Commercial Banks Lower Fixed Deposit Rates for Kartik

Author

NEPSE TRADING

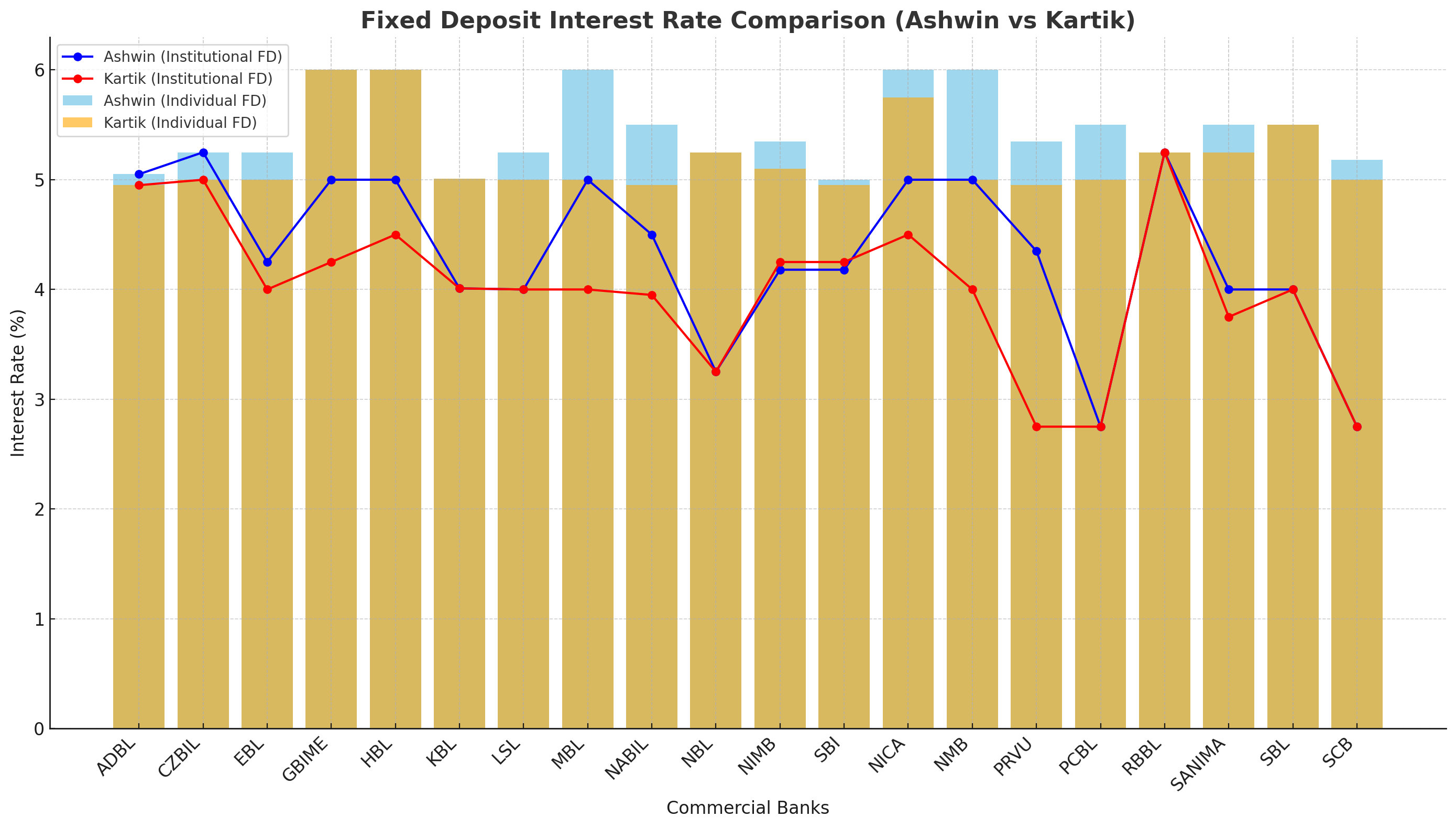

Nepal’s commercial banks have announced a downward revision in fixed-deposit (FD) interest rates for the month of Kartik (mid-October to mid-November), showing a broad decline compared to the rates offered in Ashwin. According to the latest published data, a majority of banks have trimmed their returns on both individual and institutional deposits, reflecting a softening liquidity environment and moderation in deposit competition within the banking system.

Majority of Banks Follow a Downward Trend

Out of the 20 licensed commercial banks operating in Nepal, 14 institutions reduced at least one of their deposit categories during Kartik. Only six banks — Nepal Bank, Siddhartha Bank, Rastriya Banijya Bank, Kumari Bank, Global IME Bank, and Himalayan Bank — decided to maintain their existing rates from Ashwin. The overall direction points toward a sector-wide normalization of deposit pricing as liquidity pressure eases and funding costs stabilize across the financial system.

Sharpest Declines: Machhapuchchhre and NMB Lead the Cut

The largest reductions came from Machhapuchchhre Bank Limited (MBL) and NMB Bank Limited (NMB). Both institutions lowered their individual and institutional FD rates by 1 percentage point, the steepest month-on-month decline in the market. MBL’s new rates now stand at 5.00 % for individuals and 4.00 % for institutions, while NMB offers the same. These cuts underline both banks’ confidence in their liquidity positions and their willingness to adjust liability costs in line with the slowing credit demand observed since the beginning of the fiscal year.

