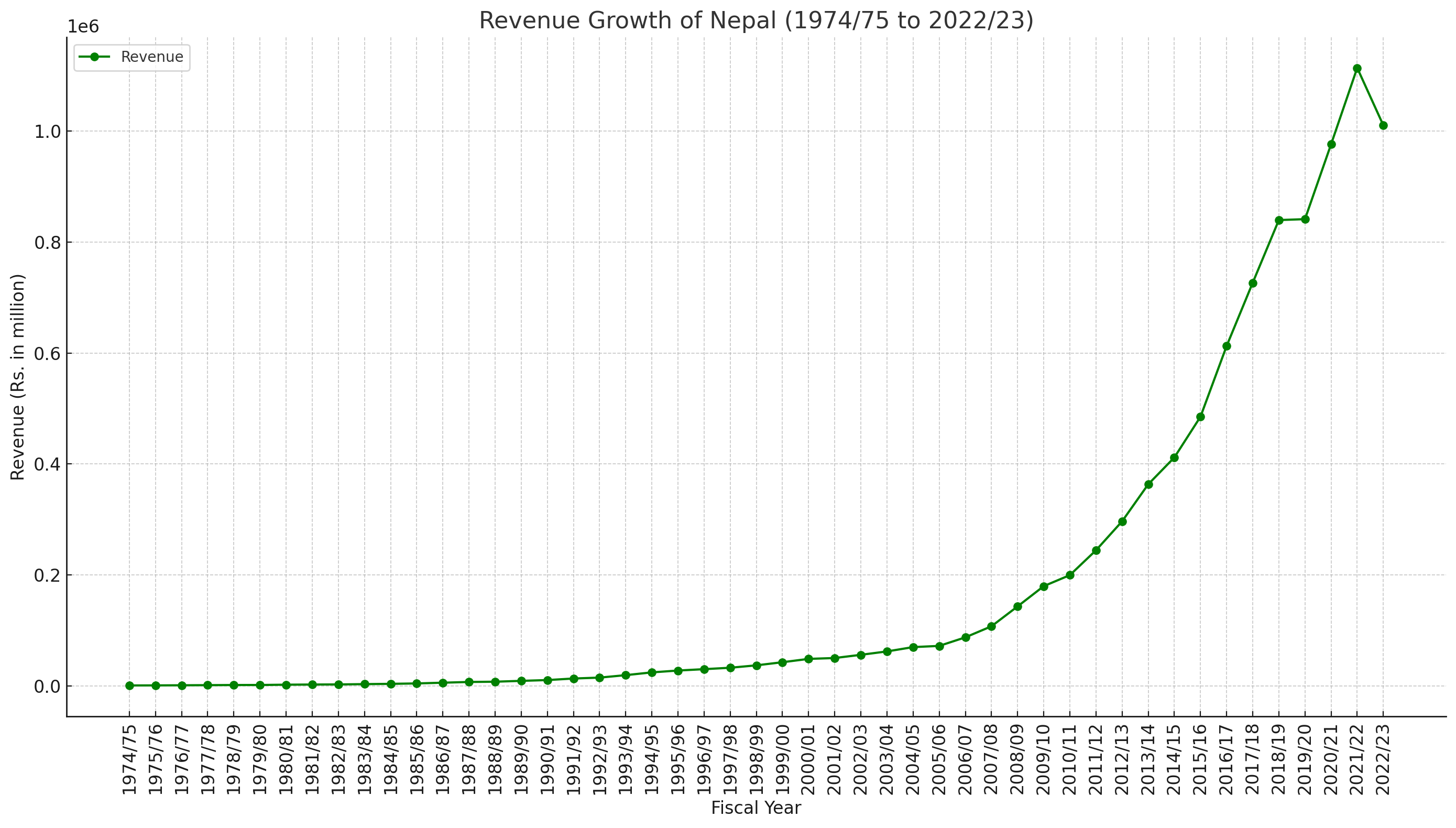

Revenue Growth and Challenges

Government revenue has also shown substantial growth, from Rs. 1,007.0 million in 1974/75 to Rs. 1,010,394.6 million in 2022/23. This growth highlights improvements in tax collection, economic expansion, and enhanced fiscal management. However, the gap between expenditure and revenue has widened, necessitating increased borrowing and foreign assistance.

