Business Transaction Amounts Cannot Be Deposited into Personal Accounts

Author

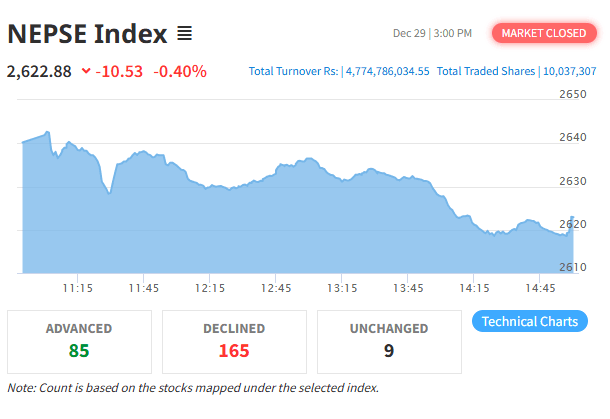

NEPSE trading

Business transaction amounts can no longer be deposited into personal accounts. The Internal Revenue Department has issued a public notice informing about the implementation of this rule.

According to the notice, Section 81A has been added to the Income Tax Act, 2058, through the Economic Bill, 2081, which prohibits depositing business transaction amounts into personal accounts.

The department has stated that if this regulation is not followed, a penalty of either five thousand rupees for each instance or two percent of the total transaction amount, whichever is higher, will be imposed.