Moderate Adjustments from Major Private Banks

Other prominent private banks also introduced moderate cuts. Nabil Bank reduced its individual FD rate by 0.55 %, setting it at 4.95 %, and trimmed institutional deposits by the same margin to 3.95 %. NIC Asia Bank decreased its rates by 0.25–0.50 %, now offering 5.75 % for individuals and 4.50 % for institutions. Meanwhile, Prabhu Bank implemented one of the most significant institutional revisions, slashing its rate from 4.35 % to 2.75 %, a 1.6-percentage-point cut — signaling an aggressive liability restructuring to maintain net interest margins (NIMs).

Stable Performers Hold Their Ground

A handful of large and government-affiliated banks kept their rates unchanged. Global IME Bank (GBIME) and Himalayan Bank (HBL) continue to offer the highest FD returns at 6.00 %, maintaining competitive positions for retail depositors. Nepal Bank and Rastriya Banijya Bank also preserved their rates at 5.25 %, in line with their stable funding base and conservative deposit strategy. These banks’ decisions to maintain rates indicate stable liquidity and limited pressure to raise or cut yields aggressively.

Average Rate Comparison and Market Implication

On average, individual fixed-deposit rates across the commercial-banking sector now hover around 5.1 %, while institutional rates stand near 4.2 % — representing a 0.3–0.4 percentage-point overall decline from Ashwin. The reduction in rates corresponds with Nepal Rastra Bank’s monetary stance, where the interest-rate corridor has remained stable and interbank market rates have normalized after festival-season volatility. This has allowed banks to lower deposit rates without risking liquidity shortages or depositor confidence.

Interpreting the Trend: Easing Liquidity and Controlled Credit Growth

The widespread cuts suggest that liquidity pressures have eased following a surge in remittance inflows and post-festival deposit recovery. As credit demand remains tepid — especially in the construction, real-estate, and trade sectors — banks are finding it unnecessary to maintain high deposit costs. The reduction in FD rates also mirrors the broader policy direction of the central bank, which is focused on keeping inflation within target while maintaining financial-system stability.

Looking ahead, analysts expect deposit rates to remain under mild downward pressure through Mangsir as liquidity continues to improve and banks maintain sufficient cash buffers. However, any sudden rise in credit expansion or government spending could temporarily tighten liquidity and slow further cuts. For now, the reduction phase represents a shift from defensive liquidity hoarding to normalized cost management across the commercial-banking sector.

The Kartik interest-rate revision underscores a turning point for Nepal’s banking industry — from a period of aggressive deposit competition to one of measured cost rationalization. With the average FD yield moving lower and interbank stability improving, the banking sector appears positioned for steady, sustainable profitability through the second quarter of fiscal year 2082/83. Depositors, however, may need to adjust their expectations for high returns as banks gradually align rates with prevailing market conditions.

Commercial Banks Fixed Deposit Interest Rate Comparison (Ashwin vs Kartik)

Company | Symbol | Ashwin Individual FD (%) | Ashwin Institutional FD (%) | Kartik Individual FD (%) | Kartik Institutional FD (%) | Change (Individual) | Change (Institutional) | |

|---|---|---|---|---|---|---|---|---|

1 | Agriculture Development Bank | ADBL | 5.05 | 5.05 | 4.95 | 4.95 | -0.10 | -0.10 |

2 | Citizens Bank International | CZBIL | 5.25 | 5.25 | 5.00 | 5.00 | -0.25 | -0.25 |

3 | Everest Bank | EBL | 5.25 | 4.25 | 5.00 | 4.00 | -0.25 | -0.25 |

4 | Global IME Bank | GBIME | 6.00 | 5.00 | 6.00 | 4.25 | 0.00 | -0.75 |

5 | Himalayan Bank | HBL | 6.00 | 5.00 | 6.00 | 4.50 | 0.00 | -0.50 |

6 | Kumari Bank | KBL | 5.01 | 4.01 | 5.01 | 4.01 | 0.00 | 0.00 |

7 | Laxmi Sunrise Bank | LSL | 5.25 | 4.00 | 5.00 | 4.00 | -0.25 | 0.00 |

8 | Machhapuchchhre Bank | MBL | 6.00 | 5.00 | 5.00 | 4.00 | -1.00 | -1.00 |

9 | Nabil Bank | NABIL | 5.50 | 4.50 | 4.95 | 3.95 | -0.55 | -0.55 |

10 | Nepal Bank | NBL | 5.25 | 3.25 | 5.25 | 3.25 | 0.00 | 0.00 |

11 | Nepal Investment Mega Bank | NIMB | 5.35 | 4.18 | 5.10 | 4.25 | -0.25 | +0.07 |

12 | Nepal SBI Bank | SBI | 5.00 | 4.18 | 4.95 | 4.25 | -0.05 | +0.07 |

13 | NIC Asia Bank | NICA | 6.00 | 5.00 | 5.75 | 4.50 | -0.25 | -0.50 |

14 | NMB Bank | NMB | 6.00 | 5.00 | 5.00 | 4.00 | -1.00 | -1.00 |

15 | Prabhu Bank | PRVU | 5.35 | 4.35 | 4.95 | 2.75 | -0.40 | -1.60 |

16 | Prime Commercial Bank | PCBL | 5.50 | 2.75 | 5.00 | 2.75 | -0.50 | 0.00 |

17 | Rastriya Banijya Bank | RBBL | 5.25 | 5.25 | 5.25 | 5.25 | 0.00 | 0.00 |

18 | Sanima Bank | SANIMA | 5.50 | 4.00 | 5.25 | 3.75 | -0.25 | -0.25 |

19 | Siddhartha Bank | SBL | 5.50 | 4.00 | 5.50 | 4.00 | 0.00 | 0.00 |

20 | Standard Chartered Bank Nepal | SCB | 5.18 | 2.75 | 5.00 | 2.75 | -0.18 | 0.00 |