By Sandeep Chaudhary

Public Finance Indicators Reflect Mixed Fiscal Trends in Nepal

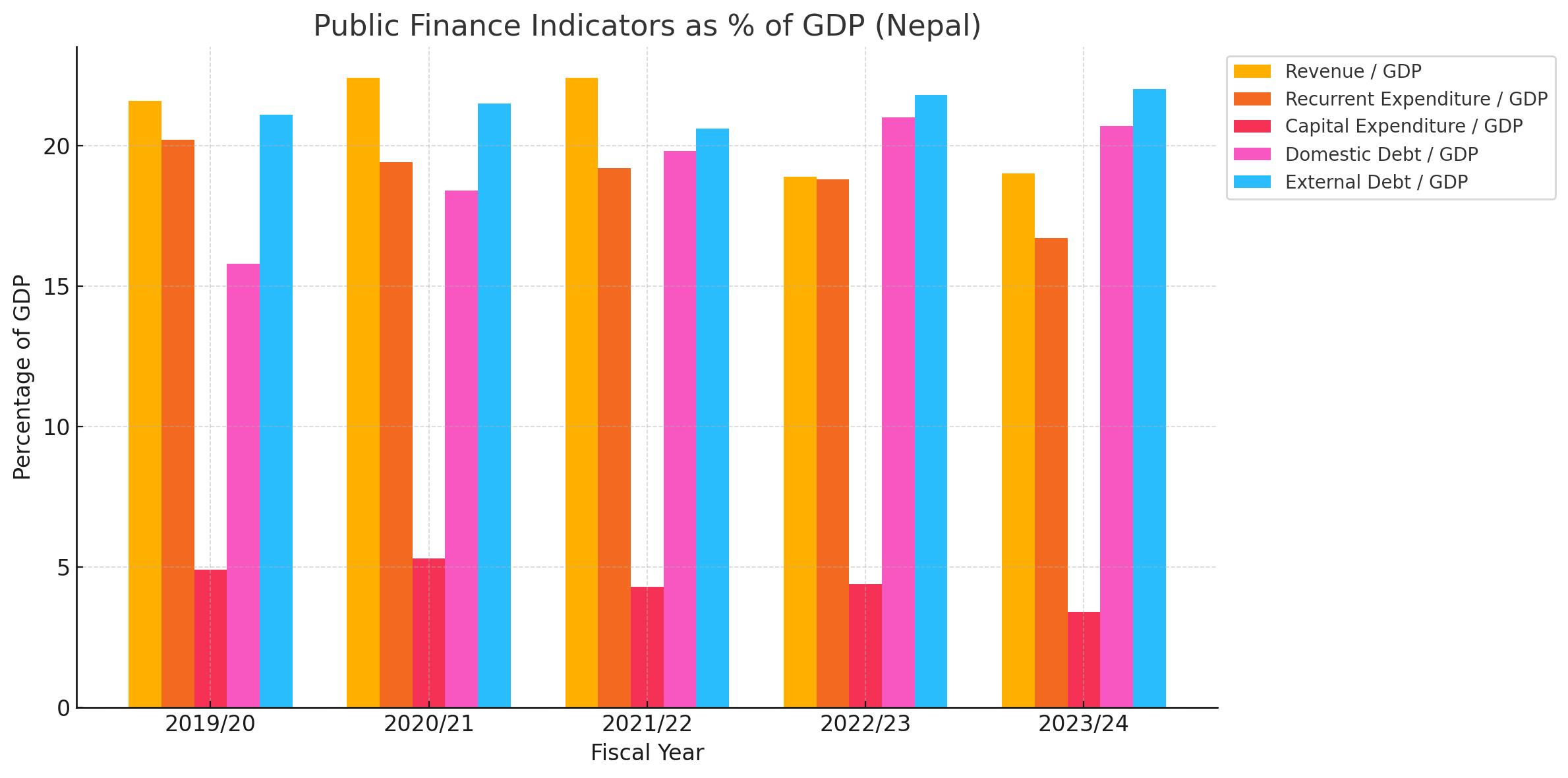

The latest fiscal indicators published by Nepal Rastra Bank highlight a mix of progress and setbacks in the country's public finance management over recent fiscal years. The data—covering ratios of revenue, expenditure, and debt to GDP—show shifting fiscal priorities and challenges faced in mobilizing domestic resources and managing debt sustainability.

The Revenue to GDP ratio, which reflects the government's capacity to generate income relative to the economy’s size, peaked at 22.4% for two consecutive years before dipping to 18.9% and then slightly recovering to 19.0%. This decline suggests strain in revenue collection, potentially due to slowed economic activity, tax inefficiencies, or policy limitations.

Recurrent Expenditure to GDP, which includes administrative and operational expenses, shows a consistent downward trend from 20.2% to 16.7%. While this could indicate improved fiscal discipline or spending efficiency, it may also reflect austerity measures or delays in disbursing essential services and public sector wages.

On the other hand, Capital Expenditure to GDP, a key indicator of developmental investment, dropped significantly from a high of 5.3% to just 3.4%. This is a concerning sign for infrastructure development and economic stimulus, as reduced capital spending may hinder long-term growth and job creation.

Debt indicators present a complex picture. Domestic Debt to GDP rose steadily from 15.8% to a peak of 21.0%, before slightly easing to 20.7%. This increase indicates a growing reliance on internal borrowing to finance fiscal deficits. However, internal debt—while often preferable to external sources—can crowd out private sector credit if not managed carefully.

External Debt to GDP also saw an upward movement, increasing from 21.1% to 22.0%. While the increase is modest, it highlights the growing weight of foreign liabilities in Nepal's public finances. A higher ratio of external debt could increase vulnerability to exchange rate fluctuations and repayment risks, especially if not matched by productive investments.

Overall, the data underline a fiscal environment marked by constrained revenues, controlled recurrent spending, and reduced capital investment—amidst rising debt burdens. For sustainable economic recovery and growth, Nepal will need to focus on enhancing revenue mobilization, improving expenditure efficiency, and ensuring that rising debt supports productive sectors of the economy.