By Sandeep Chaudhary

What is Real GDP at Purchasers' Prices ? Analyzing the Trends in Real GDP at Purchasers' Prices of Nepal (2018/19 to 2023/24)

Understanding Real GDP at Purchasers' Prices: An Essential Economic Measure

Real GDP at purchasers' prices is a fundamental concept in economics that helps us understand the health and growth of an economy. To break it down, let's start by understanding what GDP (Gross Domestic Product) is and then delve into the nuances of 'real' GDP and 'purchasers' prices.'

What is GDP?

Gross Domestic Product (GDP) represents the total monetary value of all goods and services produced within a country's borders over a specific time period. It's a key indicator used to gauge the economic performance of a country. Economists and policymakers use GDP to analyze the size, structure, and health of an economy.

Nominal vs. Real GDP

There are two primary types of GDP: nominal GDP and real GDP.

Nominal GDP: This measures the value of all finished goods and services produced within a country at current market prices. However, it doesn't account for inflation or deflation, making it less accurate for comparing economic performance over different periods.

Real GDP: To address the inflation problem, economists use real GDP, which is adjusted for changes in the price level. This adjustment provides a more accurate reflection of an economy's size and how it's growing over time. Real GDP is calculated using a base year to strip out the effects of inflation, allowing for comparison of economic output from one year to another.

What are Purchasers' Prices?

Purchasers' prices are the prices paid by consumers for goods and services. This price includes not just the cost of production but also taxes (minus subsidies) on products. In other words, it's the final price that the end consumer pays, including all taxes and transportation costs.

Real GDP at Purchasers' Prices

When we talk about real GDP at purchasers' prices, we refer to the GDP adjusted for inflation and expressed at the prices paid by purchasers, rather than the prices received by producers. This measure considers the total value of goods and services produced within a country, adjusted for inflation, and reflects the actual market prices paid by consumers.

Why is Real GDP at Purchasers' Prices Important?

Inflation Adjustment: By adjusting for inflation, real GDP provides a more accurate representation of an economy's true growth. It eliminates the distorting effects of price changes, allowing for a clearer comparison over different time periods.

Consumer Perspective: Considering purchasers' prices offers insights into the actual cost burden on consumers. It helps policymakers understand the impact of taxes and subsidies on the overall economy.

Policy Formulation: Real GDP at purchasers' prices is crucial for formulating economic policies. Governments use this measure to design policies that can effectively target economic issues such as inflation, unemployment, and economic growth.

International Comparisons: Real GDP allows for more accurate comparisons between countries. It helps in understanding how different economies are performing relative to each other, providing a basis for international economic policies and agreements.

How is Real GDP at Purchasers' Prices Calculated?

To calculate real GDP at purchasers' prices, economists follow these steps:

Identify a Base Year: Choose a base year for comparison to adjust for inflation.

Adjust Nominal GDP: Use price indices to adjust the nominal GDP to reflect constant prices.

Include Purchasers' Prices: Ensure that the prices used in the calculation include taxes and exclude subsidies to reflect the actual prices paid by consumers.

Conclusion

Real GDP at purchasers' prices is a vital economic measure that provides a clearer picture of an economy's health and growth by accounting for inflation and reflecting actual consumer prices. Understanding this concept helps in making informed decisions about economic policies and strategies, benefiting both policymakers and the general public. By focusing on real GDP at purchasers' prices, we can better comprehend the true state of our economy and work towards sustainable growth and development.

Analyzing the Trends in Real GDP at Purchasers' Prices (2018/19 to 2023/24)

