By Sandeep Chaudhary

Nepal's Inflation at 2.77% in Mid-May 2025 – Lowest in Five Years

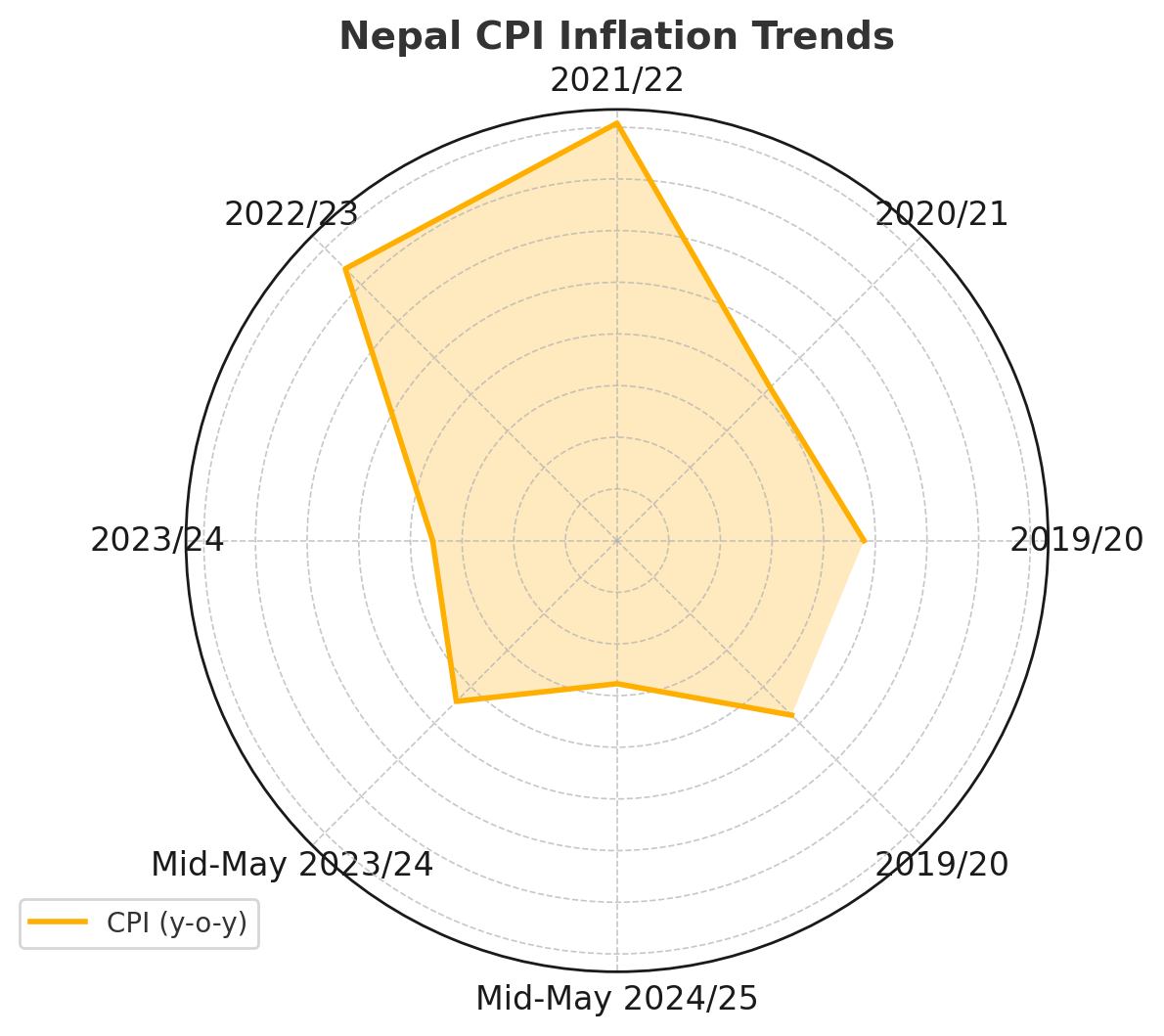

Nepal's consumer price inflation (CPI) has seen a significant decline, reaching just 2.77% year-on-year (y-o-y) by mid-May of the fiscal year 2024/25. This marks the lowest point in the past five years and reflects a continued easing of inflationary pressures in the domestic economy. Compared to the same period in 2023/24, when inflation stood at 4.40%, the drop of over 1.6 percentage points signals notable improvement in price stability.

Looking at annual trends, inflation had spiked dramatically in FY 2021/22, peaking at 8.08% due to global supply chain disruptions and rising import costs. The subsequent year, 2022/23, also saw elevated inflation at 7.44%, likely driven by continued high global commodity prices and domestic economic recovery pressures. However, by 2023/24, the annual CPI had dropped to 3.57%, showcasing the start of a downward trend in inflation.

The sharp contrast in inflation rates over these years reflects a macroeconomic shift: from post-COVID price surges and global economic shocks to a more controlled environment with possibly tighter monetary policy, improved agricultural output, and stable fuel prices. The drop to 2.77% suggests that the Nepal Rastra Bank’s inflation-targeting and liquidity management strategies may be yielding results.

If this trend continues, it could enhance consumer purchasing power and encourage investment. However, policymakers will need to remain cautious of external factors such as imported inflation, geopolitical risks, and monsoon-dependent agricultural output, which could reverse this trend.

Overall, Nepal’s current inflation trajectory is encouraging, positioning the economy on a more stable path as it heads into the latter half of 2025.