By Dipesh Ghimire

Significant Decline in Profit for Reliance Spinning Mills

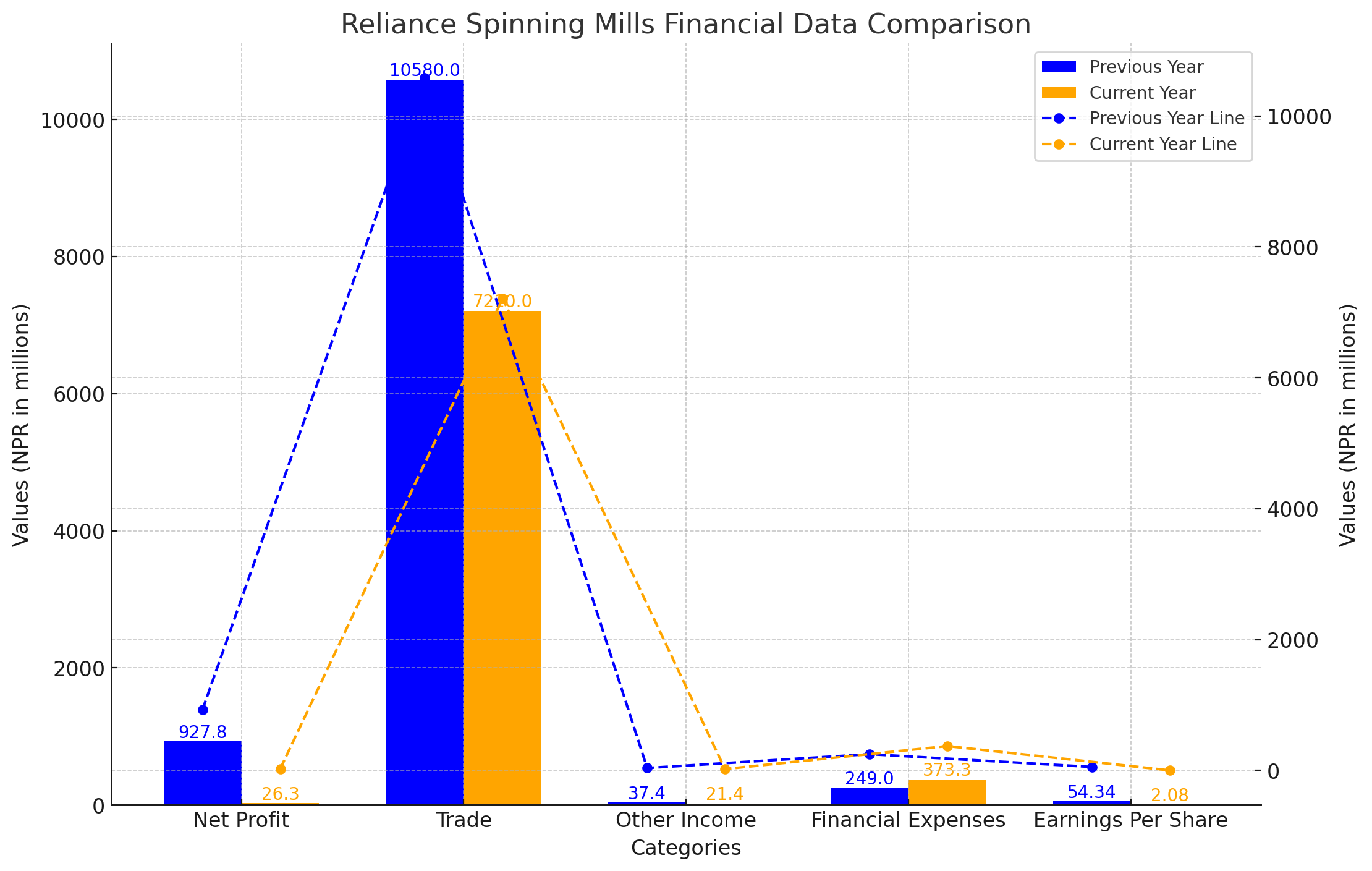

Reliance Spinning Mills Limited has reported a considerable decrease in its net profit for the third quarter of the current fiscal year, up to Chaitra. The company's net profit plummeted to NPR 26.3 million, a stark contrast to the NPR 927.8 million earned in Ashad of the previous fiscal year. This significant drop in profit reflects broader challenges faced by the company, primarily driven by a decline in trade volumes and increased financial expenses.

Key Financial Highlights

1. Net Profit:

- Current Year (Third Quarter): NPR 26.3 million

- Previous Year (Ashad): NPR 927.8 million

2. Trade Volume:

- Current Year (Third Quarter): NPR 7.21 billion

- Previous Year (Ashad): NPR 10.58 billion

3. Other Income:

- Current Year: NPR 21.4 million

- Previous Year: NPR 37.4 million

4. Financial Expenses:

- Current Year: NPR 373.3 million

- Previous Year: NPR 249 million

5. Earnings Per Share (EPS):

- Current Year: NPR 2.08

- Previous Year: NPR 54.34

Interpretation

The financial downturn for Reliance Spinning Mills is evident from the drastic reduction in net profit and earnings per share. The net profit for the current fiscal year’s third quarter is merely a fraction of what it was during the same period last year, indicating severe operational challenges. This decline can be attributed to several factors:

- Reduced Trade Volume: The company’s trade volume has decreased by nearly 32%, which directly impacts revenue generation.

- Increased Financial Expenses: The financial expenses have surged by approximately 50%, which has further strained the company's profitability.

- Drop in Other Income: A decline in other income sources also contributed to the reduced overall profit.

IPO Announcement

Amidst the financial challenges, Reliance Spinning Mills has announced an Initial Public Offering (IPO) through the book-building method, starting from Ashad 27. This IPO is specifically targeted at Nepali citizens employed abroad. The company plans to issue 10% of the allocated ordinary shares, amounting to 115,596 shares.

Key IPO Details:

1. Issuance Date: From Ashad 27 to Shrawan 10

2. Number of Shares: 115,596 shares

3. Per Share Price: NPR 820.80

4. Application Limits:

- Minimum: 50 shares

- Maximum: 20,000 shares

Conclusion

The current financial situation of Reliance Spinning Mills underscores the need for strategic restructuring and cost management to navigate through the economic downturn. The upcoming IPO presents an opportunity for Nepali workers abroad to invest in local industries, potentially aiding the company's recovery and contributing to the country's economic development. Interested investors should carefully analyze the company's financial health before making investment decisions.