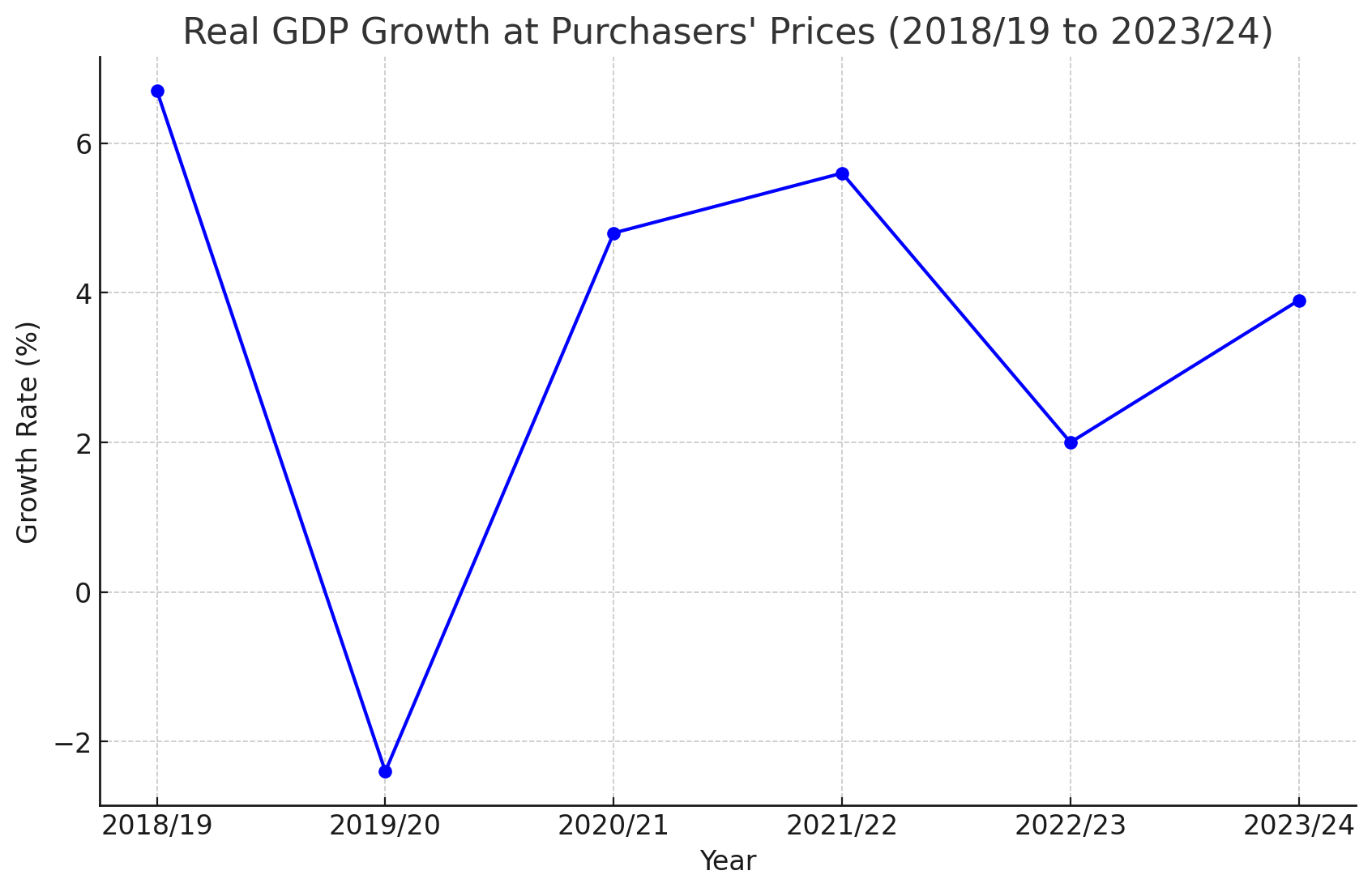

The Real GDP at purchasers' prices is a critical measure of an economy's health, reflecting the total value of all goods and services produced, adjusted for inflation and expressed at market prices. This indicator provides insights into the economic performance over time. Let's delve into the annual growth rates from 2018/19 to the projected figures for 2023/24, interpreting the trends and their implications.

Yearly Breakdown and Interpretation

2018/19: 6.7% Growth The year 2018/19 saw a robust growth rate of 6.7% in real GDP at purchasers' prices. This significant growth indicates a strong economic performance, driven by factors such as increased consumer spending, investment, and possibly favorable government policies. A growth rate of this magnitude suggests a thriving economy with expanding production and consumption.

2019/20: -2.4% Contraction In stark contrast, 2019/20 experienced a contraction of -2.4%. This negative growth rate reflects a downturn in economic activity. Several factors could have contributed to this decline, including economic disruptions, policy changes, or external shocks. The most notable reason during this period globally was the onset of the COVID-19 pandemic, which led to widespread lockdowns, decreased consumer spending, and disrupted supply chains, significantly impacting economic growth.

2020/21: 4.8% Recovery The year 2020/21 marked a recovery with a growth rate of 4.8%. This rebound can be attributed to the easing of lockdown measures, resumption of economic activities, and possibly government stimulus packages aimed at reviving the economy. The recovery indicates resilience and an adaptive response to the challenges posed in the previous year.

2021/22: 5.6% Continued Growth Building on the previous year's recovery, 2021/22 saw continued growth with a 5.6% increase in real GDP at purchasers' prices. This steady growth suggests that the economy was on a stable path to recovery, with sustained consumer demand and business investments playing a crucial role. It reflects an overall positive economic sentiment and effective policy measures supporting growth.

2022/23: 2.0% Slowdown However, the growth rate slowed down to 2.0% in 2022/23. This deceleration might indicate that the initial post-pandemic recovery phase had peaked, and the economy was facing new challenges. These could include inflationary pressures, global economic uncertainties, or structural issues within the economy. A lower growth rate, while still positive, suggests that the economy was growing but at a slower pace.

2023/24: 3.9% Moderate Recovery (Projected) The projected growth for 2023/24 is 3.9%, indicating a moderate recovery from the previous year's slowdown. This projection suggests optimism for an improved economic outlook, possibly driven by stabilization in global markets, effective domestic policies, and renewed consumer and business confidence. A growth rate of 3.9% signifies a healthy pace of economic expansion, balancing between rapid recovery and sustainable growth.

Conclusion

The fluctuations in real GDP at purchasers' prices from 2018/19 to 2023/24 reflect a dynamic economic landscape influenced by both domestic and global factors. The initial high growth, followed by a sharp contraction, a strong recovery, and subsequent fluctuations, highlight the economy's responsiveness to external shocks and its inherent resilience.

Understanding these trends helps policymakers, businesses, and investors make informed decisions. It underscores the importance of adaptive economic strategies, robust policy measures, and the need to address underlying structural issues to ensure sustained and stable economic growth in the future.