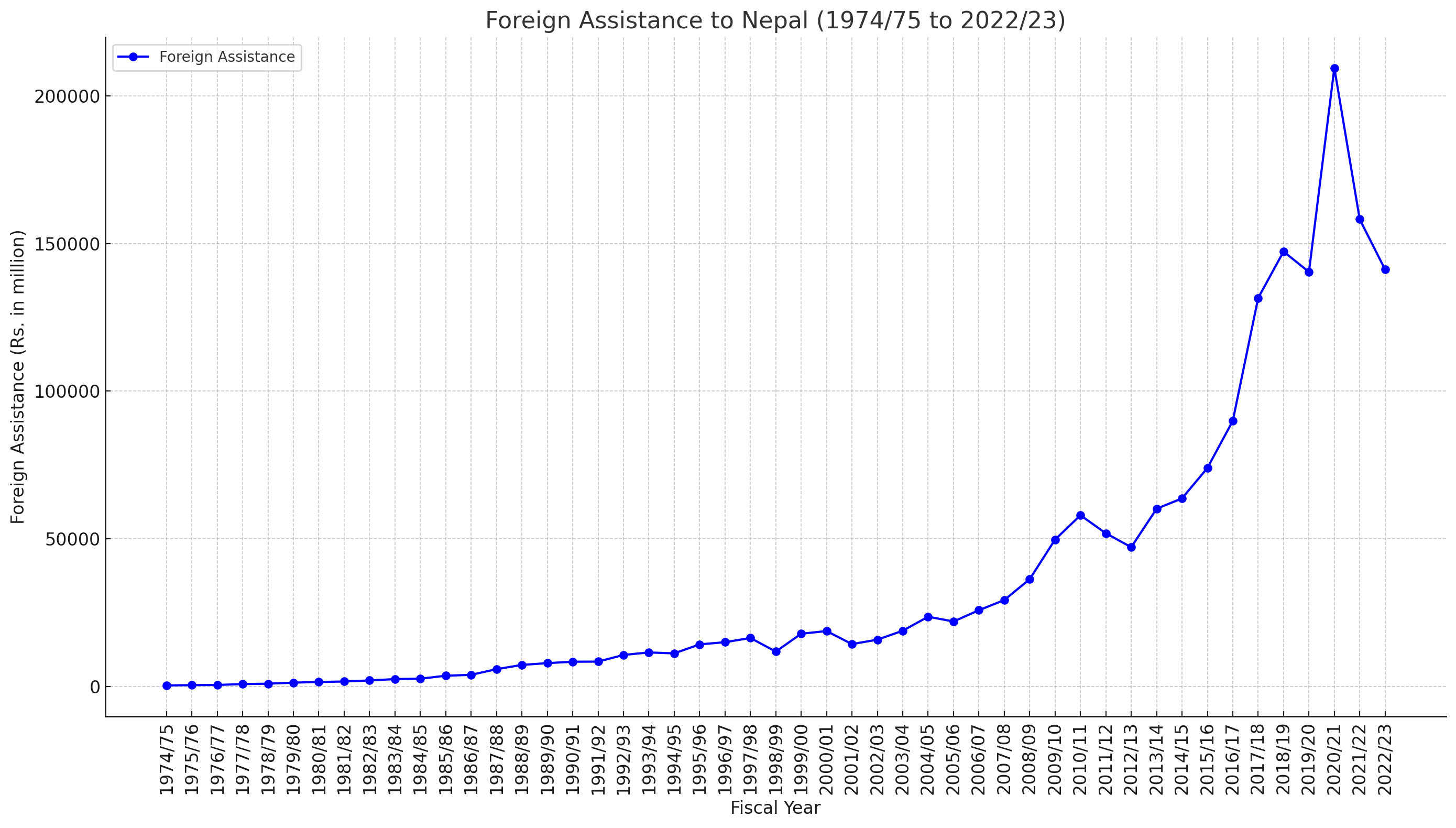

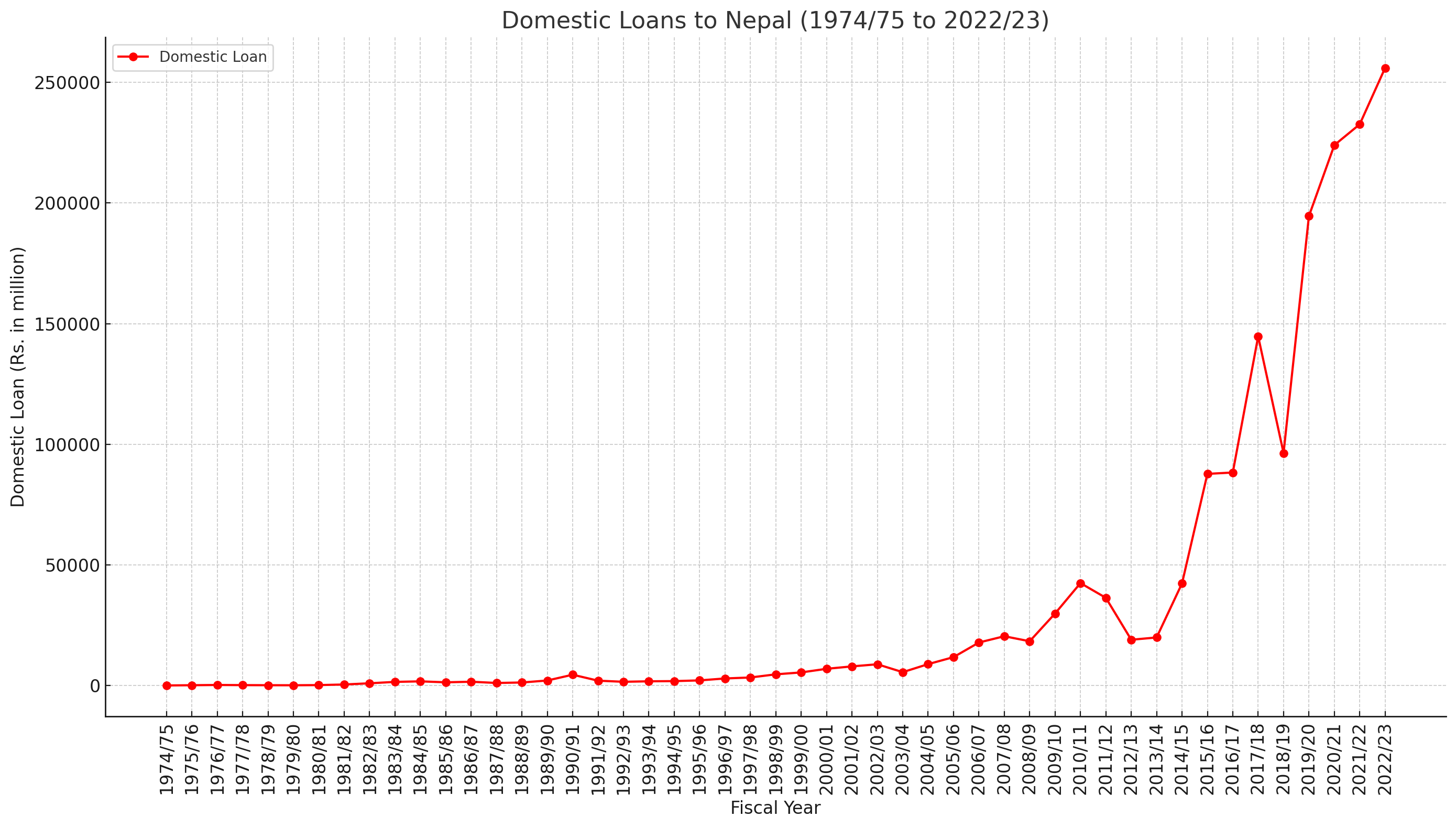

Dependence on Foreign Assistance and Domestic Loans

Nepal has relied significantly on foreign assistance and domestic loans to bridge the budget deficit.

Foreign Assistance: Foreign grants and loans have been crucial in funding development projects and budgetary support. For instance, foreign assistance peaked in 2015/16 with Rs. 485,239.0 million, reflecting international support following the 2015 earthquake.

Domestic Loans: The government's reliance on domestic borrowing has also increased. Domestic loans rose from Rs. 100.0 million in 1974/75 to Rs. 255,997.7 million in 2022/23. This trend indicates a growing capacity for internal resource mobilization but also highlights the increasing debt burden.

Interpretation and Future Prospects

The historical data on Nepal's government budgetary operations underscores several critical points:

Economic Growth and Development: The significant rise in capital expenditure reflects the government's commitment to infrastructure and development, essential for long-term economic growth.

Fiscal Challenges: Despite robust revenue growth, the persistent budget deficit necessitates continued reliance on borrowing. This poses challenges for debt sustainability and fiscal health.

Foreign Assistance: Dependence on foreign grants and loans underscores the need for stronger domestic revenue mobilization to reduce vulnerability to external economic conditions and aid fluctuations.

Policy Implications: Moving forward, Nepal needs to enhance its fiscal management practices, improve tax compliance, and focus on sustainable economic policies to ensure fiscal stability and growth.

In conclusion, the historical analysis of Nepal's government budgetary operations reveals a trajectory of growing expenditure, revenue challenges, and increased borrowing. Strategic fiscal management and sustainable economic policies are crucial to navigate future financial landscapes and ensure long-term economic resilience.