By Trading view

Tax Rates for Public Vehicle Businesses Unchanged in FY 2081/82

The Government of Nepal has retained the presumptive income tax rates applicable to public vehicle operators for Fiscal Year 2081/82, keeping them consistent with the rates enforced during FY 2080/81. According to Schedule 1(13) of the Income Tax Act, these provisions are relevant to resident natural persons engaged in the business of operating public vehicles, and no amendments have been introduced through the Finance Act 2081.

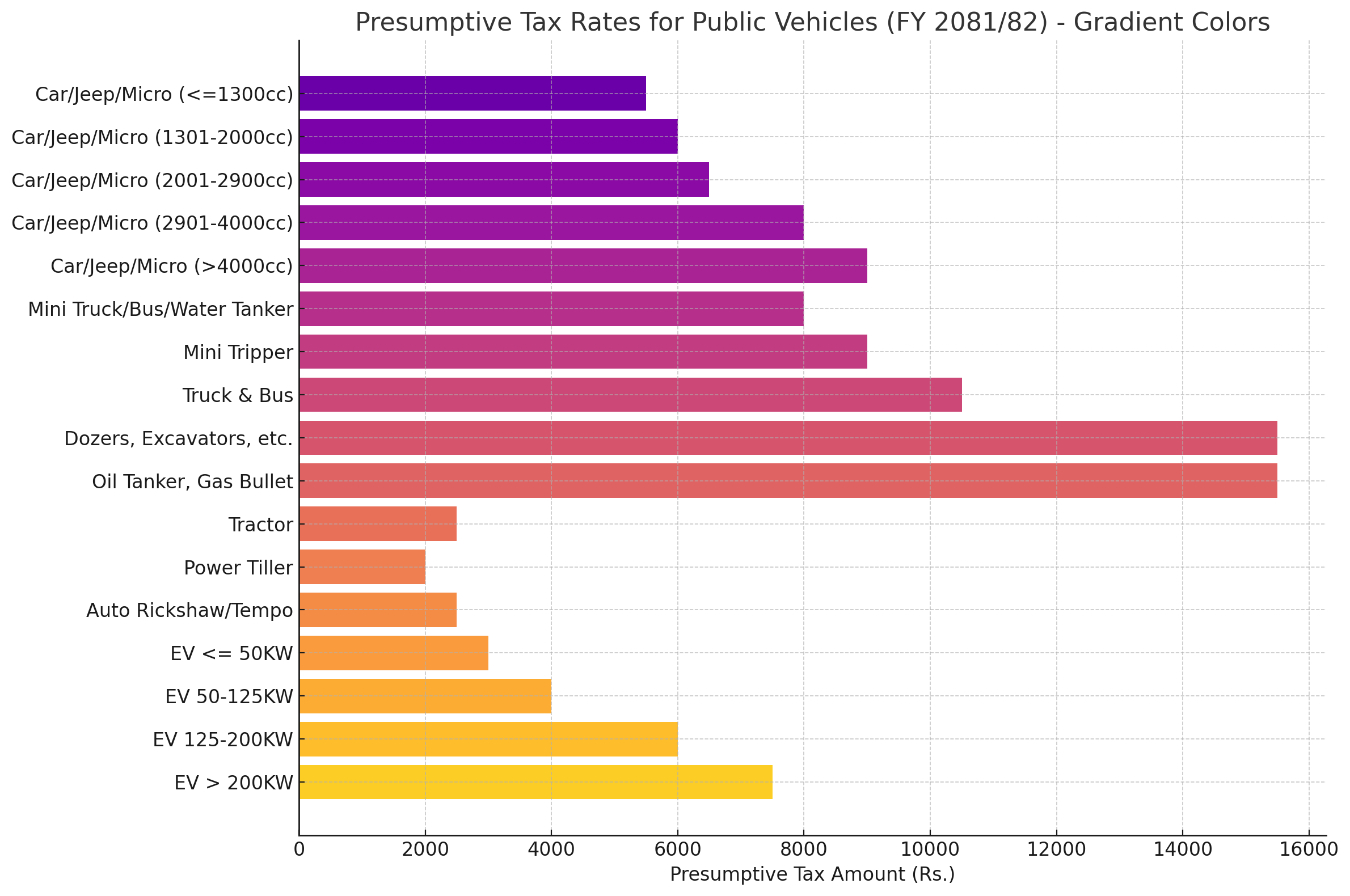

For passenger vehicles such as cars, jeeps, vans, and microbuses, the tax continues to be based on engine capacity (CC). Vehicles up to 1300 CC are subject to a tax of Rs. 5,500, while those between 1301 CC and 2000 CC incur Rs. 6,000. The tax increases to Rs. 6,500 for vehicles in the 2001 CC to 2900 CC range, Rs. 8,000 for 2901 CC to 4000 CC, and Rs. 9,000 for engines above 4001 CC.

Similarly, mini trucks, mini buses, and water tankers continue to be taxed at Rs. 8,000, while mini trippers are levied at Rs. 9,000. The tax for trucks and buses remains at Rs. 10,500.

Heavy construction and transport vehicles such as dozers, excavators, loaders, rollers, cranes, and similar machinery equipment are taxed at a flat rate of Rs. 15,500. This same rate also applies to oil tankers, gas bullets, and trippers.

For agricultural and light transport vehicles, the tax structure is also unchanged. Tractors and auto rickshaws (including three-wheelers and tempos) are taxed at Rs. 2,500 each, while power tillers attract a lower presumptive tax of Rs. 2,000.

Electric vehicles are subject to a tiered tax system based on their power capacity in kilowatts (KW). Those up to 50 KW are taxed at Rs. 3,000, between 50 KW and 125 KW at Rs. 4,000, 125 KW to 200 KW at Rs. 6,000, and those above 200 KW at Rs. 7,500. This structure encourages cleaner transportation options without altering the fiscal burden from the previous year.

In summary, the government’s decision to maintain the existing presumptive tax rates for public vehicle operators reflects a stable tax policy approach. It ensures predictability for small and medium transport entrepreneurs, particularly in a sector still recovering from recent economic disruptions. While the rates remain static, their continued classification by engine capacity and vehicle type promotes clarity and compliance.