By Sandeep Chaudhary

Understanding Total Prescribed Sector Loans According to NRB Guidelines

The Total Prescribed Sector Loan requirement, mandated by the Nepal Rastra Bank (NRB), plays a vital role in fostering economic growth and development in Nepal. This regulatory measure ensures that banks allocate a certain percentage of their total loan portfolio to sectors that are critical for the country's economic progress, such as agriculture, hydropower/energy, and micro, cottage, and small and medium industries (MCSMI).

Minimum Requirements for Total Prescribed Sector Loans

According to NRB guidelines, the minimum allocation requirements are:

Commercial Banks: 25% of the total loan portfolio.

Development Banks: 15% of the total loan portfolio.

Finance Companies: 10% of the total loan portfolio.

These requirements ensure that essential sectors receive the financial support needed to drive economic development and promote balanced growth.

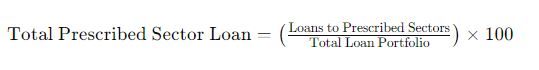

To calculate the Total Prescribed Sector Loan, the NRB uses the following formula:

Total Prescribed Sector Loan

This formula highlights the proportion of a bank's loans that must be allocated to the prescribed sectors, ensuring that these critical areas receive adequate funding.

The importance of Total Prescribed Sector Loans cannot be overstated. By mandating a minimum allocation of loans to key sectors, the NRB promotes inclusive economic growth and development. This measure ensures that agriculture, hydropower/energy, and MCSMI sectors have access to the necessary financial resources, contributing to the overall economic stability and progress of the country.

In conclusion, the Total Prescribed Sector Loan requirement is a vital regulatory measure that supports economic development and inclusive growth in Nepal. By adhering to NRB guidelines, banks can ensure they contribute to the country's economic progress, comply with regulatory standards, and promote financial stability through diversified lending.