By Trading view

Value Added Tax Thresholds Revised Amid Steady VAT Rate in Nepal

In a recent fiscal policy update, the Government of Nepal has announced changes to the Value Added Tax (VAT) registration thresholds while keeping the VAT rate unchanged at 13%. The VAT rate, which is applied uniformly on the supply of goods and services, remains stable as the government aims to maintain consistency in its indirect tax regime.

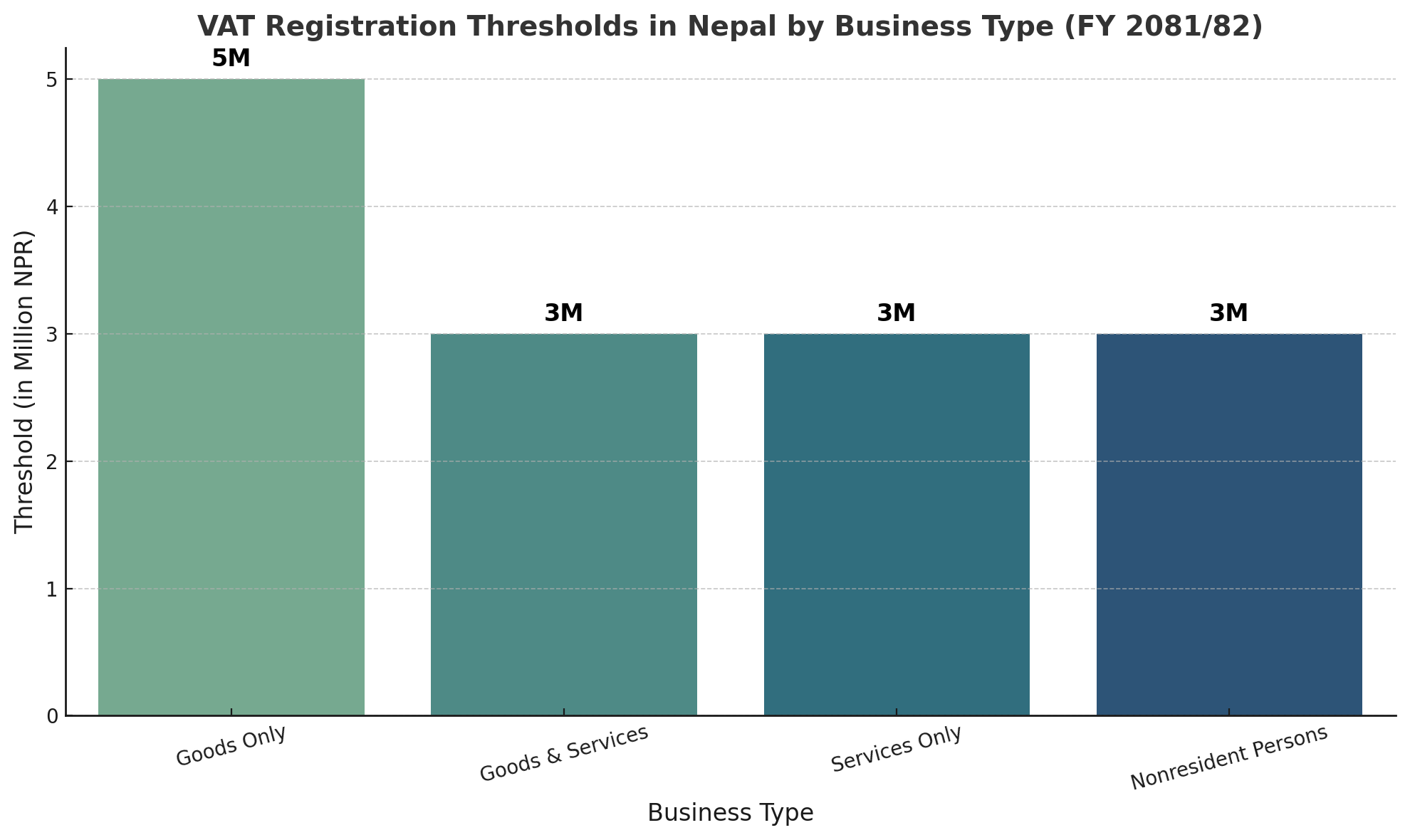

A key development in this year’s VAT policy is the revision of threshold limits that determine mandatory VAT registration. For businesses dealing exclusively in goods, the threshold has been retained at NPR 5 million. However, significant changes have been introduced for other categories. Businesses dealing solely in services are now required to register for VAT if their annual turnover reaches NPR 3 million, a revision from the earlier NPR 2 million. Similarly, enterprises involved in both goods and services must register for VAT upon reaching an annual turnover of NPR 3 million.

Additionally, the threshold for VAT registration for non-resident persons has also been revised upward. Previously set at NPR 2 million, this limit has now been increased to NPR 3 million. This revision is expected to ease compliance requirements for smaller foreign entities operating within Nepal.

Further, the Inland Revenue Department has warned that if a registered taxpayer fails to submit their tax return within four months from the due date, the tax officer may take stern actions, including halting the import or export operations of such businesses. This measure is intended to improve tax compliance and streamline revenue collection.

It is important to note that while the government has communicated these changes, the final definition and interpretation of VAT thresholds for mixed transactions involving both goods and services will be clarified in upcoming VAT regulations. The note emphasizes that for cancellation purposes under VAT law, the threshold for all service-based, goods-based, and mixed enterprises is understood to be NPR 3 million.

These updates reflect the government's intent to broaden the VAT net and bring more service-oriented and mixed businesses under formal taxation, while also simplifying procedures for small-scale and foreign businesses operating within the country.